Appearing on the always interesting, often controversial TV show - BNN’s ‘Squeezeplay’ with hosts Amanda Lang and Kevin O’Leary - on Tuesday 30th at 5:30, is Jacoline Loewen, author of Money Magnet. Find out about the world of private equity and how private capital is taking advantage of this collapsed market.

Wealth Management

Voted #6 on Top 100 Family Business influencer on Wealth, Legacy, Finance and Investments: Jacoline Loewen My Amazon Authors' page Twitter:@ jacolineloewen Linkedin: Jacoline Loewen Profile

December 30, 2008

The Baltic Dry Index

Much of the focus in the news today is on the economy, and for obvious reasons, it's subprime mortgage this, credit crisis that, the CBC's The National and its slapdash analysis of our woes would make you think we're all getting pink slips tomorrow and an ice cream cone (CTV's National News does a better job at understanding and describing what is going on in the market).

Much of the focus in the news today is on the economy, and for obvious reasons, it's subprime mortgage this, credit crisis that, the CBC's The National and its slapdash analysis of our woes would make you think we're all getting pink slips tomorrow and an ice cream cone (CTV's National News does a better job at understanding and describing what is going on in the market). Much of the economic indicators that proliferate from our nightly news, like monthly employment numbers and housing starts, mark the goal posts through which our economy is kicked. Any errant balls are wistfully reported on by journalists voraciously anticipating thousands clamoring for the newstands the next day, full of fear that their homes will soon be unafordable. At times, it seems the journalist is the first to fall to mass hysteria and the last to admit it. Thomas Jefferson said, "advertisements remain the only truth to be relied upon in a newspaper", of all the facts that come from our nightly news these day, this sadly remains true.

It's best to take our own minds into our own hands, lest we be led astray by journalists. A great economic indicator that is never quoted in the news and that may be of interest to the skeptical reader or viewer is the Baltic Dry Index. It has been touted in the past as one of the best economic indicators you have never heard of, and what's more, it's a leading indicator, a prescient little factoid that could be unwrapped neatly at dinner parties and delivered to impress the impressionable.

The short of it is, the Baltic Dry Index is a number issued daily by London's Baltic Exchange, which was founded in 1744 by the Virginia and Baltick coffeehouses in London's financial district. Every day, the exchange asks brokers around the world the cost to book a variety of cargoes of raw materials on various routes around the world. The result measures the demand for shipping capacity versus the supply of dry bulk carriers. Shipping capacity is generally inelastic, it takes two years to build a new ship, so increases in demand for raw materials pushes the index up quickly and drops in demand do the opposite at the same rate. What makes this index so interesting is that it ultimately charts the demand for the raw materials that make up our finished goods, so it would be here, at the Baltic Dry Index, where we would see the first signs of a stable increase in demand, signaling a sustained return to growth.

The index has fallen considerably in the past year, a reflection of plummeting demand and deflation, but under closer inspection it seems to have reached a bottom from which it is stabilizing at around 800. A sign of good things to come? Unfortunately, economic indicators, much like economist, make little sense alone, but the Baltic Dry is a good place to start making up your own mind on things.

December 26, 2008

Crisis on Wall Street - Blodgett's view

Back to the last big market downturn - the Tech Bubble - I took the advice of a certain Mr. Henry Blodgett (who was the tech guru at Merril Lynch) and bought AOL instead of Amazon. Herny has tried to redeem himself after his massive fall from the heights of Wall Street. I've tried to redeem my savings too.

I was intrgued to see old Henry's take on the current state of the markets. Read...

Last year, I wrote about the fall of the public markets in Money Magnet. At the time, my publisher asked me to tone it down as she could not see Wall Street ever losing value!

I was intrgued to see old Henry's take on the current state of the markets. Read...

Last year, I wrote about the fall of the public markets in Money Magnet. At the time, my publisher asked me to tone it down as she could not see Wall Street ever losing value!

December 22, 2008

Credit Crunch Games for Your Christmas Party

Want to really understand what the credit crunch means for the economy? In Canada, private equity will have a challenge getting anyone to think about debt or credit. Our economy is frozen to match the weather.

I was surprised to see that The Economist has a sense of humour during these dark days but this is a good game to play. I got it from Jeff Watson.

Check it out:

http://www.economist.com/displaystory.cfm?story_id=12798307

I was surprised to see that The Economist has a sense of humour during these dark days but this is a good game to play. I got it from Jeff Watson.

Check it out:

http://www.economist.com/displaystory.cfm?story_id=12798307

December 19, 2008

Manufacturing in Ontario

Business owners and manufacturers in Ontario are struggling with the new realities.

We have passed the agricultural, industrial, and information ages and we've entered the conceptual age. The three As—abundance, automation, and Asia—ushered in this new era.

In the same way that machines have replaced our bodies in certain kinds of jobs, software is replacing our left brains by doing sequential, logical work.

And that brings us to Asia, to where that work is being shipped.

In Asia you have tens of millions of people who can do routine tasks like write computer code. Routine is work you can reduce to a spreadsheet, to a script, to a formula, to a series of steps that has the right answer.

Daniel Pink has written A Whole New Mind about this change and how it applies to the companies we create. "This is great book to tell you where to invest your private equity fund money," says Jacoline Loewen , author of Money Magnet and a partner in the private equity company of Loewen & Partners. "Every manufacturer in Ontario should read it to know what to do."

He tells us that his generation's parents told their children, "Become an accountant, a lawyer, or an engineer; that will give you a solid foothold in the middle class."

But these jobs are now being sent overseas. So in order to make it today, you have to do work that's hard to outsource, hard to automate. To play an interview with Daniel Pink, press on link below:

http://event.oprah.com/videochannel/soulseries/oss_player_980x665.html?guest=dp&part=1

We have passed the agricultural, industrial, and information ages and we've entered the conceptual age. The three As—abundance, automation, and Asia—ushered in this new era.

In the same way that machines have replaced our bodies in certain kinds of jobs, software is replacing our left brains by doing sequential, logical work.

And that brings us to Asia, to where that work is being shipped.

In Asia you have tens of millions of people who can do routine tasks like write computer code. Routine is work you can reduce to a spreadsheet, to a script, to a formula, to a series of steps that has the right answer.

Daniel Pink has written A Whole New Mind about this change and how it applies to the companies we create. "This is great book to tell you where to invest your private equity fund money," says Jacoline Loewen , author of Money Magnet and a partner in the private equity company of Loewen & Partners. "Every manufacturer in Ontario should read it to know what to do."

He tells us that his generation's parents told their children, "Become an accountant, a lawyer, or an engineer; that will give you a solid foothold in the middle class."

But these jobs are now being sent overseas. So in order to make it today, you have to do work that's hard to outsource, hard to automate. To play an interview with Daniel Pink, press on link below:

http://event.oprah.com/videochannel/soulseries/oss_player_980x665.html?guest=dp&part=1

December 16, 2008

Getting the Public Equity Markets Right

Here is the brilliant Nassim Nicholas Taleb in a recent Charlie Rose interview:

http://www.charlierose.com/view/interview/9713

Taleb talks about Capitalism 2 where instead of relying on public markets to make money, people will now revert back to private money.

This is exactly what I said in Money Magnet, where I predicted the end of the public markets as the main model for creating value. Private equity is money which goes into companies directly from one human to another human who look eachother in the eye at least once every few months and who work together to build value in the business.

Beats the ATM machine style of investing in the public markets.

http://www.charlierose.com/view/interview/9713

Taleb talks about Capitalism 2 where instead of relying on public markets to make money, people will now revert back to private money.

This is exactly what I said in Money Magnet, where I predicted the end of the public markets as the main model for creating value. Private equity is money which goes into companies directly from one human to another human who look eachother in the eye at least once every few months and who work together to build value in the business.

Beats the ATM machine style of investing in the public markets.

The Wisdom of the Markets

Rudyard Kipling wrote his poem 'God of the Copybook Headings' and still stands a metaphor for our current woes:

Rudyard Kipling wrote his poem 'God of the Copybook Headings' and still stands a metaphor for our current woes:In the Carboniferous Epoch we were promised abundance for all,

By robbing selected Peter to pay for collective Paul;

But, though we had plenty of money, there was nothing our money could buy,

And the Gods of the Copybook Headings said: "If you don't work you die."

Then the Gods of the Market tumbled, and their smooth-tongued wizards withdrew

And the hearts of the meanest were humbled and began to believe it was true

That All is not Gold that Glitters, and Two and Two make Four

And the Gods of the Copybook Headings limped up to explain it once more.

As it will be in the future, it was at the birth of Man

There are only four things certain since Social Progress began.

That the Dog returns to his Vomit and the Sow returns to her Mire,

And the burnt Fool's bandaged finger goes wabbling back to the Fire;

And that after this is accomplished, and the brave new world begins

When all men are paid for existing and no man must pay for his sins,

As surely as Water will wet us, as surely as Fire will burn,

The Gods of the Copybook Headings with terror and slaughter return.

The poem was written in 1919, is apt and shows that nothing really changes.

Copybooks were an exercise book used to practise handwriting in. The pages were blank except for a printed specimen of perfect handwriting at the top. You were supposed to copy this specimen all down the page.The specimens were proverbs or quotations, or little sayings – the ones in the poem illustrate the kind of thing.

About Kipling: He had lost his dearly loved son in World War One, and a precious daughter some years earlier. He was a drained man in 1919, and England, which he identified with so intensely, was a drained nation. With all this as background, the general opinion is that The Gods of the Copybook Headings is a clinging to old-fashioned common sense by a man deeply in need of something to cling to....

As many do again just on 90 years later.

About Kipling: He had lost his dearly loved son in World War One, and a precious daughter some years earlier. He was a drained man in 1919, and England, which he identified with so intensely, was a drained nation. With all this as background, the general opinion is that The Gods of the Copybook Headings is a clinging to old-fashioned common sense by a man deeply in need of something to cling to....

As many do again just on 90 years later.

December 15, 2008

What is The VC Screening Process?

VCs have to screen deals that come through their doors. They see thousands of proposals and you have to break through to get their attention. Your business plan can help you stand out from the crowd, or not. If you do not have a decent plan, forget it.

Where Does Your Deal Fit?

Ask your venture capitalist where your company investment would be placed in their fund horizon. If your company is first in, then you have more time (five years) to make money before being required to pay back the full amount. If you are last in, the time for the VC to get out will be closer.

It also depends when you meet with the VCs and at which stage they are with their fund. If they have already filled up most of their fund, they will be very choosy about the last two companies. If they have just obtained the cash, then they will be feeling more generous. After the investment, find out who will handle your file. Will it be the same person who did the due diligence and who spent time getting to know your business? That person will have an emotional attachment. If a new guy is handling your file, there will be far less commitment.

The VC is a high-risk, high-return animal. Three out of ten companies in their fund will drive their fund’s return. If you are in that portfolio and your business is struggling, expect some pressure from the VCs. They want winners as these are their bread and butter. VCs make money for people who make them money. There are usually ten years in their life cycle: the first five years are used to seed your business and the remaining five are used to harvest the investment. The VCs must get out. They are not there to fund you into retirement.

Where Does Your Deal Fit?

Ask your venture capitalist where your company investment would be placed in their fund horizon. If your company is first in, then you have more time (five years) to make money before being required to pay back the full amount. If you are last in, the time for the VC to get out will be closer.

It also depends when you meet with the VCs and at which stage they are with their fund. If they have already filled up most of their fund, they will be very choosy about the last two companies. If they have just obtained the cash, then they will be feeling more generous. After the investment, find out who will handle your file. Will it be the same person who did the due diligence and who spent time getting to know your business? That person will have an emotional attachment. If a new guy is handling your file, there will be far less commitment.

The VC is a high-risk, high-return animal. Three out of ten companies in their fund will drive their fund’s return. If you are in that portfolio and your business is struggling, expect some pressure from the VCs. They want winners as these are their bread and butter. VCs make money for people who make them money. There are usually ten years in their life cycle: the first five years are used to seed your business and the remaining five are used to harvest the investment. The VCs must get out. They are not there to fund you into retirement.

How Much Should I Prepare to Meet an Investor?

Expect to spend at least a few weeks preparing to visit a sophisticated investor. Otherwise, you are dead before you even begin. Without the work, you might just as well climb into a coffin, hand a stake to the investor and said, “Drive it in, please.”

Your business plan is much like a resume and it’s the ticket that will get you to the next stage: a face-to-face meeting. Attracting money to your business will be easier if you show your vision of the business and how you plan to execute it. You can make yourself far more attractive to investors if you have a merger possibility on the radar that you can name.

“It's the people, not the product, that investors are most interested in,” says Ilske Treurnicht, MArs. “And first impressions are important. Be active and interested without being arrogant. A banking or VC relationship typically lasts four to eight years, so investors tend to look for people they like and believe they'll get along with. Also, they do want people who are prepared.”

"How people present themselves to investors says very loudly how that business owner presents their product to their customers.

Your business plan is much like a resume and it’s the ticket that will get you to the next stage: a face-to-face meeting. Attracting money to your business will be easier if you show your vision of the business and how you plan to execute it. You can make yourself far more attractive to investors if you have a merger possibility on the radar that you can name.

“It's the people, not the product, that investors are most interested in,” says Ilske Treurnicht, MArs. “And first impressions are important. Be active and interested without being arrogant. A banking or VC relationship typically lasts four to eight years, so investors tend to look for people they like and believe they'll get along with. Also, they do want people who are prepared.”

"How people present themselves to investors says very loudly how that business owner presents their product to their customers.

I Need Money - Where Do I get It?

One of the bloggers on CBC's hit TV reality show, Dragons' Den, posed the often posed question, "I'm under thirty years old, where do I get money to start my business?"

One of the bloggers on CBC's hit TV reality show, Dragons' Den, posed the often posed question, "I'm under thirty years old, where do I get money to start my business?"I recommend the Canadian Youth Business Forum.

This is program run by entrepreneurs for young, new entrepreneurs who are too high risk for banks. Don't slag off the banks either as they must look after the money given to them by depositors. If the US banks had remembered that priority, the world economy would not be in this current mess.

But back to the CYBF.

It lends money to young people but then assigns them a mentor and makes them part of a group. This helps these youthful business people get through the failures of business. 80% of small businesses do fail but CYBF's program, pushes that statistic way down.

One of these CYBF success stories is in the National Post, read the story here.

QuickSnap is being mentored by Brett Wilson, a Dragon from the Dragons' Den. Already, QuickSnap has gone to Afghanistan and, hopefully, the military will set up a contract soon.

Here is the story on CYBF, Brett Wilson and Quicksnap with more...

December 14, 2008

Driving Canada's Business Success

I live in an age which has seen the end of the British Empire, the collapse of the Soviet Union, and now, perhaps the decline of America, like a giant air balloon slowly deflating. In the meantime, the peaceful rise of a dynamic China and other Asian countries, matched with the rise in our own overambitious government entitlement programs, creates a new level of expectation for citizens.

I live in an age which has seen the end of the British Empire, the collapse of the Soviet Union, and now, perhaps the decline of America, like a giant air balloon slowly deflating. In the meantime, the peaceful rise of a dynamic China and other Asian countries, matched with the rise in our own overambitious government entitlement programs, creates a new level of expectation for citizens.When I went to McGill University, a slice of pizza at Gertrude’s on a Friday would be my one treat – otherwise I lived on peanut butter, tuna sandwiches, and beans on toast (yes, I like bread). I rarely bought a pre-made meal, which is why I was jolted by a blog written in response to Karen Selick, a lawyer with Reynolds O'Brien, LLP., who commented on Food Banks. This student was horrified at the thought of another student not being able to buy a cafeteria item. What’s wrong, I wondered, with the cheaper option of packing a cheese sandwich and an apple for lunch?

The end goal of helping the poor is desirable, but the debate rages around “how” we give.

Selick points out that there are better ways to achieve the same goal – temporarily feeding a person in dire straits. The use of supermarkets as the location to pick up goods seems a no brainer. Business owner Graeme Jewett of Marsan Foods tells me his company makes various President’s Choice frozen dinners but also a 97¢ frozen dinner, which has some meat and is preservative-free, for Giant Tiger stores. Can the Food Bank really beat the operating cost of getting an equivalent item onto Food Bank shelves? Could the savings pay for that 97¢ meal?

The Food Bank style of charity – giving to ease symptoms – is not to be confused with venture giving – philanthropy – which targets the underpinnings of society, asks why poverty occurs, and seeks to level access to opportunities.

The Food Bank style of charity – giving to ease symptoms – is not to be confused with venture giving – philanthropy – which targets the underpinnings of society, asks why poverty occurs, and seeks to level access to opportunities.

Andrew Squire used to stay up all night doing his music and longed to own his own sound studio in Toronto. Then, he benefited from the philanthropy of the Canadian Youth Business Foundation (CYBF), which redistributes money toward loans for high-risk entrepreneurs.

Andrew says, “It’s private companies like CYBF who taught me the skills to be an independent business owner by providing me with $1,000 a month for a year and giving me a mentor. CYBF insisted that I write business plans, make financial projections, and answer questions about the revenues and strategy of my business. By transferring their entrepreneurial skills, CYBF encouraged my passion for music into a business. I won the sound contract for a Sprite commercial and now I have my own studio – King Squire Audio. Of the 20 people in my CYBF program, more than half are now hiring other people. The cost – $240,000 – is peanuts compared to what the government is spending on big conglomerates.”

Andrew agrees with Selick, that “how” skills or resources are given increase the impact of levelling the playing field. “The CYBF model should be exploited as it is entrepreneurs who are running the program. Letting government ‘do the giving’ would be inefficient. It was private business people who taught me how to raise money and who gave me the right ideas about the tough world of business and this came through CYBF.”

The Food Bank is well meaning with its belief in the redistribution of wealth, but I believe in the redistribution of skills to people like Andrew Squire, who has shed his dreadlock image and projects a quiet confidence. The Food Bank tips the pendulum toward socialism. I nudge the pendulum toward free enterprise. The totality of resources is never sufficient to meet all goals at the same time. Life is dialectic – private enterprise versus public duty. But effective giving is something we can all have the courage and honesty to face.

Andrew says, “It’s private companies like CYBF who taught me the skills to be an independent business owner by providing me with $1,000 a month for a year and giving me a mentor. CYBF insisted that I write business plans, make financial projections, and answer questions about the revenues and strategy of my business. By transferring their entrepreneurial skills, CYBF encouraged my passion for music into a business. I won the sound contract for a Sprite commercial and now I have my own studio – King Squire Audio. Of the 20 people in my CYBF program, more than half are now hiring other people. The cost – $240,000 – is peanuts compared to what the government is spending on big conglomerates.”

Andrew agrees with Selick, that “how” skills or resources are given increase the impact of levelling the playing field. “The CYBF model should be exploited as it is entrepreneurs who are running the program. Letting government ‘do the giving’ would be inefficient. It was private business people who taught me how to raise money and who gave me the right ideas about the tough world of business and this came through CYBF.”

The Food Bank is well meaning with its belief in the redistribution of wealth, but I believe in the redistribution of skills to people like Andrew Squire, who has shed his dreadlock image and projects a quiet confidence. The Food Bank tips the pendulum toward socialism. I nudge the pendulum toward free enterprise. The totality of resources is never sufficient to meet all goals at the same time. Life is dialectic – private enterprise versus public duty. But effective giving is something we can all have the courage and honesty to face.

Jacoline Loewen is a financial advisor for companies seeking capital, as well as a corporate strategy expert, lecturer, and writer with three published books. the latest is Money Magnet: How to attract investors to your business.

December 12, 2008

How to Get the VC to Call

There are certain things, such as resumes, that catch the eye of seasoned pros and get them to pick up the phone and call you.

VCs don’t invest in technology or markets, they invest in people.

If the people stuff goes wrong, it’s hell. They put you through due diligence while at the same time trying to find out what kind of person you are.

When you pitch in, it’s a sociological experiment to see what makes you tick and whether you will be co-operative or will crack.

Probably the most powerful action you can take is to find a referral to a partner in the business. It’s a bit like dating. If someone they trust refers you to a VC, they will take your call. "The question I get asked the most is how to find investors," says Jacoline Loewen, author of Money Magnet. "Owners are better of having a company like Loewen & Partners find them a suitable investor."

Warning: Bad phone manners are an immediate red flag. The VC knows they are entering into a seven-year relationship and they will not waste time with someone who rankles. If they can’t see themselves married to you, it’s a quick, “thank you but no thanks.”

VCs don’t invest in technology or markets, they invest in people.

If the people stuff goes wrong, it’s hell. They put you through due diligence while at the same time trying to find out what kind of person you are.

When you pitch in, it’s a sociological experiment to see what makes you tick and whether you will be co-operative or will crack.

Probably the most powerful action you can take is to find a referral to a partner in the business. It’s a bit like dating. If someone they trust refers you to a VC, they will take your call. "The question I get asked the most is how to find investors," says Jacoline Loewen, author of Money Magnet. "Owners are better of having a company like Loewen & Partners find them a suitable investor."

Warning: Bad phone manners are an immediate red flag. The VC knows they are entering into a seven-year relationship and they will not waste time with someone who rankles. If they can’t see themselves married to you, it’s a quick, “thank you but no thanks.”

December 11, 2008

How do you define value?

"Your conversation around the valuation of your business may begin with the investor asking for a quick snapshot of your financial picture, but a weak EBITDA (see glossary) will by no means end the chat" says Jacoline Loewen. "Valuation of a business comes from the fund itself and the type of companies they already have in their portfolio."

"Your conversation around the valuation of your business may begin with the investor asking for a quick snapshot of your financial picture, but a weak EBITDA (see glossary) will by no means end the chat" says Jacoline Loewen. "Valuation of a business comes from the fund itself and the type of companies they already have in their portfolio."“Often companies we like do not have EBIDTA or revenues, so we cannot use these tools as value markers.” Instead, Peter Carrescia of VenGrowth Capital Management Inc. says, his team values businesses with:

• High barriers to entry;

• The capability of rapid revenue growth;

• An analysis of what will happen in the market over the next three years;

• Identification of the Number One Issue to overcome;

• The perfect intersection of company, services/products and cycle in the market.

The whole business of investing is complex and wrought with chaos. A very big difference when investing in IT compared to other businesses is that the VCs know that eventually it all comes down to the team involved. Tech VCs can perform the complex science of due diligence, research the market and call past clients, but the only valid metadata worth drilling into is the people. The art of predicting winning people is much harder. Investing in a practiced team is a good indicator of success, but it is still an art.

Deal dead and buried

Private equity and debt deal of the century ends. See the full story here.

Private equity and debt deal of the century ends. See the full story here.The key reason why the biggest leveraged buyout ever was killed was that it

didn't live up to a "solvency opinion" -- a declaration by auditor KPMG that the

company would have been solvent after the takeover loaded it with billions in

fresh debt.Posted by Anastassia Kobeleva

December 10, 2008

Raising Capital for SMEs

I had to cancel a meeting today with a Bay Street lawyer. He commented to me that if you have a client deal to do, treasure it because these are dark days.

Last night I was at the RBC Women Entrepreneur of the Year awards and Diane Francis of The National Post was there and also commented frequently on the tough days we are facing. There was a ripple of agreement through the room of 2,000 female entrepreneurs. The Publisher of Profit magazine brought some light to all this gloom and doom telling us about research that recessions and depressions first begin to lift in the SME sector. Our target market - Loewen & Partners, that is - is the SME with revenues of $10M+ and it’s true that there is private equity investment dollars available.

Quite heartening.

Last night I was at the RBC Women Entrepreneur of the Year awards and Diane Francis of The National Post was there and also commented frequently on the tough days we are facing. There was a ripple of agreement through the room of 2,000 female entrepreneurs. The Publisher of Profit magazine brought some light to all this gloom and doom telling us about research that recessions and depressions first begin to lift in the SME sector. Our target market - Loewen & Partners, that is - is the SME with revenues of $10M+ and it’s true that there is private equity investment dollars available.

Quite heartening.

December 9, 2008

You've Got Talent But...

J.B. Loewen's blog about Dragons' Den:

J.B. Loewen's blog about Dragons' Den:It’s time for another game of Crack the Whip with Kevin O’Leary at the head and the entrepreneur at the end.

And we were not disappointed as the Dragons’ Den show opened with Elke presenting her Lump O’ Coal, a Christmas stocking stuffer. Robert Herjavec thought it was cute but as Elke brought out her red Lump O’ Coal for Valentine’s, and so on, Arlene saw the flaw - Elke really had a single product for the investment opportunity.

There is only one thing that bothers Kevin—SKUs!

We’ve covered the topic of SKUs (Stock Keeping Unit) before with past Dragons’ Den presentations; Kevin means that the cost of managing and delivering single unit orders will eat up the profits. Think shirts: If you only had one design of shirt, you can see why delivering orders of one shirt to many stores would not be cost effective. To scale up, a company needs a wider range of products to pack for each client, otherwise you will be SKUed. And with that, Kevin skewered the deal, saying, “Deep in your heart, Elke, you know Lump O’ Coal will be a lump of you-know-what.”

Arlene tried to reason with Elke and said with a calming smile, “Cut through the harsh criticism (I’m really sorry you have to listen to Kevin) and hear the very good advice (Kevin is not such a ‘nothing burger’, he does teach at an important Business School).”

What Arlene was trying to explain is that an equity investor needs to make returns of above 20%, but by no means is Elke in a bad business. A single, seasonal product will simply not attract investors like the Dragons, and she would be better off getting debt financing or a government loan from the EDC. Quite rightly, Jim Treliving also respectfully advised that the company was a nice cottage industry and to keep it that way.

Single SKU companies can work and we saw this with a previous presenter – Sue and her Omega Tree Stand – who did well after fizzling at Dragons’ Den. Getting exposure on the show resulted in orders coming to Sue—landing her Canadian Tire and big-box stores high volume orders.

That doesn’t change the fact that for venture capital, the Dragons made the right decision, but thanks to Dragons’ Den, Sue got the free marketing exposure to get her phone ringing.

W. Brett Wilson, who is more used to coal as a source of energy, squinted in his tough guy way and rasped, “But why would anyone buy a lump of coal?”

Being of Scottish descent, I know that the Lump O’ Coal comes from the tradition of having a tall, dark stranger with a piece of coal for your fireplace be the first to cross the threshold in the New Year (Fabio look-a-likes being particularly popular with the ladies of the house.)

But I digress.

Let’s get back to Robert Herjavec, he of the matching tie and handkerchief sets, with his agreeable—almost rakish—way of chatting with entrepreneurs. It’s evident that Kevin doesn’t want to be any entrepreneur’s Facebook friend, but Robert’s warmth will soothe entrepreneurs, getting them to relax. But it was not enough to calm the nerves of the laid-off auto worker team, Jason and Leigh, as they presented their wall calendar. Arlene, being a single mum of four children herself, knows what it is like to co-ordinate family and commiserated that a shared wall calendar sounded good but, like some Nanny 911 ideas, hard to follow through.

Indeed, Kevin wished he could fire his family for their slacker ways over schedules.

When unpacking what went wrong afterwards with Dianne Buchner, the Den’s insightful host who adds helpful hints, Jason said the presentation was not good enough.

Ouchey! I wondered if Jason’s wife, who did the lion’s share of the presentation, was thinking, “Buddy—you’re not getting any for the next month!

There is a great deal of ambiguity in investing and each Dragon has their style. One Dragon might love your product but another one not be remotely interested. Throughout this season, the rookie Dragon, W. Brett Wilson, has been the shining light for entrepreneurs, coming through to invest in people he sees are trying their best or with a unique product. Likewise, we see Kevin O’Leary invest with his strict set of rules which, luckily, he teaches us.

We saw Brett do a handshake deal for a million dollars with a green energy technology entrepreneur, the big prerogative being IF Magnacoaster passes through the due diligence process and does what the entrepreneur says it does. Then Brett returns to Moxy Trades with a reduced offer, and clinches that deal. Finally, Brett and Arlene both shake hands with the First Memories Photobook team. After all, new mums can never have enough pictures of their baby snuggle-muffins.

What happened? Two words.

Deals done.

Clearly, Brett is a Dragon ready to invest and I love the “Kaching, Kaching” noises inserted every time there’s a handshake.

Finally, up comes a magic show, Illusions Dinner Theatre - would Brett sign up another entertainment act? Would we see more of Big Jim’s smooth dance moves which rival the Four Tops? To the bemusement of all, Robert volunteered for the magic act. Whoa! Robert, what were you thinking? By that stage, had the entrepreneur, Don, already sensed the deal was not happening? He could have been planning a horse’s head under Kevin O’Leary’s bed. Now you’re going to let him stick knives in your head?

Repeat: Knives and Dragons are a dangerous mixture—especially when the entrepreneur may be unhappy with the “no investment” decision.

Again, the Dragons enjoyed Don’s talent show but real estate financing is not the typical type of deal that equity investors do. As Big Jim advised, “It was a great show but cabaret acts last twenty months. Get to a bigger place, like Vegas, and don’t get saddled with real estate.”

And that’s all folks.

I’m sure you will agree that Dragons’ Den has succeeded in pulling back the curtain of mystery to reveal what are the features of a business every entrepreneur must be able to discuss with a potential investor. The Den is a gateway into how to be a great entrepreneur and, if you watch the whole season on the website, it’s an MBA course in Entrepreneurship 101—minus the school fees. Many of the presenters asking for investment dollars in the Den are Creative Achievers—people who do not fit the traditional management career track, who take risks and who change the world a little or a lot. Probably all of the Dragons fall into this category. None of this season’s presenters need bother with an MBA, and with Dragons’ Den giving many a jump start, they will be phenomenal.

Kudos to CBC for creating the Dragons’ Den website with the Forum where fans can blog. I think it has elevated the level of transparency and trust – a boost for the CBC brand. Also, the updates on companies from the show as they begin to blossom with a little help from their Dragon investors, is proving to be a terrific platform for Canadian enterprise. We can find out more about EcoTraction, for instance, which reminds me to buy the eco-salt for my doggy’s paws, as well as anything sporting the Dragons’ Den logo. The CBC showcases how an investor might work for your company by cross-selling products. Quicksnap goes to Afghanistan with CDs of a Canadian country singer who also wears Hillberg and Berk jewellery. Here you see three products, two from Dragons’ Den, being cross-marketed in a compelling way.

Watching the video of Quicksnap in Afghanistan though, with the enthusiastic Afghanistan gentleman enjoying the music, was the best Christmas present for me this year, bringing tears to my eyes. That is the true heart of business.

Before I get too schmaltzy, better close.

Dragons’ Den is my (and I suspect for a lot of you too) weekly passion. Now, as the season draws to a close, what are we going to do? Here’s an idea—the CBC has taken a leaf out of the play book of Gene Simmons’ success with KISS, by marketing the band of Dragons. I recommend wearing your favourite Dragon T-shirt to do your grocery shopping on a Saturday morning; it will probably improve your dating odds. Can you see it now—Arlene bumps into Big Jim in the tofu aisle.

I’ve said it before but even Kevin will agree Dragons’ Den is a great use of our tax payer moneeeeeeeey.

See you on January 11th.

December 8, 2008

Private Equity: Up, Up and Away

Job losses in the United States are the early cough of the venerable cold Canada will catch soon enough. Unemployment statistics out of the U.S. released last weak showed jobs are being shed across the whole economy and at a faster rate than expected. Big, infectious coughs, blowing up over the Adirondacks and into our backdoor.

Though many fund managers will tell you that they have barrels of "dry powder" stowed away in their coffers (aka, cash ready to invest), the reality is that the powder is being preserved for a much larger offensive likely to begin during the typical (military) campaigning season, beginning in the Spring. In the same breathe, they will explain that the deal flow they are seeing right now is actually greater than it was a year ago, but the caveat is that the quality of the deals are not as good.

There are a few reasons for the increased deal flow. Private equity's growth in the new millennium, largely due to increased private savings of a wealthy middle class, began to pique the interest of newsmen and women the world over, but it's popularity struck most significantly in 2007 with the advent of the blockbuster deals. Beginning in the summer of 2007, just after the green movement fell out of vogue and before the sub-prime crisis began spilling ink, private equity was all the rage in newspapers across the continent and in Europe. Blockbuster deals like the buyouts of BCE, TXU Energy, and Chrysler splashed across the front pages of newspapers across the globe; the private lives of fund managers were being written about, from their their cop orate jets flying all across the world, to lobster dinners on Fifth Avenue.

So with lower quality deals blowing in the door, fund managers have grown more discriminating in regard to what they would deploy their 'dry powder' into. This is leading to a great many "orphaned deals" disseminating throughout the market. Generally speaking, the public market is trading shares at half their value from a year ago and a fund manager won't invest into a private company at a greater price than he can invest in a comparable public company, which means that the value of private companies are being depressed at this time as well. At first light of market stabilization, the dry powder will begin to be deployed at an incredible rate, as funds compete to snatch up companies still trading at relatively low multiples, getting more equity for their investment dollar.

Though the Canadian economy will inevitably be pulled along with the current global problems, look for activity in the private equity market to signal a recovery. Fund managers are intelligent and have the flexibility to creatively carve out the returns they crave, but they are not superheroes, and will wait until the volatility gives some indication of subsiding.

December 6, 2008

Tough Times

Who's next?

Who's next?Sure, it's tough times out there and the banks are not helping.

Currently the government is reaching out to the business community to find out if the banks are lending as they are claiming. I was contacted by the Canadian Venture Capital Association (CVCA) to add in our experiences over the past few months as Loewen & Partners places deals.

The banks are stuck between a rock and a hard place. This is not a sub prime crisis – it’s now a credit crisis.

Apparently, the banks are showing the government figures and reports that they are lending - they even had an 11% growth in lending this last month.

When you dig a bit deeper though, and ask if this is new lending or established lines of credit being drawn, the real picture emerges.

Business owners who are established clients are pulling down their lines of credit and tucking it under the mattress. That is not new lending on the books.

Loewen & Partners met with RBC this week and it was refreshing. RBC is doing something counter intuitive to all the other banks. They told us, "We want to lend." They say they are open for business.

As one of the account managers told me, “People remember how you treat them in the tough times.” RBC will probably scoop up some clients for life in this next year with this strategy and it will build a rock solid brand, one customer at a time. Smart work, RBC.

December 4, 2008

Hand-Written Notes Improve Your Brand

There is a great deal to be said for the hand-written note. The habit of actually picking up a pen and writing a quick comment to someone has faded away as emails and cell phones grew in use. A thank you note, even with scratchy hand writing, still brands the writer as someone with style; a note packs a wallop and makes your message stand out from the crowd.

I received a hand written note penned by one of Loewen & Partners’ clients thanking me for getting their company into the Ernst & Young Entrepreneur of the Year awards.

The company owner, Patrick Bermingham, wrote that he was amazed to win in his category, manufacturing. His company, Bermingham Construction, has received a great deal of recognition since, he tells me, from clients and that the award was also a huge moral boast for his employees.

Bermingham recently decided to move his company up a notch and with Loewen & Partners' corporate finance assistance, bring in private equity partners, C. A. Bancorp. This has not been easy sailing to get employees to buy in or even the owner, Patrick Bermingham. To win an award as prestigious as Entrepreneur of the Year helps ease the situation and reminds everyone that the business is doing very, very well. But it does take work for which Loewen & Partners did not get paid to do.

So will I do something extra that I do not get paid for again for Patrick?

Absolutely.

I received a hand written note penned by one of Loewen & Partners’ clients thanking me for getting their company into the Ernst & Young Entrepreneur of the Year awards.

The company owner, Patrick Bermingham, wrote that he was amazed to win in his category, manufacturing. His company, Bermingham Construction, has received a great deal of recognition since, he tells me, from clients and that the award was also a huge moral boast for his employees.

Bermingham recently decided to move his company up a notch and with Loewen & Partners' corporate finance assistance, bring in private equity partners, C. A. Bancorp. This has not been easy sailing to get employees to buy in or even the owner, Patrick Bermingham. To win an award as prestigious as Entrepreneur of the Year helps ease the situation and reminds everyone that the business is doing very, very well. But it does take work for which Loewen & Partners did not get paid to do.

So will I do something extra that I do not get paid for again for Patrick?

Absolutely.

December 3, 2008

Live Long and Prosper

Need to be revved up and pushed back out into the market place? Here’s a great place to go and get inspired. It’s Rick Spence’s video series on how to get your business started but it applies also as a quick reminder for those who have been working at it for years.

At Loewen & Partners, we are using the marketing plan video as the base for doing our plan for next year.

At Loewen & Partners, we are using the marketing plan video as the base for doing our plan for next year.

Dragons Bail on Yet Another Deal

The CBC show, Dragons' Den, is in serious danger of getting the same tarnished image that tinged the British show - the Dragons will not close the deals they agreed to do on national TV. There are all sorts of excuses.

Again, after the Uno letdown, Brett Wilson is left alone holding the bag to finance a great product, Ecotraction, and finally, this is getting noticed by the newspaper journalists. Mary Teresa Bitti, Financial Post writes, "all five (Dragons) agreed to put up a combined $500,000 for a 25% stake." They blame their change of heart on the market collapse.

That's a convenient excuse.

There are two types of investors: those that do it for a living and those who have made it, and invest their own money. The Dragons are supposed to be in the later category. Surely, they can afford $75,000 each on a product with guaranteed sales? Or maybe not?

I have a spread sheet tracking deals declared and deals done. Email me if you want a copy to see how much these Dragons are actually putting into our Canadian entrepreneurs. CBC should be asking Arelene Dickinson and Brett Wilson if they have any buddies who want to be Dragons and kick out the others who don't cough up the dough.

Again, after the Uno letdown, Brett Wilson is left alone holding the bag to finance a great product, Ecotraction, and finally, this is getting noticed by the newspaper journalists. Mary Teresa Bitti, Financial Post writes, "all five (Dragons) agreed to put up a combined $500,000 for a 25% stake." They blame their change of heart on the market collapse.

That's a convenient excuse.

There are two types of investors: those that do it for a living and those who have made it, and invest their own money. The Dragons are supposed to be in the later category. Surely, they can afford $75,000 each on a product with guaranteed sales? Or maybe not?

I have a spread sheet tracking deals declared and deals done. Email me if you want a copy to see how much these Dragons are actually putting into our Canadian entrepreneurs. CBC should be asking Arelene Dickinson and Brett Wilson if they have any buddies who want to be Dragons and kick out the others who don't cough up the dough.

December 2, 2008

Which Dragon Invests the Least?

Here’s a challenge for all of CBC's Dragons' Den armchair investors. You have been riveted by these intelligently selective Dragons sifting over the business ventures brought into the Den. Now it’s time to swivel your armchairs away from the entrepreneurs, towards the Dragons.

First up, let’s do a little of our own “Due Diligence.”

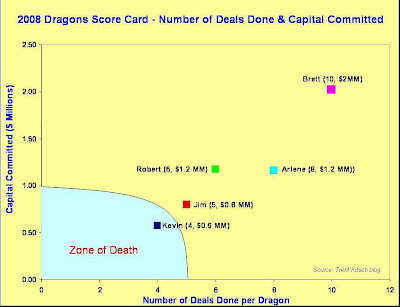

If you pull up the CBC Dragons’ Den website and find Trent Kitsch’s record of past episodes, he helpfully lists the dollar value of the deals made and the Dragons who committed capital, making it easy to jot down the investment record of each Dragon. Since Trent’s blog only goes up to Episode 8, I may be missing a deal here or there, but I think there’s enough to chew on the interesting statistics.

I invite you to examine the Dragons’ Score Card (at the top of this blog) where next to each Dragon’s name, you will find the number of deals done and, as Robert Herjavec likes to say, “money put at risk”.

So chaps, how’s the investing going?

From my calculations, our Dragons from Alberta are demonstrating why they are the “have” province and Ontario is the “have not”. W. Brett Wilson and Arlene Dickinson committed to 18 deals and $3.2 million in investments.

And surprise, surprise – what do we have here? The lowest investor is the one with the most bluster. It’s dear old Mr. Kevin O’Leary. Well, well, well.

Jack Welsh, the leader who took General Electric (GE) to the top of the stock market, had a firm but simple rule: the bottom 10% performers of the work force got fired – every year!

Sounds cruel?

Well, Kevin has been telling us all season that the market is cruel, so why shouldn’t the market bite down hard on a low investing Dragon? Why should it just be the presenters who have that unwanted feeling of hot adrenaline?

By the current rules, the Dragons are not under any obligation to spend a dime, but surely they should be under pressure? After all, in the real world, investors have their laws of the marketplace too. If they don’t invest, they obtain a low return on their capital, and if they are managing other people’s money and don’t have the ‘ovaries’ (or other body parts) to place it, that cash would be taken back rapidly.

If an investor does not commit dollars to companies, the only return they are making is on their original lump sum of capital and what’s the point of that? Kevin should know better than any as he runs a fund and, for sure, works within this rule. Right now, Kevin has the lowest record for investing capital and for that, to coin one of his favourite phrases, “he should be blowtorched out of existence.”

A common complaint by investors in the real world is that they don’t see good enough deals, and I suspect that the Dragons would say the same about the visitors to their Den, “They’re a little subprime, not likely to profit.”

Pardon me, but all sorts of idiotic things do well. The game Trivial Pursuit got turned down by hundreds of Angel investors who thought it was too dull. I still love mood rings, tiny troll dolls with pink hair, Billy Bee Honey but who would’ve invested in those things at their start? Even Barbie had its troubles getting launched.

That’s an excuse.

With the celebrity of the Dragons, many of the company products could gain some momentum. Surely, with several Dragons pitching in with their skills and rolodexes of global contacts, they could achieve something?

Ya’think?

Ah…but Kevin would say he adds valuable entertainment which should be factored in to his score card.

Fair enough.

Although, the Dragons’ Den is a display of Canadian entrepreneurship, it has to be watchable and it’s an added benefit that Kevin does an exceptional job of teaching. Our Canadian show is far superior to the British version because we are fortunate to have entrepreneurs with deep experience: Jim Treliving adds gravitas, Arlene Dickinson mixes in marketing sense, Brett Wilson brings formidable gunpowder, Robert Herjavec has spark and it is exciting to see Kevin grasp onto entrepreneurs and drag them flailing around the Den. People going on the show do realize there must be good ratings, but the fair swap is that there is a real cash opportunity too.

If it’s ratings the CBC needs, maybe one of the entrepreneurs could come back on the final show and say, “Kevin, you’re out!” push him shouting across a moat and as the draw bridge pulls up, a sofa-sized dragon could lunge at him.

Is it possible that he could even scream?

You have to admit, that would make great entertainment and since ratings are a factor in this materialistic, greedy, money-grubbing world of ours, a scene of a Dragon’s demise would be of enormous interest to more than a few viewers.

Which Dragon would you roast?

Right – so we are agreed then. Here are the new rules for the Dragons: lowest cash investor, you are the weakest Dragon. In Kevin’s words, “You’re a nothing burger”. You’re off the show!

Now, that’s entertainment.

Cluster$%#@ to Power

This is the worst possible scenario. Amidst the most severe economic turmoil since the Great Depression, Canadian politics got interesting. Not good. Of course, I hope no one is under the impression that the concerns of the guerrilla faction, namely the leaders of the opposition parties, is entirely concerned with the absence of a stimulus package. The plans for this coup were put in place weeks ago by Jack Layton and the Separatists; and there could not be a worst time to be getting politically creative, it will be the economy that suffers.

This is the worst possible scenario. Amidst the most severe economic turmoil since the Great Depression, Canadian politics got interesting. Not good. Of course, I hope no one is under the impression that the concerns of the guerrilla faction, namely the leaders of the opposition parties, is entirely concerned with the absence of a stimulus package. The plans for this coup were put in place weeks ago by Jack Layton and the Separatists; and there could not be a worst time to be getting politically creative, it will be the economy that suffers.Canada's economy, still regarded by many as a bastion of stability amidst the world's other large economies, actually exceeded analysts' expectations last month while others continue to falter. The country's gross domestic product expanded by an annualized rate of 1.3%, the fastest in a year, last month, a month which saw some of the most volatile stock market movements in 20 years. While Britain and the U.S. wane under the pressure of the crushing lack of credit, Canada's approach has squeezed stability and modest growth from our industry. Obviously, it is unlikely that this will continue with exports declining as they are (1.4% last quarter, the fifth straight decline), but a rash, emotional approach to this situation will destabilize confidence and certainly create uncertainty. The wherewithal of a coalition government, one led by Dion and backed by socialists and separatists, is, though historic, an unlikely, unproven, and confusing alternative to what is in place now.

The Canadian dollar will certainly depreciate as a result of this politically driven turmoil, and considering the fall in commodity prices and weakened American demand, will not prove advantageous to the Canadian manufacturing and resource industry. Interest rates will rise in pursuit of fleeing capital, which will make credit even less accessible, making investment in infrastructure and development less productive and less profitable.

A stimulus package from a coalition will undoubtedly be influenced considerably by the NDP, preying upon the acquiescence of the Liberals, desperately clinging to power. A socialist stimulus package would likely be focused on consumers rather than industry. Rather than corporate tax breaks and subsidies to provide incentive and support for investment in infrastructure to support sustainable growth, for example, the coalition would benefit most from a package that pacifies voters with consumer focused incentives, such as Bush's tax rebate that delved out about $1,200 to each citizen in the U.S. last February. As Bush's example showed this type of incentive program would prove ineffectual, even disastrous, since consumers are free to spend as they wish. The $1,200 that Bush dished out went, in large part, to foreign exports, which is no help to the domestic market, some even stashed the money in the bank for darker days, like today. The Liberals do have some economic heavyweights that seem poised to act as advisers, if a coalition is to take over governing, who would likely see the impracticality of this approach. The issues are that the Liberals may have no choice in the matter and as a result, no one knows what is in store or who would be involved or in which capacity.

The point is that the very economy that the coalition says it's protecting will suffer on account of their actions, certainly in the near-term, likely in the long. The cornucopia of potential quagmires we are headed towards if we are led by a coalition government of liberals, socialists, and separatists is a distasteful, abhorrent, godless thing to behold. Of course, the Conservatives are not without blame in this mess, and there are points in their fiscal update that definitely deserves vilification, but to usurp the government as its walks a tight rope through these volatile times is hypocritical to the very cause the coalition seems committed to resolve. In the long-term, this may prove as politically disastrous for the liberals, NDP, and Separatists, as it will prove to the economy in the short-term.

December 1, 2008

Why Hank Paulson Let Lehman Brothers Go

The reason Hank Paulson let Lehman Brothers fail, according to a Wall Street insider, is because he hated the CEO, Richard Fuld – the man who got punched in the face while exercising at his company gym. Seems Paulson was not alone in those feelings. Paulson, who rose up the ranks to run Goldman Sachs, is leading the government program to get the American stock market back to its punching weight.

“Thank heavens Paulson’s doing it,” says this leading investment banker, as we chatted at the St Andrew’s Ball, waiting for the next Scottish dance, Strip the Willow, to get going.

“He knows what he’s doing and this is a situation we have never seen before. He's not going to let Goldman Sachs go because it's the centre of capitalism. If that goes, the very essence of capitalism goes too.”

The banker went on to explain that in the USA, if a business person joins government, they get a once-in-a-life-time chance to sell off all of their business interests tax free. For Paulson, this was reportedly about $600M in tax free savings as he made the switch from Wall Street to the government. Apparently this is a great incentive to get top quality brains working for the government.

Agreed.

It does show you that even in melt downs, who you know and who likes you still counts.

“Thank heavens Paulson’s doing it,” says this leading investment banker, as we chatted at the St Andrew’s Ball, waiting for the next Scottish dance, Strip the Willow, to get going.

“He knows what he’s doing and this is a situation we have never seen before. He's not going to let Goldman Sachs go because it's the centre of capitalism. If that goes, the very essence of capitalism goes too.”

The banker went on to explain that in the USA, if a business person joins government, they get a once-in-a-life-time chance to sell off all of their business interests tax free. For Paulson, this was reportedly about $600M in tax free savings as he made the switch from Wall Street to the government. Apparently this is a great incentive to get top quality brains working for the government.

Agreed.

It does show you that even in melt downs, who you know and who likes you still counts.

November 26, 2008

Confused by the Credit Crunch?

Having a hard time understanding collateralized debt obligations? Those financial instruments that got us into this financial mess are confusing many investors.

Marketplace Senior Editor Paddy Hirsch gives a superb lesson on how this credit crisis started and may give you a sense of when it may end.

Check it out:

http://www.youtube.com/watch?v=eb_R1-PqRrw

Marketplace Senior Editor Paddy Hirsch gives a superb lesson on how this credit crisis started and may give you a sense of when it may end.

Check it out:

http://www.youtube.com/watch?v=eb_R1-PqRrw

Someone to Watch Over You

I listened to a speech while lunching at Bay Street's secret handshake club last week where the guest speaker was Tom Hockin.

I listened to a speech while lunching at Bay Street's secret handshake club last week where the guest speaker was Tom Hockin.He told us not to tell anyone else, but since the finance industry was in such a crisis, now was the time to stop the madness of 13 separate regulatory bodies and merge into one.

Mr Hockin had travelled across Canada, putting together legislation that everyone - except Quebec - agreed to support.

Appears that The National Post got the story a few days later:

Canadian businesses would no longer have to file securities filings with 13

different provincial and territorial regulators, as they have for decades, and

brings to an end a much-criticized regulatory system described as "convoluted",

"unwieldy" and "Byzantine".

Instead, stock and bond-issuing institutions

would have to file prospectuses and other regulatory documents with only two

regulators -- a national body and its Quebec counterpart.

November 25, 2008

I'm Quiet and Thoughtful - Really!

Let’s talk about the real stars of Dragons’ Den – the brave entrepreneurs pitching their stories.

Let’s talk about the real stars of Dragons’ Den – the brave entrepreneurs pitching their stories.Did you know you can find past Dragons’ Den some of these people blogging on the CBC website, commenting on the deals and the Dragons?

It’s all very impressive.

In another reality show, The Bachelor, the girls who compete to win the heart of the single male return for one episode to confront the poor fellow.

Unlike The Bachelor, Dragons’ Den does not dedicate a show to the entrepreneurs returning to roast the Dragons - Arlene, Brett, Kevin, Jim and Robert.

To give the CBC credit, it lets fans know how the entrepreneurs and their businesses progressed and gives past winners, like Trent Kitsch of SAXX, their own blog too. But here’s the thing: participants can get in their two cents about their deal by blogging on the Forum just like TomChalker of dataSentinel who helpfully answered other bloggers’ questions. If you are expecting mildly depressed, dejected entrepreneurs who harbour ill will, forget that.

There are the budding armchair venture capitalists, like Dannolin and Pinebox, rating the merits of each business or venting about their own Den experience. Reading the past contestants and their often provocative takes on current pitches is fascinating because these guys know their stuff. It’s as if they’ve been through the miracle of entering the Dragons’ Den as innocents and emerging as venture capitalists (with tougher comments than Jim or Arlene would ever utter.)

The leader of the blogger pack is Ralfcis – he of the “sharpened keyboard” – was an engineer at Nortel. With his quirky wit and prolific writing, Rolfcis could make a career change from engineer drop-out to ad copy writer. Ralfcis describes his experience on a previous season of Dragons’ Den and as I read, it all came flooding back. Rolfcis was expecting a display table where he could spread out his samples. Instead, he had to stand up and pull out each item from the bag. Needless to say, things did not go well.

Rolfcis blogs about the good natured reaction to the pitch by Dragon Laurence Lewin, who sadly has just lost his battle with cancer.

Allison of Ariel Angels blogged all the way from Dubai to recommend a book called What Makes Things Stick. At first I was dubious and thought she just wanted to make Kevin O’Leary stick to the wall. In fact, the book’s inspired by Malcom Gladwell’s best seller book, Tipping Point and is a must read for anyone selling a product.

Maybe the bloggers could run a book list?

My happy browsing came to an abrupt halt when I read the name of a blogger called Darryl Koster. Hang on a mo. Isn’t he the pleasant CEO of Buster Rhino, that delicious sauce signed on with Brett Wilson and Robert Herjavec?

In the CBC Forum, Darryl Koster, the CEO, reveals to us that he turned down Brett and Robert’s deal. When I read that I went oooh nooo!

Where was the spoiler alert, Darryl?

I know there’s that six month delay from filming to the airing of the show but think about it, if you found out before season end of The Bachelor that the final girl has split and is living cheerfully with someone else, wouldn’t that be a huge let down? Darryl does make up for it by giving great website and technology advice to other presenters which may mean I have to vote him the season winner. Darryl, can you check out my website and give me some feedback?

There are many financiers who build their careers from the engineering profession and one of those people is the Big Kahuna blogger, Dragon W. Brett Wilson. How great is that to have a Dragon cruise around the Forum and drop in to blog?

Brett does not do much chit chat on the TV show except when he revves at warp drive to do a deal. Fasten your seat belts, ladies and gentlemen. The bloggers do appreciate how Brett shows up on the chat forums explaining why he made decisions and answering issues raised. He also says that he is not as the CBC portrays him – quiet and thoughtful.

Are you kidding, Brett?

That’s like describing Clint Eastwood as quiet and thoughtful. You are in the entertainment industry for a reason; it’s not because of your bookish ways. But don’t worry, your secret’s safe with us.

The bloggers do spend a great deal of time debating whether the show is better or worse with Kevin’s dramatics. One blogger calls Kevin a troll hiding under the bridge waiting to trap entrepreneurs which is a gross insult and unfair to trolls worldwide. Yet, I do believe Kevin really does the fairest exchange on Dragons’ Den as he teaches while he makes his decisions. After going through the hour meeting with Kevin, not one entrepreneur could possibly say, “I do not know why he did not invest with me, why my business needs to be changed, how my revenues might not reach the amount I expect or what I need to do.”

Not one Angel investor out in the real world would give anywhere near that much information for an entrepreneur to take away. In fact, investors say, “I like your plan but could you give us a call in a year?” That translates into au revoir. Most entrepreneurs would prefer to get more feedback than that.

I notice many bloggers have picked up Kevin’s key phrases too – the sign of a great teacher:

Let me use my time machine, slash, crystal ball and visit the future to imagine how the business revenues go.

Here comes Kevin and his bus.

How do we make moneeeeeeey.

Brett on the other hand chooses to share his investment strategies after the fact on the blogs. Either way, I think this sharing of knowledge is a fair swap between presenters and Dragons.

There is the trade theory that when people show each other their goods, it creates more perceived value, even though money may not have exchanged hands. The Dragons’ Den has entrepreneurs show their businesses and Dragons give their analysis and, sometimes, cash. Maybe this does create good will.

Several bloggers, like sslondon, liked the Dragons giving away cash in cheap loans because they had sympathy for someone’s situation. Brett Wilson and Robert Herjovec have done this so far and the Forums fans eat it up. I hate to rain on the parade, but if venture capitalists and Angels practiced this style of investing, they would be bankrupt within the year. Most businesses have their investing rules and deal structures. Doing venture capital and then veering abruptly to the left to give a loan or two means way too much complication for your average VC to manage.

Firms tend to do their philanthropy separately and for good reason. Maybe a philanthropy option should be built into the Dragons’ Den rules as a life line to be given once during the season, but Kevin O’Leary is right: feeling for a business owner is generally not the way the prickly world of investing works.

Kevin is teaching entrepreneurs how to fish; actually, he’s teaching how to spear gun and he doesn’t just hand over the darn fish.

For all you past contestant bloggers – here’s an idea for you:

What about a road show? You could call it, Lessons Learnt in Dragons’ Den. (Ralfcis, I’m sure you could come up with a catchier title). Maybe the sponsors like Profit magazine or EDC would be interested in supporting an event? Perhaps the School Boards may like you speaking to their high school students taking business classes. There are many entrepreneurs out in Canuckland who would benefit from hearing more from your side. I know I did.

Just a thought.

November 24, 2008

Theatre of the Absurd

Recently I spoke to a young, upwardly mobile, American private equity associate out of Chicago at the latest ACG Conference in Toronto. I asked, as I did many, how low EBITDA multiples had dropped in the U.S., and this particular investment professional said something absurd... "Actually, we recently lost out on a deal because we valued the company too low at a 16x multiple, the final valuation was 20x apparently".

Recently I spoke to a young, upwardly mobile, American private equity associate out of Chicago at the latest ACG Conference in Toronto. I asked, as I did many, how low EBITDA multiples had dropped in the U.S., and this particular investment professional said something absurd... "Actually, we recently lost out on a deal because we valued the company too low at a 16x multiple, the final valuation was 20x apparently". Where had this guy come from, El Dorado? The more common language trudging through the marble halls of private equity firms is far more vehement at its core as the tide of credit slips through their hands. Many in the portfolio management industry are using words like "capitulation" to describe the current market apoplexy. Private equity fund managers are not exactly having that much fun, but they are now being forced to reinforce their dykes against the fallout flood of melting consumer confidence, recessionary hyperbole, and teetering financial institutional giants.

The G20 meeting held by the world's undisputed champion of empty pledges, George W. Bush, was held in Washington on November 14, and looked like a charming get-together for the President and 20 of his closest friends, its effectiveness is yet to be seen, but certainly the opportunity to establish a sense of global solidarity was lost amidst the vagueness of the summit's conclusions. And today, before a podium and in front of a dilapidated-looking Henry Paulson, George Bush announced yet another emergency and absolutely necessary bailout package for another of the United States' beleaguered financial institutions, though Congress dismissed the auto industry the week prior.

It seems things have reached a point of absurdity, the now mighty Democrats (though so did a few Republicans) triumphantly lambasted the auto industry executives about the dysfunctional nature of their business models last week, but petitioned the very same industry not a month earlier by calling for protectionist measures (also laying the ground work for higher operating costs and material costs) when they were fighting for their own jobs.

In 1961, Martin Esslen coined the term Theatre of the Absurd to describe a type of tragicomedy, in which rationality is usually corrupted to disenchant the audience and cultivate a sense of unreality...nowadays it seems life does imitate art. Though a 20x multiple is absurd to most in the private equity industry, these days, absurdity may actually lend itself to credibility.

November 23, 2008

We are all richer with Free Trade

" Do you know how to make a sandwich?" asked Mr. Lajeaneusse, an economics teacher at UCC high school.

Do you know how to make a sandwich?" asked Mr. Lajeaneusse, an economics teacher at UCC high school.

Sure, I thought - two slices of bread, ham, cheese and maybe a piece of tomato.

"What would be the price of that sandwich?"

Well, depending on where you are buying all the parts making up that sandwich, but probably several dollars.

Mr Lajeaneusse then asked, "Now, what about a pencil. Can you make a pencil?"

Errr...nope.

"So why is the cost of a pencil so much lower than that of a sandwich?"

Adam Smith explained this concept of specialization back a few centuries when he used the example of the cost to an individual to make a pin. There are economic clubs trying to do just that but Mr Lajeanesse makes the point just as well.

The tasty sandwich example illustrates why specialization of skills pays off in bringing down the time and price for making something. He also showed how trade is of benefit to us all. Instead of our neighbours, today we trade around the world and there is talk about trade barriers going up again.

Here's a video clip of Milton Friedman Mr.Lajeanesse shared, explaining why free trade is a great thing for the world. I particularly like it when Milton Freidman talks about world peace. Now if only we could get beauty queens to discuss how world peace and free trade work together!

http://www.youtube.com/watch?v=d6vjrzUplWU&feature=email

Do you know how to make a sandwich?" asked Mr. Lajeaneusse, an economics teacher at UCC high school.

Do you know how to make a sandwich?" asked Mr. Lajeaneusse, an economics teacher at UCC high school.Sure, I thought - two slices of bread, ham, cheese and maybe a piece of tomato.

"What would be the price of that sandwich?"

Well, depending on where you are buying all the parts making up that sandwich, but probably several dollars.

Mr Lajeaneusse then asked, "Now, what about a pencil. Can you make a pencil?"

Errr...nope.

"So why is the cost of a pencil so much lower than that of a sandwich?"

Adam Smith explained this concept of specialization back a few centuries when he used the example of the cost to an individual to make a pin. There are economic clubs trying to do just that but Mr Lajeanesse makes the point just as well.

The tasty sandwich example illustrates why specialization of skills pays off in bringing down the time and price for making something. He also showed how trade is of benefit to us all. Instead of our neighbours, today we trade around the world and there is talk about trade barriers going up again.

Here's a video clip of Milton Friedman Mr.Lajeanesse shared, explaining why free trade is a great thing for the world. I particularly like it when Milton Freidman talks about world peace. Now if only we could get beauty queens to discuss how world peace and free trade work together!

http://www.youtube.com/watch?v=d6vjrzUplWU&feature=email

November 22, 2008

Stand out in this economy

What makes one conference centre company’s service so much better than the others?

What makes one conference centre company’s service so much better than the others? The human element.

But when most venues say they train their staff, what can make the crucial difference?

Ricky Bhang of The National Club says, “My pet peeve is when someone says no.” Ricky trains the staff at this exclusive Bay Street club to never let the word “No” be heard by a client. If a club member makes a request that the staff member believes to be impossible, they are trained to start the conversation with, “Let me find out and get right back to you.”

As Ricky says, “If you are paying and someone says no, that is going to reduce the experience. Even if it’s just a little, it’s still not the best.” This week, listen to how you speak to clients. How about a week where we all take a little training from Ricky Bhang and say, “Yes.”

As Ricky says, “If you are paying and someone says no, that is going to reduce the experience. Even if it’s just a little, it’s still not the best.” This week, listen to how you speak to clients. How about a week where we all take a little training from Ricky Bhang and say, “Yes.”

November 18, 2008

Do You Want to Be Rich?

J.B. Loewen's Blog for Dragons' Den:

J.B. Loewen's Blog for Dragons' Den:This week, Paul of Moyer Farms found himself in the foul Dragon's pit, blinking at the lights and trying to pretend with all his heart that this was where he wanted to be.

How Paul actually saw his situation was that his industry - agriculture - was in the dumps, his back was up against the wall. He needed cash to support all the orders flowing in for his added-value product of candied apples or he was in serious trouble.

As a business owner, before you decide to enter the Dragons' Den, do us all a favour and answer: "Do you want to be rich or do you want to control your business?"