Wealth Management

July 14, 2009

What's a Great Job Now?

I suspect many of these recently minted MBAs think that the private equity asset class is where the big salaries lurk and may be disappointed. Private equity is about far more than the money, the best PE people are fighters for the businesses they bring into their portfolios. They have to know the full range of business - in particular, cash flow. You can not get that from an MBA. Anyway, here's the WSJ article in brief:

"The percentage of graduates from the world's top business schools taking private-equity jobs has more than doubled in the past six years, according to the business schools' numbers.

"Financial News analyzed figures from five of the most popular M.B.A. schools:

- Harvard Business School,

- Stanford Graduate School of Business and

- the Wharton School at the University of Pennsylvania in the U.S.;

- the U.K.'s London Business School; and

- Insead, based in France and Singapore.

The percentage of Harvard M.B.A. graduates moving into private equity and venture capital has more than doubled, from 8% in 2003 to 21% among last year's graduates. In that time, the proportion moving into investment banking rose far less, from 7% in 2003 to 9% last year.

Data from Stanford showed a similar trend, with 9% of graduates choosing private equity in 2003 rising to 19% last year, compared with 4% and 5% for investment banking. Harvard supplied the highest number of M.B.A. graduates moving to private equity last year, with 191. Stanford was second with 72, ahead of Wharton's 45, Insead's 25 and London's 22.

Private equity's rise in popularity reflects the perception that graduates could make more money working in the asset class than in investment banking, but also follows substantial growth in the size of the private-equity market. However, an M.B.A. isn't a prerequisite for joining many private-equity firms. A sample of 10 large European and U.S. firms showed that 52% of the executives at partner level or above had obtained M.B.A.s.

Firms' Web sites showed French group PAI Partners had the lowest proportion, with 21%, or four of its 19 partner-level executives.The private-equity units of U.S. firms Kohlberg Kravis Roberts and Blackstone Group also had high proportions of MBAs among their senior staff, 61% and 63%, respectively.

Patrick Dunne, group communications director at 3i Group PLC, where 48% of partner-level staff had M.B.A.s, said: "For some people, [an M.B.A.] can be fantastically helpful -- for those without a finance background, for example, it can be a useful way of picking up necessary skills and knowledge."

July 7, 2009

How's your AQ?

Something like that.

Like Rocky, my favourite movie character, said, "It's not how hard you can hit, but how much you can take and still keep moving forward.

So, when I emailed the many entrepreneurs I knew from the Profit 100 list, I mentioned that their adversity quotient must be very high. Most of them understood what I was saying, but a few wrote back asking if this was their "pig-headedness" quotient too!

Here's a quick summary of AQ:

Adversity Quotient, called AQ, is like Intelligence Quotient or IQ.

AQ is the science of human resilience.

People who successfully apply AQ perform optimally in the face of adversity — the challenges, big and small, that confront us each day. In fact, they not only learn from these challenges, but they also respond to them better and faster. For businesses and other organizations, a high-AQ workforce translates to increased capacity, productivity, and innovation, as well as lower attrition and higher morale.

July 1, 2009

5 Ways GE is charging up their tired batteries

Jeff Immelt spoke before the Detroit Economic Club yesterday and I got summary notes from Judith Ellis via Tom Peters web site. Here is some of what he said:

Jeff Immelt spoke before the Detroit Economic Club yesterday and I got summary notes from Judith Ellis via Tom Peters web site. Here is some of what he said:"Many bought into the idea that America could go from a technology-based, export-oriented powerhouse to a services-led, consumption-based economy — and somehow still expect to prosper. That idea was flat wrong."

"Recently my colleague Peter Loescher, the CEO of Siemens, extolled the importance of Germany as an exporting country. In my career, I have never heard an American CEO say that the United States should be leading in exports. Well, I am saying it today: This country ought to be, and we can be, not just the world’s leading market but a leading exporter as well. GE plans to lead this effort. We have restructured during the downturn, adjusting to the market realities. At the same time, we are increasing our investments. We plan to launch more new products during this downturn than at any time in our history. We will sell these products in every corner of the world. We are creating a better company coming out of this reset. Similarly, America needs a dramatic industrial renewal. We have to move forward on five fronts."

First: Increase investment in research and development.

Second: America should get busy addressing the two biggest global challenges — clean energy and affordable health care.

Third: We must make a serious commitment to manufacturing and exports.

Fourth: We should welcome the government as a catalyst for leadership and change.

Fifth: It is possible for a global business leader to also be a good citizen.

June 30, 2009

An equation for valuation

Armada Data Corp. is a bright spot in the auto industry. With car sales down 15% to 20% in the past three months and GM and Chrysler continuing their downward slide, Mississauga, Ont.-based Armada Data is enjoying a 40% to 50% jump in sales and a doubling of market share, and it has plans to expand through acquisition.

In its 10th year, the company listed on the TSX Venture Exchange in Vancouver, gathers new car pricing data and sells the information directly to new car buyers via Car Cost Canada.

"We help consumers save money by giving them the information they need to negotiate a better price," says Paul Timoteo, president of Armada Data. "In these times, people are shopping around more. The more research they do, the more they see the value in our service. We've seen a huge spike in sales in the past six months."

Strong sales plus a debt-free balance sheet have placed Armada Data in shopping mode, and it is now looking at potential acquisitions. "When it comes to assessing value, I know what to look for," Mr. Timoteo says.

Namely: the company's ability to grow; its market share; its rate of growth; its history of profitability, current profitability and potential for future profitability; and its debt load. That's the financial side. Then there are the less tangible questions such as: How uniquely is it positioned in the marketplace? Who are its competitors? How does it compare to those competitors? What kind of marketing initiatives is it involved in? How do consumers and investors look at the company?

"If your company is profitable, typically the market says your company is worth anywhere from five to 10 times its annual profit," Mr. Timoteo says.

"That said, if we feel that merging a company with ours will disproportionately increase the value of our company, I may be prepared to pay more than it's theoretically worth because I know together we'll grow faster than either of us would have on our own."

That is why Jacoline Loewen of corporate finance firm Loewen & Partners and author of Money Magnet: How to Attract Investors to your Business, describes valuation as an art not a science. "It's expectations. How you sell yourself is huge," she says.

"It's about a lot more than money. Sales revenues give you enormous credibility but many companies get investment without any revenues. Angels will want to help because they like you and your business. At the end of the day you have to be able to stand by your valuation, build a case for the amount of time you've put in, the goodwill of your brand, your intellectual property," Ms. Loewen says.

How you choose to build that case may take different approaches says Steve Gedeon, professor of entrepreneurship at Ryerson University's Ted Rogers School of Management.

"There are essentially three reasons an entrepreneur would put a value on their business: To attract investment or if you are selling shares or selling the entire company; in the event of divorce or for estate-planning purposes; or if you want to offer employees stock options," he says.

"There are many different ways to go about placing a value on the business. The valuation method you choose is the starting point for negotiation. Ultimately, a company is only worth what someone is willing to pay for it."

Mr. Gedeon outlines three approaches to business valuation:

-Discounted cash flow, which is the net present value of all future profits of the company. "The trouble, of course, is nobody knows what the future will hold," Mr. Gedeon says.

-Similar company transaction, where basically, you adopt the known price someone was willing to pay for a company like yours.

-Replacement method, which pegs value at the cost to recreate the company.

When it comes to startups a rule of thumb applies: "Early stage businesses that don't have revenue will never be worth more than $2-million," Ms. Loewen says.

To build value, Mr. Gedeon, shares this rule of thumb: "The larger your profits and the more stable they are, the higher the valuation. How do you build stability? Diversify your client base and increase your differentiation in the market."

For Mr. Timoteo, the key to being profitable is simple: "Either increase revenue or lower your expenses. If you can do both you're in good shape."

The National Angel Capital Organizations' Best Practices Guide for Angel Groups and Investors ( angelinvestor.ca/Best_Practices.asp)has a detailed review of valuation methods.

June 29, 2009

Kevin O'Leary hates private equity

Kevin O’Leary says that he hates private equity – he threw out this comment on Twitter (I am enjoying his tweets). In actual fact, with Kevin's trademark honesty, he hits on the truth.

Kevin O’Leary says that he hates private equity – he threw out this comment on Twitter (I am enjoying his tweets). In actual fact, with Kevin's trademark honesty, he hits on the truth.I can get Kevin’s pain.

Private equity investing ain't for most investors because most people only want to give their money out for a year, and then they want to get it back.

Private equity is not the usual asset class or public market vehicle you can pick up or drop overnight. It is for the long term. For investors like Kevin who likes to have his money come home to visit Daddy once in a while, private equity (with its five year investment horizon) is simply too long term.

O’Leary’s right – private equity is hard. Funny thing though, I think Kevin would be a great private equity investor as owners would appreciate his candour, his rolodex, his big vision and his energy. Now, with all this talk about ribs, I'm going for lunch.

How far do you go to invest?

Financial gurus are bellowing that the next twenty years growth will be in BRIC countries. "You need to move on to richer, more verdant pastures!" How will this play out for private equity?

Where to find growth is a pressing question and it is a difficult challenge for small PE firms. How will these Canadian private equity experts invest? Will it be directly into Indian and Chinese companies? The more likely scenario is to invest in Canadian companies doing business with BRIC countries?

I do know that the equity partners within a few hours drive are more likely to consistently show up to the Board meetings, contribute and even drive the strategy, get people into the office on Mondays to drive the action and generally make themselves very useful.

If the PE firm can do all of that even if far away, then terrific.

Here's Carried Interest chatting about his investment in an Australian company and they challenges he is learning about - including the language. Turns out that even though they speak English, "S'tralian has to be translated a bit. Read more...

Do this with your family

Do you remember a particular tree from your summers past? Is there a tree your family gathers beneath and has shared history with you? Here's your chance to do something with your family this summer.

Do you remember a particular tree from your summers past? Is there a tree your family gathers beneath and has shared history with you? Here's your chance to do something with your family this summer.Heritage Trees could be those around which a community has held an annual picnic for the past 100 years, the tree that was planted to commemorate a coronation or other important international event, a tree that was planted to celebrate the life of a soldier or one in an historically designated neighbourhood. The trees should be part of the fabric of that community.

Anyone can nominate a tree by registering on the Trees Ontario Heritage Tree web site (http://www.blogger.com/www.heritagetrees.on.ca). A nominated tree is evaluated by a Trees Ontario representative based on the following characteristics: its historical and cultural importance to local and broader community; rarity of species; prominence based on size and age; aesthetics and/or artistic peculiarity; and its physical conditions and expected longevity. The evaluation criteria can be found on the Heritage Tree web site.

If the tree meets the above criteria, it will be placed into the Heritage Trees online database. If identified as a Heritage Tree it will also be recognized with a certificate.

A Heritage Tree is usually more than 70 years old. What sets them apart is the important cultural and historical significance they represent. “If these trees could talk, they could provide an intriguing history lesson about the people and land around which they are rooted,” said Michael G. Scott, President and CEO, Trees Ontario. “For the communities and people that enjoy, celebrate and nurture these green giants, they are a source of pride, full of rich memories and stories that they can now share.”

The Ontario Urban Forest Council’s (OUFC) Heritage Tree Toolkit formed the basis for the Trees Ontario Heritage Tree program. “The toolkit was developed in response to the public’s interest in identifying heritage trees in the community,” said Jack Radecki, Executive Director, OUFC. “OUFC is thrilled to be working with Trees Ontario to launch the online provincial program.”

“We are pleased to be working with OUFC to extend their Heritage Tree Toolkit into a province-wide program available to the public,” Scott continued. “We look forward to receiving nominations from across the province and to reading wonderful stories about important trees in our province.”

Trees Ontario has already begun working with other agencies to identify some trees that could be nominated. These are currently under review by Trees Ontario representatives and include trees from Aylmer, Cataraqui, Collingwood, Prince Edward County and Toronto.

Another important aspect of this program is the opportunity to collect seeds from recognized, native Heritage Trees, thus ensuring that the tree’s seeds live on. Trees Ontario plans to work with local communities to locate and collect these seeds. Growing trees from native seeds is important as those species have adapted to the regional environment over thousands of years and are more likely to survive.

For more information on Trees Ontario and the Heritage Tree Program, visit http://www.blogger.com/www.heritagetrees.on.ca.

June 25, 2009

Jack Welch gets into videos.

One of my favourite podcasts is Jack and Suzy Welch, listed under BusinessWeek. Each week, Jack riffs about business, with Suzy pushing for clarification. It's a great listen. Jack is now starting his online university and all I can say, this is the new way of education.

Here is the next level of Jack and Suzy's show.

RT @jack_welch: Web show- It’s Everybody’s Business (with Microsoft) View it here. http://bit.ly/6dCCF

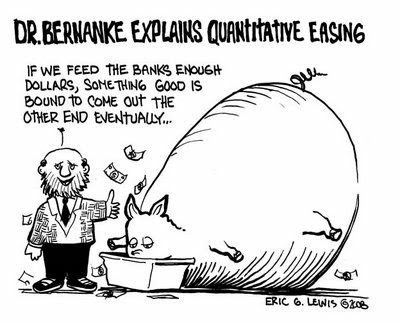

Those tasty green shoots turn out to be weeds

Green shoots turn out to be weeds, says Ross McKitrick, Financial Post:

The four problems are: the diluted balance sheet of the U. S. Federal Reserve; Obama's deficit binge; the growing wave of "Option-ARM" mortgage resets in U. S. real estate; and the California state budget crisis. We need to watch how these issues develop over the summer to know whether a recovery later this year will be possible. Those green shoots could be weeds.

June 22, 2009

China will boost your bottom line

Guest Blogger this week is Dr. Michael Power, Strategist for Investec Bank, South Africa, who is on the left of the photograph. Dr. Power predicted the housing bubble popping to the exact month. I think he was so clear headed because he is not situated in North America and is not as biased by the driving wish to see economic growth return to the Western World. Here he talks about the need to be in the Chinese market. Private equity knows this but it is good to get reminded. Check out Dr. Power:

Guest Blogger this week is Dr. Michael Power, Strategist for Investec Bank, South Africa, who is on the left of the photograph. Dr. Power predicted the housing bubble popping to the exact month. I think he was so clear headed because he is not situated in North America and is not as biased by the driving wish to see economic growth return to the Western World. Here he talks about the need to be in the Chinese market. Private equity knows this but it is good to get reminded. Check out Dr. Power:And, off in the far distance, there is a second debate coalescing along the lines of “Even if the US does have to endure a W-shaped recovery, just how robust will that final up-leg be?” The fear is that it might not be the incline of a steep hill but rather that of a gentle slope. Furthermore, the fear is that the new trend GDP growth rate it will gravitate towards will be materially lower than the old, pre-2008 level of 3.0% to 3.5%; 2.0% trend is the whispered number. If so, then perhaps the US (and most likely most of the West with it) is indeed turning Japanese.

You can reach Dr. Power at his email address - michael.power at investecmail.com

June 20, 2009

Building Canada - one business at a time

As previously indicated, here is proof of the value of your book. Cheers! Rolf Eichfuss.

I am will be returning your copy of "Money Magnet" to you tomorrow. I used temporary markers to highlight useful sections of the book. As you can see from the attached photos, I pretty much covered the whole book.

June 19, 2009

What the heck is an exit strategy?

Leading business owners use Exit Strategy to make better decisions for the long-term value of their enterprise.As a business owner, the long term legacy of your company should be a fairly important consideration. Yet, according to a Queens University SME study, an astonishing 82% of owners do not have an exit strategy. In other words, only 18% of CEOs have planned how to get out of their company with a cash payment. The others are doing what comes naturally – waiting until retirement creeps up or is forced.

Leading business owners use Exit Strategy to make better decisions for the long-term value of their enterprise.As a business owner, the long term legacy of your company should be a fairly important consideration. Yet, according to a Queens University SME study, an astonishing 82% of owners do not have an exit strategy. In other words, only 18% of CEOs have planned how to get out of their company with a cash payment. The others are doing what comes naturally – waiting until retirement creeps up or is forced. From Wishful Thinking to Reality

I guess it is natural that entrepreneurs who tend to rely on the old hit-and-miss, fly by the seat-of-the-pants approach of dealing with other parts of business put off their exit strategy. Tragically, this means that all the blood, sweat and tears shed by the entrepreneur in her business could fade away into oblivion without much value. With a bit of decision making today, however, the smart entrepreneur can maximize the return for her hard work.

An Exit Date Forces Action

Close your office door, get out a pen and paper and write down the exact date and strategy of your exit, it may be 5 years or 10, and state if you would be selling to a competitor or having your daughter take over. The specific details and timing are not important – it is the psychological power of having a date and a rough plan that will wake you up to the fact that one day you need to exit your business. A written plan and potential exit date will assist your management team and advisors in a course of action.

Example:

With a long view to the finish line, a good tax accountant will be able to assist you with minimizing your taxes. Maybe you will not reach that dreamed level of the IPO, but you can be assured you will be further along in organizing for the best sale value.

Put the Focus on Talent

Identifying a destination date also deals with one of the most common problems of successful entrepreneurs - ensuring the company can operate without them. Too many business leaders cannot step away from the business without it falling apart, which only reduces the value of their company. This common trap of micromanaging squashes the development of management skills as human beings learn from making decisions and mistakes. With an exit date fixed, the gaps in talent will become obvious, encouraging owners to deal with issues sooner than later.

It is a common observation that children of entrepreneurs are often overshadowed by the owner/parent. If you are interested in passing your business to your children, the setting of an exit date would encourage an earlier transition.

Example:

An exit date delivers a clear path for the next generation, showing the opportunity, instead of a vague promise of “Someday all this will be yours…or your brother’s.” Once family members are let in on the timeframe, the dynamics will change rapidly and entrepreneurs may be surprised at who steps forward with an interest in taking over the reins. The second generation can trust that there is a role for them and begin to take more risks, learning from mistakes while the expertise of the founder is still easily accessible.

Link the Personal and the Business

When you own your own business, personal issues are closely linked to with the business and, for true success, you need to manage both. By sharing your vision for the business with your spouse and children, family members will get a better grasp of the legacy you want to create. They will become more accommodating about the amount of time you are devoting to work once they know your time frame to leave the business.

You can also get your personal life more co-ordinated. Perhaps it is time to buy that smaller home in the location your spouse always dreamed about and get the new life going. Too many owners sell their business and then experience a massive shock from loss of a huge part of their lives. (Spouses also suffer!)

Call your doctor and make the time to have your annual medical tests. This may seem an obvious statement that has nothing to do with exit strategy, but your health impacts on the business and you should catch problems early. Do your family a favour and keep informed about your health as it affects their life too.

Example:

Remember that bumps in the road can change plans in a dramatic way but, with an exit date set earlier, management can be the little bit more prepared. Being diagnosed with cancer can move your sell point or ‘access point’ from five years to three months. If you prepare for an exit within five years time, even as a simple exercise, you can reduce stress at a time when your family needs you the most.

Know your Role in your Business

Michael Gerber, author of The Entrepreneurial Myth, says too many entrepreneurs are looking down at their desk when they should be looking outwards for new opportunities. Your job as the owner is to work on the business, not in the business.

Ask yourself if you are one of those business owners who prefer to focus on building the profit and cash flow? Be warned - this is tactical. Instead, you should be overseeing the managers and not doing the work.

Push the Vision to Produce Results

Golfing with the girls or sailing at Muskoka can inspire flashes of brilliance on how to improve the value of your business. It is astonishing how many business owners tell potential buyers what would boost the worth of the business considerably, but have not executed these clever ideas themselves. Don’t wait for someone else to make money on your vision - do the activities now that you know will add value to the bottom line. When you have an exit date, you will be surprised at how it turns up the heat psychologically to get more done. Maybe you postpone a golf game or two, but in the time frame of your exit strategy, the pay-off will be very worthwhile.

Example:

If you are imagining an IPO in five years, you will see the tremendous growth required to achieve this goal. Perhaps you will look at other options such as merger, buy-out or franchising.

In summary, with short term vision, it is no wonder that many businesses struggle to get the recognition and financial backing they richly deserve. An exit strategy can make sure you do retire rich, and surely that is worth a little bit of effort now?

Jacoline Loewen is an experienced business advisor, lecturer and writer who raises capital for growth companies. Her latest book is Money Magnet, Attract Investors to Your Business.

June 16, 2009

Are we the new Japan?

Here is Mike Shedlock's presentation at Google Tech Talk May 6, 2009.

http://www.youtube.com/watch?v=1YKc0UolTqE

June 12, 2009

Private equity sees reality and adapts

Just as America attracted the world's aggressive investment money last century (away from Britain) the Chinese economy is busy attracting the world's currently available investment money and is seen as the lushest place for future steep growth.

Just as America attracted the world's aggressive investment money last century (away from Britain) the Chinese economy is busy attracting the world's currently available investment money and is seen as the lushest place for future steep growth.I know British fellows who have still not accepted the decline of their Empire and I suspect it will be as painful for the American money experts to believe this new reality.

A finance strategist from London told me that he has a terrific presentation showing the movement of money supporting this theme, but was instructed by his senior manager "not to show it to the American clients as it would upset them too much."

Private equity is already nimble and investing in companies working with BRIC countries. That means even less money for the public markets and more money staying in private hands.

Jacoline Loewen sources private equity for companies that want to grow.

June 11, 2009

We are Entrepreneurs

I am not that comfortable talking about women entrepreneurs and business, as each woman's experience is so diverse. I can only speak from a financing perspective for women, where success comes from the ability to get the cash flow to grow the business aggressively.

I am not that comfortable talking about women entrepreneurs and business, as each woman's experience is so diverse. I can only speak from a financing perspective for women, where success comes from the ability to get the cash flow to grow the business aggressively.June 10, 2009

Another reason private equity is better than public money

Consider this. The Dow board decided that Travelers Companies Inc. (TRV) and Cisco Systems Inc. (CSCO) should get included in the Dow - only this month. As for GM and Citigroup, they have finally been given the heave-ho out of the index. GM has been part of the index since 1925 but after declaring bankruptcy this week, it would be shocking to say the least, for it to maintain its status within the index. Citigroup was also removed and quite right too, with its US government stake in the company. Why did it take so long?

Everyone knows the Dow as the oldest and most quoted index when it comes to financial markets. You may have also heard that the index is a weighted average of stock prices of its 30 components. What is not well known however are the criteria for selecting the component stocks that go into the index. As a matter of fact, I have no idea what the exact criteria are and would love to learn (if you do know can you email me?). We do know that the Dow Jones editorial board makes the final decision on which components to select.

Here's what really bothers me. This is why I question the public markets. When you consider the immense power that this editorial board has by making such a selection, it makes me wonder just how good a reflection of the true economy lies in the Dow and why it's still such an important barometer for the general public. More importantly, could there be any conflicts of interest in the selection process?

June 9, 2009

Break through the bear market line

June 6, 2009

Advice for women entrepreneurs on ins and outs of financing

Financing entrepreneurial ventures is always a tough sell, but in today’s bleak economy the task is even more difficult.

Financing entrepreneurial ventures is always a tough sell, but in today’s bleak economy the task is even more difficult.However, understanding of the ins and outs of financing goes a long way in increasing the chances of success.

At an upcoming Ivey Women Entrepreneurs Connect event, experienced entrepreneurs and finance specialists will share their expertise and concerns related to business financing.

The event takes place Wednesday, June 10 starting at 6 p.m. at Verity Club in Toronto.

Organized by the Richard Ivey School of Business and KPMG Enterprise, the session will open with a presentation by Jacoline Loewen, Partner with Loewen & Partners Inc. and a best-selling author, on venture financing and what options and strategies to consider to find the best financing fit. A private equity expert, Loewen has raised more than $100 million for companies and shares her insights in her latest book Money Magnet: How to Attract Investors to Your Business.

A panel session will follow with Sarah (Whatmough) Thomson, Founder and President of Women’s Post; Colleen Falls, Senior Vice President of KPMG Corporate Finance and Jen Kluger, Co-Founder of Foxy Originals, a Toronto-based jewelry design company. Beth Wilson, Canadian Managing Partner with KPMG Enterprise, will moderate the panel.

“Economic conditions may have changed the investment environment, yet history has shown that many successful businesses are born in recessionary times so it’s well worth pursuing an entrepreneurial vision,” said Stewart Thornhill, Executive Director, Pierre L. Morrissette Institute for Entrepreneurship at Ivey Business School. “The best way to manoeuvre in this challenging landscape is to broaden your knowledge and contact base.”

Event: Ivey Women Entrepreneurs Connect (including cocktail reception & networking)

Date: Wednesday, June 10

Time: 6-9 p.m.

Location: Verity Club, 111-D Queen Street East, Toronto, Ontario

To purchase tickets, please contact Ellen Brown at 519-661-4236, mailto:embrown@ivey.uwo.caor click here: Purchase tickets

Media interested in attending, please contact Dawn Milne, 519-850-2536, dmilne@ivey.ca About the Richard Ivey School of Business, The University of Western Ontario The Richard Ivey School of Business at The University of Western Ontario (http://www.ivey.ca/default.htm) offers undergraduate (HBA) and graduate (MBA, Executive MBA and PhD) degree programs in addition to non-degree Executive Development programs. Ivey has campuses in London

June 2, 2009

An Entrepreneur who made it to the other side

It is inspiring to listen to entrepreneurs who have succeeded in taking their idea from start up, over the chasm and managed to get to the other side. Their stories can teach other early stage entrepreneurs a great deal but also inspire them to take the risks to get to the other side.

It is inspiring to listen to entrepreneurs who have succeeded in taking their idea from start up, over the chasm and managed to get to the other side. Their stories can teach other early stage entrepreneurs a great deal but also inspire them to take the risks to get to the other side. When you hear Ron's comments on how he lead his company through the ups and downs, it becomes clear that he was always someone who cared very strongly about the people. I particularly liked his comment that he knew his staff were smart and would act if given the information. It is tough being a boss but believing your staff might be able to surprise you means that they will - and often.

What Private Equity Does For Your Business

First up is McKinsey chatting about how they see private equity working for business owners and why this leap frogs bank money:

The Financial Post Executive: What Private Equity Does for Your Business - Sacha Ghai, McKinsey & Company

Then we have an entrepreneur who made his fortune and is now entrepreneur-in-residence with MaRS which incubates about 400 companies.

The Financial Post Executive: How Entrepreneurs Can Make the Leap - Ron Close, MaRS

June 1, 2009

Not all private equity firms are White Knights

Here is a case with a bad private equity firm in the NYT by J. Crosswell. To all business owners out there, be very careful how you pick your private equity partners. Loewen & Partners works with business owners to match them with ethical partners and we know these players who take advantage of bank leverage.

Here's what the company had to say:

“What soured me on this experience is that these private equity firms that come in and buy companies don’t look at a company to grow it. Whether it sinks or swims doesn’t really matter to them,” Mr. Pfeifer said. “They don’t think about the people whose livelihoods depend on that company. I hope I never have to go through that again.”

And here is a quote I got from Catterton's website to sum it all up:

Establishing a close working relationship with the management team of a portfolio company is a critical element in our operating philosophy and a key driver of our success. As a rule, we do not involve ourselves in the day-to-day operations of a portfolio company. Rather, we seek to create equity value in a company by assisting management in identifying the key strategic, operating, and financial priorities, and the resources needed to successfully execute against those priorities. We generally hold at least one seat on the Board of Directors and on key sub-committees of the Board.

May 29, 2009

Issues Facing Women Raising Capital

The good news: perceptions are slowly changing and there is money available for solid, high-growth firms that can adequately communicate their promise to investors. If you are female, grow some thick skin and deal with the stereotypes early on in your conversations. Here are a few:

• Woman entrepreneurs do not want to grow their business as quickly as men do.

• Female entrepreneurs just don’t ‘get’ how to source funding.

• Lack of networks is one reason for women’s challenges. When women were asked about their networks, they listed various men’s names. When those men were asked about their networks, they did not mention the women.

Before you write to your local newspaper to complain about the above list, take a breath. Let's go to the facts to verify these issues. What is true are the statistics on male- versus female-run businesses which illustrate that female companies may grow at a slower clip, but they tend to have a higher survival rate.

Understand that, when it comes to accessing private equity, Fund Managers favour the growth versus survival factor. It’s only logical that when you go about raising capital, your pitch must be at growing the business, otherwise leave private equity to the more aggressive CEOs. Keep on doing your slow growth but do not expect private equity investors to invest.

Barbara Orser, professor at Carlton, reiterates that critical point, “Here’s the bottom line for women: only entrepreneurs who start robust, high-potential businesses - and communicate that promise - will get the money they need.” Smart women understand that thinking, and reassure investors by spending more time on illustrating their ambition when reaching out to the VCs.

Are Women Capable of It?

I am invited to talk about women in business frequently which is always a pleasure as each and every time I learn something new from the audience. I will be speaking at Ivey about women and finance next week which got me thinking...

I am invited to talk about women in business frequently which is always a pleasure as each and every time I learn something new from the audience. I will be speaking at Ivey about women and finance next week which got me thinking...Cash is King for General Motors

"General Motors is a monster company employing a quarter million people worldwide. It sells $150 billion in cars – or at least it used to. It is not just a producer of vehicles. It is also a supplier. It has been through several joint ventures and has owned a number of foreign manufacturers, Isuzu and Opel being but two. In short, the company is a very big player, financially, economically and politically. Yet, somehow you get the impression that many in the financial media think we could just turn the lights out and go home. This is just not the best option." Watch Edward explain this further:

May 28, 2009

May 27, 2009

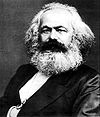

What would Marx Do?

When it comes to banking, many governments are now owners or part owners of their nation's banks. For retail banking (which has become a commodity) this may be a good development. Leave the higher risk financing to private equity and keep the meat and potato transactions for retail banking. It means that the people are not left drowning from this popped, speculative bubble while the bankers who created this situation are sitting on piles of bonus money.

When it comes to banking, many governments are now owners or part owners of their nation's banks. For retail banking (which has become a commodity) this may be a good development. Leave the higher risk financing to private equity and keep the meat and potato transactions for retail banking. It means that the people are not left drowning from this popped, speculative bubble while the bankers who created this situation are sitting on piles of bonus money.Jacoline Loewen is a partner at Loewen & Partners, private equity for companies over $10M in revenue.

Three Ways Private Equity Helps Grow Your Business

In these economic times, your private equity partners will advise you to forget the fads and get back to basics. With all of the latest and greatest concepts webcasts, podcasts and blogs vying for your attention, you would think that growing your business was as complicated as building the space shuttle. The fact is, there are only three ways to expand business...

Option #1 – Increase the number of customers

You increase the number of customers you have by reaching new customers with your existing offering or developing a new offering. Ideally you will leverage the offering you have to enter a new market or expand the reach in your exisiting market. Three key questions to answer to increase the number of customers are:

Who has a real need for the product/service I’m selling? Does my product meet that need in a manner that either saves money or provides additional value?

How much, if anything, are they spending to address that need today?

How many of those potential customers are there? How do I reach them?

Answering these questions meaningfully necessitates market research. Market research is like eating your broccoli – the idea is not appealing but it does the right job in keeping you healthy. Research teaches you a great deal about what you will need to know to effectively reach these new customers such as what to say, how to say it and to whom.

For example, in my industry which is finance and involves investing in companies, many of the big players have had a brick smashed to their heads. Private equity and venture capital funds are in bad shape. The market research done by the top funds and consulting firms like McKinsey and Company show that funds invested in smaller companies are faring better and enjoying higher returns. With this information, many or the funds are now looking for smaller companies. Reducing their size of company as a potential client opens up the customer pool.

Could you reduce one of your criteria to include a whole new category of client?

Option #2 – Increase the frequency of purchase

The shampoo companies used the wash, rinse, repeat mantra. This ordered their customers to use double the shampoo that is actually required. How many times have you washed your hair twice?

The quickest path to increasing the frequency of purchases is by making it as easy as possible for your existing customers to do business with you repeatedly. Another way to look at this is providing additional customer value – and ultimately building customer loyalty. If you make it easier for customers to buy from you, relative to your competition, then you will continue to win their business. This, of course, assumes your products or services are comparable or superior to your competitors.

Outside of customer loyalty programs, here are a few areas to consider improving:

- Responsiveness to requests, phone calls, emails

- Accessibility to the customer’s primary contact

- Consistency in offering

- Simple contract and pricing

- Bite-sized projects

- Follow-up and follow-through on meetings

- Accurate and timely billing.

While these may seem like common sense, consider how many vendors you no longer use because they were too difficult to do business with. Don’t become one of them to your customers. Option #3 – Increase the number of units sold

By default you will increase the number of units sold when you increase the number of clients and frequency of purchase. But you can also increase the number of units sold by understanding how to add value. If you want to sell more products or bill more hours, providing a value-add benefit or solution will begin to strengthen your customer relationship. If you are to consistently add-value to the customer relationship, you need to fully understand how your customers interpret, define, and quantify the value they receive from your products and services.

Here is a consumer example: A restaurateur offered existing customers 20 percent off for parties of 4 during lunch and early dinner. The idea was to add value to her existing clients by providing them with a benefit they could share. Result: Her lunch business went up by 88% in one month and by 53% over the campaign. On the frequency side, she experienced 71% retention of her customers when she dropped the campaign after 3 months.

Finally, don’t forget, to see real results, private equity will remind you to start with what you already know about your customers. It is the market research, customer knowledge you already have, that is literally a hidden goldmine of profit that can grow your business and increase your company's top line. It is this customer-focused information that will provide the foundation for generating more sales, retaining and cross-selling customers, and acquiring new customer business. Armed with customer-focused information, you will know which is the best way to grow your business.

Jacoline Loewen assists companies in raising capital and can be reached at www.loewenpartners.com. She is the author of Money Magnet:How to attract investors to your business (http://www.moneymagentbook.ca).

May 22, 2009

The stimulus package Washington is not talking about

Already, companies are beginning to link with private equity which is a new type of money which came on board within the last decade for small and mid sized companies. The banks have had a massive slap down and will be risk adverse for the next economic cycle at least. This leaves private equity to fill the role of higher risk lender or partner. By the way, if you are a business owner,do understand that Private equity is a misnomer as it also includes debt.

Listen to this podcast from Business Week on the money private equity is beginning to spend. You will understand why optimism about the economy is beginning to grow and private equity will play a large role.

View Private Equity Stimulus Package.

May 20, 2009

The public markets are calming down

Jacoline Loewen is a contributer to Trusted Advisors' Survivial Kit and a partner with Loewen & Partners.

What every business owner should know

Ezra opens by describing his own situation as the owner of a business accused of human rights abuse but, to his credit, quickly puts that aside and tackles a full blown investigation of the HRC cases – a human rights audit if you like. Even if he has cherry-picked the vexatious cases, there are too many, and I was particularly disturbed by the cash payment rulings against small business owners. Ask any tax accountant, most small business owners do not have a great deal of cash and often go without a monthly salary or contribution to a pension just to keep going – unlike HRC agents with their salary (many over $100,000), indexed pensions and benefits.

Using his education in law, Ezra unpacks case after case illustrating the imbalance between the person making the human right’s complaint and the business owner. The complainant gets a lawyer (funded by tax payers), does not need to face the business owner they are accusing, may get a cash payment ($50,000 has been paid), may get a written apology even published in the paper.

Now, when was the last time you saw an embezzler’s letter of apology to a business owner in the newspaper?

If the complainant’s case is dismissed, they are not required to cover the costs to the business owner as a real court case dismissal would require. It gets worse: the HRC can enter your work and home, seize any property they want without a warrant – good Lord, is this Zimbabwe?

For all of us non-lawyers, Ezra illustrates how hundreds of years of legal framework and code of conduct gets swept aside by these HRC agents pursuing frivoulous complaints. Is there not enough salt in the soup at your company’s canteen? Gee, file a human rights complaint to your local HRC and you could end up with some cash.

I wondered if the HRC had industrial relations or business expertise. Ezra fills us in. The head of the BC HRC’s education is nursing. Well, that explains it. She’s got Head Matron Syndrome: she thinks she’s thundering down sterilized, scrubbed halls of a hospital, patients tucked meekly between starched sheets, nurses and orderlies all bowing their heads obediently in fear. That head nurse has real power – that’s for sure.

The deadliest part of Ezra Levant’s book is his description of his own interrogation. The HRC government agent does not have the slightest clue about the damage she is inflicting on a business owner or on the future well-being of our society. She does not realize how these claims will tarnish the very good work done by so many government employees.

As Mark Steyn explains in the foreword, “Go to YouTube and look at the videos of Ezra Levant’s interrogation, you will not find some jackbooted thug prowling a torture chamber but a dull bureaucrat asking soft spoken questions in a boring office. Nevertheless, she is engaged in a totalitarian act.”

Of course, I would not want to call that HRC agent a “Loser” for fear of hurting her feelings. Then she could complain her human rights were abused and I will be dragged through five years of court proceedings, fined and forced to write a letter of apology printed on the pages here in The Women’s Post.

As these crazy Human Rights case rulings become public with the help of Ezra, the repercussions for our business community will be chilling. These human rights cases make entrepreneurs feel angry and downtrodden. Why take the risk, stress and responsibility to run a restaurant or hairdressing salon when you can get slapped with a human rights case that can cost you your business? Heck, let’s all become government employees because as Ezra Levant makes very clear in his book, Shakedown, just like Rodney Dangerfield, business owners don’t get no respect.

May 19, 2009

Why private equity is taking money from public markets

These company executives apparently did not have much faith in their own firm and yet, they expected the US taxpayer to effectively own them - hmm...

So where are bailouts going? I hope the American people can demand answers.

If a private equity fund was asked to invest in such a company and they didn't see the same commitment from the senior executives, why should they put in money? The US taxpayers should ask the very same question or rather, the US government, on behalf of the US taxpayers.

Yet another example of the difference between private equity fund boards and public market boards. When you are putting in your own money, you want clear answers and results.

May 18, 2009

What is Private Equity?

Investments could be your Uncle Jim’s $1M he put into your brother’s video gaming company. This is private, it is not listed on the public market where the shares can be bought and sold by anyone. This definition, however, omits the key difference that sets private equity far apart from alternate capital.

One of the leading private equity players, David Rubenstein of The Carlyle Group, gets to the nub. “Private equity is the effort made by individuals with a stake in a business.”[i] These individuals will put capital in, try to improve the business, make it grow, and, ultimately, sell their stake.

Jacoline Loewen is a partner with Loewen & Partners which has raised over $100M for owners of companies.

[i] Rubenstein’s definition sourced from the website www.bigthink.com/business-economics/6380>.

May 15, 2009

Private Equity can be alarming

Private Equity is such a tough type of financing to help owners of companies understand. The big deals done get the media attention. Some of the stories told are alarming for owners.

Private Equity is such a tough type of financing to help owners of companies understand. The big deals done get the media attention. Some of the stories told are alarming for owners.It is only in the last decade that this type of money has now become available in all sorts of formats for business owners of mid-sized companies. These stories do tend to fly under the media radar.

This is why Loewen & Partners runs CEO Round tables with Ivey Business School to showcase private equity. Yesterday, we had McKinsey and Company and Bill Wignall giving detailed presentations to a room of business owners. Here is the take away from Paul Hogendoorn, owner of OES.

"It’s both a professional benefit and a pleasure to attend your CEO events. Yesterday was no different. (BTW, my most recent column again referenced a key take-away from a previous event).

My big take-aways from this last one were:

- It’s OK not to need PE money

- Know specifically what you want to use any investor PE money for

- The structure of a deal can make even an otherwise unattractive deal workable

Ken enjoyed it to. Much of the first presentation was greek to him (and therefore intimidating – which was consistent with my first experienced a couple years ago), but he recognized the value in gaining some exposure to it, and he really enjoyed the second speaker."

The second speaker was a professional manager, Bill Wignall, who gave his experience in accessing Angel, Venture Capital and Private Equity Fund money. It was a great day and it is always gratifying to see that you are helping business owners.

May 13, 2009

Companies with Debt Are Attractive to Private Equity

I can say this because in my experience, I have often been astonished at which businesses are liked and coveted by investors—yes, even those that are not currently profitable.

McGregor Socks, a long serving Canadian company is such a case. After struggling to adapt to the fast changing global market, McGregor knew it needed to add China as a destination for knitting up Canadian-designed creations. It was a private equity fund that put up the money since they already had experience in China. Bringing in partners is a difficult transition but with supportive investors, an excellent Canadian brand continues to fill store shelves (look for a pair of McGregor’s the next time you need socks).

Jacoline Loewen is a contributing author to Peter Merrick's book, The Trusted Advisor's Survival Handbook.

May 12, 2009

6 Reasons to Read Money Magnet: Attracting Investors to Your Business

I just finished reading Money Magnet. Thank you for writing/recommending it! The information you shared will save me a lot of time instead of reinventing the wheel. I like reading materials from people like you who can share specific industry insight (eg. when you described what VC Rick wants to see in slides). Some of my key takeaways include but are not limited to the following:

- Targeting qualified investors based on their mathematical fit and specifically asking them to clarify their full criteria

- How to be investor ready/the legacy investor concept.

- An investors’ protection/clauses (ensuring that I negotiate unnecessary ones).

- Knowing common pitfalls/key criteria investors like

- Ensuring that I answer the 4 investor-ready questions and

- Investor-friendly methods of structuring a presentation

May 11, 2009

May 5, 2009

5 Questions Board Directors Can Learn From Private Equity

These translate into five key questions that directors should pose to senior management and expect a thoughtful analysis in response. If you are a Board Member, take note and try asking them at your next Board meeting:

1. Have we left too much cash on our balance sheet instead of raising our cash dividends or buying back our own shares?

2. Do we have the optimal capital structure with the lowest weighted after-tax cost of total capital, including debt and equity?

3. Do we have an operating plan that will significantly increase shareholder value, with specific metrics to monitor performance?

4. Are the compensation rewards for our top executives tied closely enough to increases in shareholder value, with real penalties for nonperformance?

5. Have our board members dedicated enough time and do they have sufficient industry expertise and financial incentive to maximize shareholder value?

Jacoline Loewen is a partner with Loewen & Partners and has been a Board Member for Bilingo China, Innovation Exchange, The Women's Post, Strategic Leadership Forum and more.

May 4, 2009

US Debt May Crowd Out Private Investment

The trouble is that government borrowing risks crowding out private investment, driving up interest rates and potentially slowing a recovery still trying to take hold. That is why the American Federal Reserve announced an extraordinary policy this year to buy back existing long-term debt — $300 billion over six months — to drive down yields. The strategy worked for a while, but now the impact of that decision appears to be wearing off as long-term interest rates tick up again.

Then there is the concern that the interest the government must pay on its debt obligations may hurt future generations. The Congressional Budget Office expects interest payments to more than quadruple in the next decade as Washington borrows and spends, to $806 billion by 2019 from $172 billion next year.

GRAHAM BOWLEY and JACK HEALY report in the Wall Street Journal, May 3, 2009: “You’re just paying more and more interest and having to borrow more and more money to pay the interest,” said Charles S. Konigsberg, chief budget counsel for the Concord Coalition, which advocates lower deficits. “It diverts a tremendous amount of resources, of taxpayer dollars.”

Of course, no one is suggesting the United States will have problems paying the interest on its debt. On Wednesday, even as it announced its huge financing needs for the latest quarter, the Treasury said financial markets could accommodate the flood of new bonds. “We feel confident that we can address these large borrowing needs,” said Karthik Ramanathan, the Treasury’s acting assistant secretary for financial markets.

One worry, however, is that there are fewer eager lenders to buy all that American debt. Most of the world is in recession, and other nations have rising borrowing needs as well. As other nations’ surpluses turn to deficits, America will face competition in global financial markets for its borrowing needs. For the moment, the United States is actually benefiting from a flight to quality into Treasuries brought on by the global financial crisis, which helped reduce rates to record lows this winter. But the influx will not continue forever.

China has lent immense sums to the United States — about two-thirds of its central bank’s $1.95 trillion in foreign reserves is believed to be in United States securities — but it has begun to voice concerns about America’s financial health.

To calm nerves and fill the deficit hole, the government is getting creative. The Treasury is ramping up its auction calendar, holding more frequent sales of government debt and selling the debt in expanded amounts. It is now holding sales of its 30-year bond each month, up from four times annually.It is also resuscitating previously discontinued bonds, such as the seven-year note and the three-year note, to try to mop up any available money all along the yield curve. There is even talk of issuing billions of dollars of a new 50-year bond, though the idea has not won official approval

April 30, 2009

Even Facebook likes private equity

"Facebook meets private equity firms to raise capital," reports the Dow Jones Newswires, 30 Apr 2009. Facebook has held a series of exploratory meetings with private equity firms on raising additional capital but the two sides are about $3bn (€2.2bn) apart on what the social networking website is worth, The New York Post reported, citing sources close to the situation.

April 27, 2009

Pitching to Raise Capital

“What don’t you like?”

“It’s the lack of a big, driving goal. Imagine if General Montgomery spent all his time discussing how war ships and planes were built - and their fire power - instead of getting on with the big picture for D-Day. It’s the same for entrepreneurs. They must show the vision of D-Day, the milestones to get Normandy done and what the results should be. Cost – reward. They must show they can use the left side of their brain to steer their earnings before interest, taxes, depreciation, and amortization (EBITDA).”

Michael takes a breath and continues. “It’s never the technology alone that gets money out of the customer’s wallet. Ask Beta, Eight Track tapes, Lotus Notes, and all those companies with the way-cool technology that overshot the customer’s need. If you spend your twenty minutes telling me about your technology, I can’t stand it! It means you’re just not CEO material.”

“You hate seeing pitches?”

“Nope, I just get bored out of my skull by people who have not taken the time to expand their skill set. Owners bogged down in their product are like finger nails down a blackboard.”

Crikey! No wonder business owners get intimidated by pitching to investors. It is why I tell company owners who are about to raise capital that pitching to the fund managers is fifteen minutes under a hot, hot spotlight. When you get before the investors with the big bucks, you may have been invited for an hour, but in reality you have just fifteen minutes to break through and get them wanting to know more. For those silver-tongued owners who can communicate their business situation effortlessly, they will attract the finance partners to take their company to the next level. For those lesser mortals (most business owners) they could learn a lot from Andy Warhol’s phrase “fifteen minutes of fame” when prepping for pitching.

Make no mistake, the initial pitch is a short time to explain your value and, quite frankly, this process annoys the heck out of owners who know their companies are solid performers with a good financial record. They bristle, “Can’t these guys just read the business plan and we can email the PowerPoint?”

Eeeer, no. Private equity investors put their money (and it is often their own cash) into management and the pitch is their first opportunity to assess the team. Put yourself in the place of these investors. Imagine that you must make an investment decision. How would you make your decision? Would you choose the owner who froths at the mouth about their fabulous technology that U of Waterloo admires? Then there’s the owner who is obviously a great manager but the product is iffy. Lastly, you meet the owner who talks in broad brush strokes about the technology, how it will translate into cash, but also how much your investment could earn you over the next five years. The entrepreneur who can communicate and is thinking about my investment gets my vote – n’est pas?

For many owners, it can come as a surprise the extent that quality of management influences the investors. Most fund managers will tell you they would rather put their money into the great management team with a B product, rather than the less than stellar team with the A product because leadership is what gets results.

One of my clients, Angella Hughes of Xogen, swept me up in her enthusiasm because of her ability to get across her business value. Angella said, “Water is a scarce resource, not here in Canada but across the world, and it is dwindling every year. We have a cheap way of purifying water.” Ok, got that and I know fund managers in the green sector would agree. She pitched a brief investment thesis in a few words that people can grasp. She understands that there is time to get to her technology and complex business model in the second half of the meeting, once the value has been established. If she spoke about her water purification technology too early, her science would only serve to numb the interest of her investor audience.

The best case scenario is to get plugged into advisors and investors who really know and love their industry before you decide to take on private equity. “Even if they aren’t looking for capital at that time,” says Robyn Lawrie Rutledge, an investor with TSG Consumer Partners. She advises, “When the time is right for both parties, there will be a relationship in place which will lead to a more streamlined process and a stronger partnership out of the gate.” You might not have to burn under that fifteen minute spotlight by then.

I don’t want to suggest that pitching is like taking in a Staples “Easy Button” and the fund mangers will punch it, writing you a fat check. Simple is never easy. Deep preparation is needed and those who do it, get the funding. The investment community is globally small and, by golly, if you treat the visit to any investor with the same forethought as a chat with a friend in the school parking lot – well, put it this way, you don’t deserve the money. If you are one of the many business owners not comfortable with the communication required to finesse a capital raise, for heaven’s sake hire a professional corporate finance expert. Or find yourself a partner who can communicate.

Jacoline B. Loewen is the author of Money Magnet and managing director at Loewen & Partners, a private equity and venture capital firm based in Toronto. Jacoline works with the owners of companies to access capital. Jacoline can be reached at www.moneymagnetbook.ca.

April 26, 2009

Canadians watch the US bear market rally

Posted by Jacoline Loewen, Loewen & Partners and author of Money Magnet.