Wealth Management

April 21, 2009

Top 7 Questions of Private Equity

By Jacoline Loewen.

Most business plans are dull and, frankly, too crafted and full of motherhood statements such as market leader. Well what does it all mean and will it honestly set your potential investor on fire? Most probably not. Here are the top seven questions an investor will be wanting you to answer. So get your story written up in a dynamic business plan:

1. What's the opportunity?

It's not enough to say you've spotted a problem and a way to fix it. Investors despise those marketing studies that say "this market is expected to grow 250% a year for the next 10 years, and if we can capture just 1.7% of the market, we'll all be multi-billionaires." Instead, you need to show how your approach will work better than any previous attempts to exploit the opportunity, and how you'll make money doing so.

2. What’s your competitive advantage?

Don’t get put off by the jargon – it simply means what does your business do well. As Woody Allen said, you only have to be five minutes ahead of the competition. Maybe you have management team with a distinct skill set that a rival company couldn't easily match. Investors probably won't be impressed if you claim your advantage is having a head start on the competition — not unless you have a barrier to entry, such as a patentable product or process that would make it hard for new rivals to imitate your offering.

3. What’s your big vision?

If you are planning to be the big boy in all of Mississauga, don’t count on getting funding. If you are wanting to go international, there are consulting firms who will help your set up channels to access markets elsewhere. Show this big thinking capacity.

4. What is the secret of your future sales success?

Investors know that selling is a special talent, and one that many young companies don't have on board. They'd love to hear that you have a rainmaker on your team, or a proven sales technique that can easily be taught to others. Or perhaps you have signed on with a top sales firm who will represent your product to the USA market.

5. What have you learned from the competition?

The more specific your answer, the better. For instance, "competitor X impresses us by being so systematic in asking new customers what they like and dislike about its service. We plan to take that idea a step further by responding immediately to customer dislikes." Also, consider what is the worst thing your competition could do to your business and address this.

6. How will you use the funds you raise?

Buy a Porsche? I don’t think so! Investors are more concerned than ever that their money be spent in ways that most directly generate revenue and profits. They'd rather hear you itemize how you'll use it to hire three more salespeople and develop sales support literature than on product innovation research.

7. What are the risk factors?

Your realism in this area will reassure investors. If it's likely that competition in your industry will intensify over the next six months, then tell them you expect this to happen and explain how you plan to respond.

Jacoline B. Loewen is a managing director at Loewen & Partners, a private equity and venture capital firm based in Toronto, Ontario. Loewen & Partners works with the owners of growing, privately held companies to access capital. Jacoline can be reached at 416 961 0862 or Jacoline at loewenpartners.com.

April 19, 2009

Private Equity Myth #5: Private equity investors are only interested in your exit strategy.

In any event, your private equity partner has a vested interest in growing your company over the next several years up to the exit event. Their goal during this period is the same as yours: to increase the value of your company by expanding the business.

Focus on what's important, put the myths to rest

Whether to take on private equity is a complex decision, requiring in-depth analysis of your personal and business goals, the market environment, and the financing options available. Focusing on these important considerations -- rather than on common misperceptions -- will help you make the right decision. It's time to put the myths to rest.

Jacoline Loewen is a partner at Loewen & Partners, Toronto, Ontario, Canada office, a private equity and venture capital firm. Jacoline can be reached at 416 961 0862 or jacoline at loewenpartners.com or http://www.loewenpartners.com

April 18, 2009

Private Equity Myth #4: Taking venture capital means you lose control of your company

Just remember though, that more work goes into your company the more ownership you give over to investment partners. You will get more heavy lifting, the higher the percentage the investors own.

In the book Money Magnet, by J. Loewen, there is a chapter devoted to this topic.

Jacoline B. Loewen is a managing director at Loewen & Partners, a private equity and venture capital firm based in Toronto, Ontario. Loewen & Partners works with the owners of growing, privately held companies to access capital. Jacoline can be reached at 416 961 0862 or Jacoline at loewenpartners.com.

April 16, 2009

Private Equity Myth #3: Private equity investors don't add value because they haven't been in an operating role.

However, they can add value by challenging management to think outside the box.

Investors who have backed many different companies at rapid growth stages can recognize patterns that may not be obvious to the management team. They may have a network of relationships that can also assist companies in recruiting talent at the board and management level. They can often help companies explore strategic partnerships with other firms.

Jacoline B. Loewen is a managing director at Loewen & Partners, a private equity and venture capital firm based in Toronto, Ontario. Loewen & Partners works with the owners of growing, privately held companies to access capital. Jacoline can be reached at 416 961 0862 or Jacoline at loewenpartners.com.

Private Equity Myth #2: Valuations are the only consideration

When you focus exclusively on valuation, you risk ending up with a partner who doesn't understand your company, your growth strategies, or your industry.

Let's say, for example, that you sell your company to an investor whose expectations for your business are unrealistically high. You may obtain a good price for your company, but that relationship is likely to sour as the business fails to meet the investor's expectations. On the other hand, an investor with a more nuanced understanding of your company would work with you to increase its value in a realistic and sustainable way.

Jacoline Loewen, author of Money Magnet, shares her insights on attracting investors. Ms. Loewen works in Toronto, Ontario.

Jacoline B. Loewen is a managing director at Loewen & Partners, a private equity and venture capital firm based in Toronto, Ontario. Loewen & Partners works with the owners of growing, privately held companies to access capital. Jacoline can be reached at 416 961 0862 or Jacoline at loewenpartners.com.

April 15, 2009

Myth #1: Private equity is a win-lose game

According to this myth, private investors somehow make off with the value of your company -- perhaps buying at a too-low price and cutting you out of the eventual rewards that you'd earn from going public or selling to another company. Remember, though, that private equity investors only make money if the value of your company appreciates -- and, in most cases, the entrepreneur retains a substantial interest in the business. After all, it's in their best interest to help you grow your company and increase its value. Almost by definition, if the investor wins, the entrepreneur wins.

Moreover, a private equity investment provides entrepreneurs with the opportunity to diversify their assets. You receive cash for part of your share in the company, which you can spend or invest as you see fit. As a result, you immediately reduce your exposure to events at a single company, in a single industry -- and can access cash that you may need for retirement, college tuition, or major purchases.

Jacoline B. Loewen is a managing director at Loewen & Partners, a private equity and venture capital firm based in Toronto, Ontario. Loewen & Partners works with the owners of growing, privately held companies to access capital. Jacoline can be reached at 416 961 0862 or Jacoline at loewenpartners.com.

J Loewen is the author of Money Magnet: Attract Investors to Your Business and is a partner with Loewen & Partners, working with business owners to raise capital and restructure finances.

The Five Myths of Private Equity

As venture capital and private equity continue to make news headlines, entrepreneurs may find it challenging to distinguish fact from fiction.

- Do investors win at the expense of entrepreneurs? Are investors out to wrest control from management?

- Is an investor's sole focus on the final liquidity event?

Without question, misperceptions can prevent an entrepreneur from making rational, fact-based decisions. During my 20 years working with business owners, I have come to identify what I call "The Five Myths of Private Equity."

Jacoline Loewen is the author of Money Magnet: How to Attract Investors to Your Business and her book can be found at http://www.moneymagnetbook.ca

Myths of Private Equity

Whether to take on private equity is a complex decision, requiring in-depth analysis of your personal and business goals, the market environment, and the financing options available. Focusing on these important considerations -- rather than on common misperceptions -- will help you make the right decision. It's time to put the myths to rest.

Jacoline B. Loewen is a managing director at Loewen & Partners, a private equity and venture capital firm based in Toronto, Ontario. Loewen & Partners works with the owners of growing, privately held companies to access capital. Jacoline can be reached at 416 961 0862 or Jacoline at loewenpartners.com.

April 14, 2009

BMO hires leveraged lender

BMO Capital Markets is getting ready for the return of private equity funds by hiring an experienced leveraged finance expert in its New York office.

Eric Luftig, a veteran of GE Capital Markers and CIBC World Markets, joined the U.S. investment banking arm of Bank of Montreal as a managing director. The Manhattan-based executive is now responsible for debt and equity private placements in BMO's leveraged finance group.

Bank of Montreal is one of several former mid-tier players in U.S. private equity to upgrade its talent at a time when most Wall Street firms are cutting head count. The credit crunch has trimmed the ranks of lenders to private equity funds, while improving the terms on which loans get made. That makes this sector far more attractive to Bank of Montreal and domestic rivals such as Royal Bank of Canada, which has also added expertise in this area.

“Eric's experience in private placements, including 20 years of solid deals, complements our team's overall mandate as we look to broaden our lead role participation in the leveraged financing arena,” said Jim Moglia, New York-based executive managing director and co-head of the BMO Capital Markets' leveraged finance group. This team deals in both leveraged loans and high yield bond financings.

The Big Dreams Private Equity Favours

For all of you who need some inspiration, here is a great story sent to me by Elliott Bay, founder of the kids' camp - Real Programming 4 Kids:

For all of you who need some inspiration, here is a great story sent to me by Elliott Bay, founder of the kids' camp - Real Programming 4 Kids:April 12, 2009

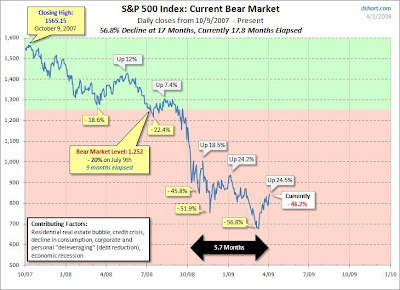

How Bear Markets Turn

April 6, 2009

Bear Market Bounce?

April 3, 2009

Managing private equity portfolios in the downturn

Portfolio company management:

- Critical to proactively manage portfolio company performance through a downturn - increased focus on dashboard reporting and managing expectations

- Cash flow "Quick Hits": Dial back growth; Focus on streamlining direct costs as opposed to SG&A; Aggressively manage working capital

- Very rarely are cuts too deep - need to react to current environment quickly and prepare for the worst - revisit downside case

There you have it and Shailen Chande can be reached at Shailen Chande at hotmail.com

What is new with valuations and structuring of transactions?

- Valuation of Canadian PE deals never reached the heights of their US counterparts - many Canadian sponsors sat on the bench and leverage levels were relatively prudent.

- For the most part, there is not widespread acceptance of the "new world" amongst sellers - deals getting done are when sellers are distressed.

- Lack of transaction comps post Fall 2007, significantly deteriorating current trading and lack of visibility through 2009 make valuation incredibly difficult - greater emphasis on diligence.

- To mitigate valuation concerns, recent transactions have seen a greater emphasis on earn outs and vendor take backs - trend will likely continue.

- Most interesting opportunities have a restructuring angle - need to structure for the downside case.

By the way, you can reach Shailen at Shailen Chande at hotmail.com.

April 2, 2009

Two ways of looking at things

There are always two ways to see a situation.

There are always two ways to see a situation.Take this economy, for example.

So, how do we turn this economy into an opportunity?"

How do you know who can help you to raise capital?

1. Experience and knowledge of innovative financing structures to maximize client value (by proof of past clients)

2. Direct relationships and established contacts with a breadth of private equity funds - ability to present a deal and know the funds will listen.

3. Produce an extremely high quality financial model and written report in a manner that will attract fund managers.

4. Prepare some 75% of the due diligence material material required by a fund - save the client the time and effort

And most importantly:

5. Be capable and experienced enough to negotiate the best terms for the client with the fund. Fund managers negotiate financing deals for a living, whereas most entrepreneurs negotiate a major financing once or twice in a lifetime. A good I-banker evens the scales.

Hope that helps!

April 1, 2009

CVCA's PD session on Deal and Valuation trends

Market overview:

- PE deal activity has been crippled by significant expectation gaps between buyers and sellers and a lack of financing

- Current baseline LBO structure for a "middle of the fairway" business - EV: 5.0-6.0x EBITDA; Total debt: 2.0-2.5x EBITDA

- Shift towards smaller deals - Larger US sponsors are looking at equity tickets in the region of US$200m

- 2009 has seen positive inflows into leveraged loan and high yield funds marking a potential return to mainstream lending

- Increasing number of GP's are returning LP commitments and/or reworking terms - fundraising market is limited, although there is demand for distressed/turnaround funds

- Increasing number of mid market US sponsors looking North to Canadian carve outs and/or distressed situations

- 2007/2008 funds will make for some of the best vintages given unprecedented buying opportunities

Is anyone getting any money?

So to get back to the question -is anyone putting money into companies?

Yes.

First up the government is handing out sugar plums to early stage companies. But since our banks are very conservative - as they should be we have come to appreciate - it has made room for a very healthy private equity fund industry.

If you have a business generating over $10M in revenues, you are of interest to a private equity fund in your field of expertise. Old style manufacturers, do not despair, as you are of interest too.

Last night, Loewen & Partners had a board meeting with one of our clients who is doing very well with global clients. Two years ago, when we first met, it was not a pretty picture. What happened? We matched the owner with a private equity fund who bought a 35% stake in the business. They also pushed him to do the strategic changes he had always meant to do. We raised capital - over $15M for the company and they had revenues of $35M and a downward trend. So you can see that there are possibilities where your Canadian banker may not wish to go.

The smiles around the table make private equity a great business.

March 31, 2009

Is private equity taking away bank business?

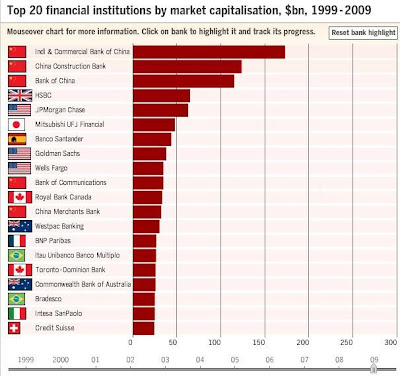

Now we can fast forward to 2009 and a completely different picture emerges.

Now we can fast forward to 2009 and a completely different picture emerges. Private equity and the bank share of market

In the book Money Magnet, Jacoline Loewen talks about how the unthinkable does happen. Like the music industry, technology is transforming the traditional banking and public markets.

In the book Money Magnet, Jacoline Loewen talks about how the unthinkable does happen. Like the music industry, technology is transforming the traditional banking and public markets.March 27, 2009

Green Technology is a Money Magnet

I predict Green is the new "bubble", with the growth set to continue, by 2010 investment in the sector could climb as high as $19bn. Here is a stimulus package!

There are already the market behemoths - like Google - just five firms attracted $600m of the total investment.

The reports says shifting public opinion and growing policy support for green technologies were two of the main raising agents that helped the sector attract more cash than even medical devices, telecoms, and semiconductor sectors. Biotech and software are still more attractive overall ($4.92bn and $5.25bn receptively), but have seen nothing like the same growth.

Green Technology is a Money Magnet and if you want to read more, check out the book.

March 26, 2009

Will this crisis end all future crisis?

The banking business has been around for a thousand years, it’s the life blood of any economy and it’s not going to go away. This crisis, when it’s all over, will have taken huge capacity out of the international banking and financial business. Those banks that survive this turmoil will be extraordinarily well positioned to do outstandingly well and I think that includes the Canadian banks.

In 1873, there was a financial panic and banking crisis in Paris and Baron Rothschild said the time to buy is “when there is blood in the streets”. Well, we must be getting close.

Booms, busts, bubbles, panics, crashes and bankruptcies – to some extent we’ve seen it all before, but somehow the system always survives, adapts and moves on to bigger and better things and, in time, I am sure it will again.

Also, we should remember that the U.S. economy is;

- the most entrepreneurial

- the most innovative

- the most competitive

- the most flexible and

- by far the most resilient in the world

For two centuries, it has demonstrated time and again an enormous ability to bounce back.

This time it may just take longer.

Will this be the financial crisis to end all crises – not a chance.

Twenty years from now, this crisis will be ancient history and long forgotten, and the young people running the businesses at that time will set out to do the same thing all over again.

Nevertheless, hope springs eternal and I hope the lessons of the past year and a half are indelibly ingrained;

- on central banks

- on regulators

- on Boards of Directors and most especially

- on top corporate management

so that the financial business may once again become an industry of choice for investors.

March 25, 2009

Step to recovery

The consumer accounts for about 70% of GDP in the United States. Most recessions over the past fifty years have been caused by excessive inventories or over capacity.

This is different. This is a consumer led recession.

There is too much consumer debt and it won’t turn around until consumers have restored their family balance sheets and are confident once again to start spending. The American consumer has over-borrowed and overspent for a decade and is now tapped out. Irrespective of much lower interest rates and the prospect of lower income taxes, I believe we have moved into a multi-year period of consumer retrenchment and thrift.

The consumer in the U.S. is shell shocked.

Their equity and retirement portfolios are down but, far more importantly, 68% of American families own their own homes and home prices are down by more than 20% and likely to fall further.

If the value of your home drops by 25%, it shakes your confidence.

As a matter of interest the average Canadian carries 2 credit cards whereas the average American carries more than 6.

The average credit card balance per family is $2,000 in Canada and over $8,000 in the U.S. On top of all this, the job market is uncertain. In this environment I expect consumers to pull back and the U.S. personal savings rate, having fallen for more than twenty years, will now start a gradual rise back to the traditional range of 6% to 8% or higher.

The only way consumers can restore their balance sheets is by saving more and spending less – and spending less will delay recovery.

Step 1 to Recovery

My views are no better than anyone else’s except to say that this credit crisis and economic downturn has turned out to be vastly more serious than anyone anticipated every step of the way.

Notwithstanding the major stimulus plan currently under consideration in the U.S., I’m not sure why that should change.

Accordingly, I would anticipate a longer and deeper recession than many observers envisage at this time.

I wish I had a more definitive view, but there are just too many unknowns.

The first step to recovery

We need the stabilation of the banking business in the U.S. and the U.K.

At this stage we still don’t know which banks in the U.S. and Europe are going to survive in their present form – or who is going to own them. To date, various initiatives to repair these banks have failed, but a new plan is under consideration in the U.S. and due to be announced in the near future.

If this fails, there’s a real possibility, even a likelihood, that some of these major banks will have to be nationalized or perhaps put in “conservatorship” a la Fannie Mae and Freddie Mac.

Business owners will have to look to other sources of capital, such as private equity. In Money Magnet, there is a chapter on how to find funds and what they like to see.

Where can I raise capital?

The money will be doled out over five years and the fund will match small to medium private-sector investments and receive an interest in the companies it backs.

News of the fund comes about a month after a report that found that financing activity in Canada's venture capital market dropped to its lowest level in 12 years in 2008 as the economic downturn choked the flow of funds to small start-up companies.

If you want to raise capital, read Money Magnet to learn how to get the cheque books opening. Read more at Reuters.

Entrepreneurs get on with it

Naomi Klein stoked a fire with her negative spin on the evil of corporates. I will leave that topic but the smaller companies are just too busy surviving and are surprisingly devoted to their staff. The hardest part of this downturn for many of the CEOs is letting people go.

Private equity in Toronto has played a big role in getting SMEs transformed into professionally run companies who can then operate globally. I believe the credit crisis is part of a larger fundamental shift in power shifting away from large institutions like banks, who used to be the only place to get money to grow companies - along with the public market. I expand on this shift in Money Magnet. Over the past ten years there has been an explosion of private money being invested into companies but these venture capitalists would also get in guide the entrepreneur.

Here's The Economist bolstering the role of the entrepreneur.

March 23, 2009

Credit rating agencies are broken

- Pennsylvania Railroad went into receivership in 1970 – rated triple A.

- Venezuela defaulted in 1982 – rated triple A.

Over the past several years lots of structured products were rated triple A only to go to triple C in the blink of an eye.

Rating agencies are paid by the issuer. Why would a buyer of securities rely on a rating provided by the seller.

Companies rate shop. They visit all the rating agencies and give the business to the agency which accords them the highest rating.

Mary Schapiro, the incoming Chair of the SEC, testified earlier this month, “until we deal with the compensation model, we’re not going to deal with a conflict of interest and people are not going to have confidence that the ratings are worth relying on, worth the paper they are printed on”.

In my opinion, rating agencies are dangerous because they provide investors with a false sense of security.

Paul Krugman despairs about the Obama Plan

Private equity partners with Ontario Government

In the same vein, people investing their own cash into a business are more likely to pick winners.

It is uplifting to see that the Ontario government is recognizing this human trait and is partnering with private equity to invest in up and coming companies.

Karen Mazurkewich, Financial Post, writes about useful government initiatives that support venture capitalists and what entrepreneurs really think of them. Marzio Pozzuoli started his company RuggedCom and recognizes that the VC funds are the most competent at funding early stage companies.

"The best guys to fund the emerging technologies and start-ups are the VCs because they are doing diligence to do the investments," says Mr. Pozzuoli. Earlier this week, the Ontario government announced a new $250-million co-investment fund intended to help companies working in clean technology, life sciences, digital media and information and communication technology. If a venture capital firm invests money in a company, the government will match it dollar for dollar. Another bone to the sector was a new $205-million Ontario Venture Capital Fund created last June, comprised of Ontario government cash and funds from institutional players.

Mr. Pozzuoli says the best program the government has for companies like his is the Scientific Research and Experimental Development Tax credit, which has a federal and provincial component. "We still use it today as a public company."

March 22, 2009

Private equity would be better for AIG

I talk a great deal about the difference in the psychology of investing, in my book Money Magnet. But if you want to see some real life examples of people's behaviour when they invest other people's money, not their own, then take a seat to learn from the drama of AIG. Watch the US government and their tax payers' treatment of one of their "investments" - AIG.

I talk a great deal about the difference in the psychology of investing, in my book Money Magnet. But if you want to see some real life examples of people's behaviour when they invest other people's money, not their own, then take a seat to learn from the drama of AIG. Watch the US government and their tax payers' treatment of one of their "investments" - AIG. March 20, 2009

Too much leverage is a bad thing

In April 2004 the SEC granted the five big U.S. investment banks virtually unlimited leverage.

Following this decision, the assets and leverage ratios of the five firms exploded.

In just the four years to the end of 2007, the aggregate assets of these five firms doubled from $2.1 trillion to $4.2 trillion and the average leverage ratio, as measured by total assets to common equity, increased from 23 times to 33 times.

These ratios were “off the charts” – especially when you consider these weren’t investment banking firms at all.

Over a decade these firms had morphed into being gigantic hedge funds, dealing in risky assets and they were financed largely by wholesale money.

They were an accident waiting to happen.

Financial firms love leverage because it can do wonders for your profits and your return on equity in the good times.

Unfortunately, leverage can kill you when business turns down.

Most people do not appreciate the destructive power of leverage. At 33 times leverage, as these five big investment banks were, if your assets drop by just 3.3%, you are out of business. And at 40 times leverage, where some European banks were, if your assets drop by just 2.5%, you are gone. With these leverage ratios, there was zero room for error – no cushion.

Leverage is especially destructive in a deflationary environment.

Asset prices decline, debt remains the same and the equity gets crushed.

March 19, 2009

Prime Minister Stephen Harper visited Toronto today to officially announce a $10M grant to my company CYBF. He visited some friends of mine in their Tortilla restaurant on St. Claire & Dufferin and then headed off to a press conference to make the announcement. La Tortilleria is only 10 months old with 3 locations....best authentic Mexican in Toronto. The entrepreneurs, Axel and Juan are 26 yrs old...and immigrants from Mexico.

Some stories so far...http://www.ctv.ca/servlet/ArticleNews/story/CTVNews/20090318/harper_presser_090318/20090318?hub=Canadahttp://www.thestar.com/News/Canada/article/604397

The ability to say no

This is incredibly difficult because if one, or a few, increase their risk profile and start taking your clients, there is strong pressure within your own company – and from the market place to, increase your own risk profile to maintain your competitive position.

In boom years this process rachets up the risk profile across the entire industry on a continuing basis. As Jacoline Loewen discusses in Money Magnet, "The business goes to the private equity fund prepared to take the most risk."

It’s the same thing in investment banking. If one firm increases their risk profile on new equity issues, usually the others fall in behind.

I don’t know how many times I’ve heard we’ve got to go into this business, or we’ve got to make that loan or we’ve got to go into that deal because everyone else is in it.

My conclusion is that the most important word in the financial business, apart from please and thank you, is the ability to say no.

- No, we are not going to do that deal.

- No, we are not going into that new business.

- No, we are not going to make that stupid acquisition.

- No, we are not going to make that loan.

Many times the best deals you do are the ones you don’t do.

In the course of my career I wish I had said “no” more often.

Bank of Canada a winner

This time will be no exception.

The fact is the market has lost confidence in the Federal Reserve, the SEC, the Bank of England and the Basel One or Basel Two regulatory regimes.

This crisis built for years under their watch.

I believe OSFI and the Bank of Canada have provided better oversight. In particular, the SEC has acted like a head waiter to the securities industry in the U.S.

In any event, there is a ray of light and that is Paul Volcker age 81, who was Chairman of the Federal Reserve from 1979 to 1987 and is arguably the greatest central banker alive today.

Last July the group of 30 nations launched a project on regulatory reform under the leadership of Paul Volcker. This report was tabled just ten days ago and contains four core recommendations and eighteen sub-recommendations, focused directly on problem areas which have emerged over the past two years including;

- structured products

- proprietary trading by banks

- regulation of hedge funds and private equity firms

- leverage

- and several more

At the press conference tabling the report last week Mr. Volcker called the current financial system by a four letter word – he called it a “mess”. He said “we are going to have to rebuild this system from the ground up”.

We are fortunate, indeed, that the highly capable, blunt talking, Volcker has been appointed Chairman of President Obama’s Recovery Board.

The long and the short of it is;

The grand experiment of deregulation of financial markets and financial institutions which started with President Ronald Reagan’s appointment of Alan Greenspan in 1987, is over.

Forget being globally competitive

What is globally competitive anyways?

Does that mean like Citigroup, Deutsche Bank or UBS?

If so, forget it. If there’s a pothole, these big global banks will find it. There are probably more than 12,000 banks in the world.

Why do you have to be in the top five or ten? It’s all egos run amok.

What’s wrong with being the twenty-fifth, or the fiftieth, largest bank in the world and growing your business organically by offering good service. Shares of the biggest banks in the world have been the worst performers as long as anyone can remember.

I have learned that the financial business is a marathon and not a hundred yard dash –

- slow, steady and dull often wins the race –

in many cases because your fast moving hot shot competition blows up. Bear in mind every time a competitor blows up and goes out of business, the survivors win.

In my view Canadian banks are plenty big enough to compete where they want to compete.

Take away the punch bowl

They could have done this by aggressively raising interest rates at an earlier date, increasing stock margin requirements and perhaps by also increasing bank capital requirements.

It didn’t happen.

Once again it was the age of deregulation. Let the market take care of itself. It’s been said that one of the primary jobs of a central bank is “to take the punchbowl away just when the party is getting started” which, in retrospect, looks like sound policy.

In short, should central banks target, and rein in, overheated and speculative industry and market bubbles even if it causes a slowdown or a recession – the answer is yes.

March 18, 2009

Innovation and financial engineering

This has been a big problem area – actually disastrous.

Toxic complex structured products developed and aggressively marketed around the world by U.S. dealers and banks were the multi-trillion dollar time bomb that finally blew up the system.

In the five years or so up to 2006, big U.S. banks and dealers were bringing new and complex highly leveraged structures to market a mile a minute.

There were CDOs, CLOs and CMOs and a dozen other acronyms.

Many of these structures were leveraged more than ten times with exotic derivatives. For hundreds of billions of these structured products there is now only a market at distress prices – if there is a market at all.

The financial industry should get out of complex structured products.

If a security has more than two bells and one whistle, just say no. Think $32 billion of frozen Canadian non-bank asset backed commercial paper. It took a small army of top lawyers and top accountants a year to figure it out and, even now, no one knows what it’s worth.

It’s an amazing story that this could happen.

March 17, 2009

What's happening to our money?

http://www.thedailyshow.com/video/index.jhtml?videoId=221516&title=jim-cramer-unedited-interview

This video raises many questions and whether you like Jim Cramer or not, at least he had the guts to come on the show and get publicly humiliated for his “mistakes”. My personal problem with the investment community though is still the fact that there are pervasive conflicts on interest throughout the industry. And despite or perhaps because of regulatory oversight any recommendation must always be taken with a grain of salt. Nobody can predict the future and yet many institutions are paid to do so. Personally I feel the bigger blunders are with the ratings agencies who are after all still getting paid by the companies and institutions they are supposed to rate, including those sub-prime CDO’s and CMO’s. Compare that with the simple conflict of interest rule for brokers. No broker can accept gifts of over $100.

It is also clear that the news media and reporters are not free of conflicts of interest. To that extent we must question why reporters (disguised as comedians) could not or did not expose these conflicts of interest, the false predictions, the questionable role of CNBC and other organizations earlier. When things are good, everyone including John Stewart’s 401K enjoyed the (false) benefits of a booming economy. Yet, a rational person should have questioned how on earth someone’s home could double in value every 5 years … and continue to do so indefinitely?

Too big to manage

There are six banks in the world with assets in excess of $2 trillion each and perhaps another twelve with assets of between one and two trillion.

Banking has become incredibly complex.

If a bank has a trillion dollar balance sheet, operating in perhaps thirty countries, with trading desks, loans and proprietary trading books all over the world, it becomes immensely challenging.

In the financial business, risk grows exponentially with the size and complexity of your balance sheet and I think many of these banks just became too big to manage and they lost control.

That’s what the record shows.

I learned long ago not to expand your business beyond your ability to closely and tightly manage. I think a strong case can be made to break up these big global banks into smaller, more focused and more manageable institutions. I think it’s going to happen.

In fact, it has already started.

March 16, 2009

Too big to fail

Ladies and Gentlemen.

Lehman deserved to go bankrupt.

Capitalism is the freedom to do outstandingly well and make a lot of money and it’s also the freedom to go bankrupt and that has to be demonstrated from time to time.

There has to be at least some discipline in the market place.

It is unfortunate indeed, that many more like Citi, AIG and RBS were too big to fail because of systemic risk but make no mistake - - they all deserved the same fate as Lehman – to go bankrupt because they all mismanaged their businesses and had lost the confidence of the market place.

One thing to think about. If some banks in the U.S. were too big to fail before this crisis, with all the mergers and acquisitions, they are going to be much bigger still after the crisis. While in the U.S. there will always be thousands of banks, the system is gradually reducing down to three or four super giants which are going to be so big and so highly regulated, they will operate almost as arms of the government.

March 15, 2009

Where the heck were the Economists

Along with Wall Street, it is quite incredible that central banks and the IMF, with all the firepower they devote to economic analysis and forecasting, did not pick up on this credit bubble and a possible crisis.

The second largest financial crisis in a hundred years wasn’t on the radar screens.

Worse still, since the crisis first started, policy makers have vastly underestimated its rapid spread and devastating impact every step of the way.

Actually, all of us in the financial business should be wondering why we did not see this crisis coming. All the signs were there. We should have picked it up.

There were a small handful, probably less than one-half of one percent of all economists and market participants, who did foresee some of these major problems. But when everyone is making money, no one wants to listen to a naysayer.

In the future we must do a better job of forecasting.

March 13, 2009

The TSX is only down 50% - great!

With so much government involvement and government ownership of big banks in both the U.S. and the U.K., we won’t know the full impact of all of this for a decade. The stock market impact has been significant.

- the Standard & Poor’s diversified bank stock index is down 72%

- the financial index is down 76% and

- the insurance composite index is down 72%

The TSX Bank Stock Index is only down 50% - isn’t that wonderful – (we have outperformed).

I am not going to dwell on the causes of this crisis because they have been extensively and well covered in the press.

They include;

- Major public policy failure in the U.S. in the housing area.

- Far too low interest rates and easy credit under Alan Greenspan.

- Failed financial innovation on a massive scale.

- Almost complete regulatory failure in the U.S., U.K. and Europe – it was the age of deregulation.

- Total rating agency failure - - for the tenth time and

- Finally, too much leverage everywhere you look.

You could write a book on each of the above but for business owners, I recommend you pick up a copy of Money Magnet to find out about the new money - private equity.

March 12, 2009

The old model for Finance is dead

The collapse of this twenty-five year credit bubble made 2008 a year for the history books. I never thought I would see the day when the likes of Citigroup, AIG, Royal Bank of Scotland, UBS and B of A, the biggest names in the banking world, had to be bailed out by their respective governments and partially nationalized – to forestall collapse.

I never thought I would see the likes of Merrill Lynch, Wachovia, Washington Mutual, and Countrywide Mortgage, all huge financial institutions, being forced to sell to forestall bankruptcy. In particular, the five big investment banking firms in New York, which a year ago had total assets of $4.2 trillion, blew themselves out of the water.

- Bear Stearns, with total assets of $350 billion, forced to sell out for a pittance and Lehman, with assets of $700 billion, bankrupt.

- Merrill forced to sell to Bank of America which over-reached itself and is now in trouble.

- Morgan Stanley and Goldman forced to raise equity at distress prices and convert to bank holding companies to get federal aid.

For these five big investment banks, this has been a complete and unmitigated self-inflicted disaster.

As I said in my book, Money Magnet, the old model of investment banking for these five big firms on Wall Street is dead. The new era will have private equity race ahead with its focus on relationships and its manageable size.

March 11, 2009

Quite a Laundry List - Bubbles

Look at the incredible decline in the U.S. personal savings rate over the last 20 years.

Look at the acceleration of U.S. housing prices starting in 2000 (existing houses doubled 2000 – 2006).

Globally, from 2002 to 2006 there grew a euphoric feeling that low interest rates, easy credit, vast liquidity and rising house prices would last forever.

It was a classic example of herd mentality, “when everyone is thinking alike, no one is thinking”.

Commodity prices took off, and the private equity and hedge fund industry exploded on cheap money. Borrowing and spending were in vogue and saving was out.

It was obvious the trends on these charts were unsustainable, but where was the tipping point.

A credit bubble is like blowing up a balloon – it gets bigger and bigger and bigger and you never know when it’s going to burst. This bubble could have broken three years ago, or it could have broken two years from now.

But now we know, this bubble broke in the Spring of 07.

(One thing investors should learn about investment bubbles and manias – “it’s much better to leave the party an hour early than two minutes late”.) Every bubble is different, but in many respects every bubble is the same. The difference this time is that we have an all encompassing credit bubble and it’s global. This was a bubble;

1. In housing prices and mortgage debt

2. In consumer debt

3. In new and untested financial products

4. In commodities and

5. A bubble in bank lending, private equity deals and hedge funds

Quite a laundry list.

March 10, 2009

Twenty-Five Year Credit Bubble

Well, over the past two years we have witnessed the bursting of a twenty-five year credit bubble of monumental proportions.

The epicentre of the bubble, of course, has been in the U.S. sub-prime mortgage market.

Contrary to almost all forecasts, it spread quickly to all sectors of the banking and credit markets and now to the real world economy – main street.

This economic contraction is the first synchronized global downturn since the 1930s.

March 9, 2009

What is the new risk?

- What is the long term impact of one to two trillion dollar deficits in the U.S. annually for the next few years?

- Who will purchase all these treasury bonds”?

- Will the Federal Reserve ultimately resort to printing money?

- Will some of these big banks have to be nationalized.

- Do we have now, in effect, a bubble in U.S. treasuries?

- Will all the credit creation lead to major inflation three or four years out?

- Will we have a major crisis in the U.S. dollar over the next year or two?

This is all uncharted water and, no one on the face of the planet knows how it will play out.

Finance deep freeze

We are now in a deep freeze of credit. It is trickling down that it is no longer business as before. There are new rules and it's back to the basics.

We are now in a deep freeze of credit. It is trickling down that it is no longer business as before. There are new rules and it's back to the basics.-running a more conservative business across the board

-reining in your growth expectations to more realistic levels.

-reducing leverage

-much less financial innovation and much less financial engineering

-more focus on client business

-more organic growth and fewer grandstanding acquisitions and

-for the world’s biggest financial institutions it means downsizing your business and scraping your plans to rule the world.

The Human Capital of Private Equity

- Banks are in trouble and have curtailed lending.

- Commentators predict widespread industrial bankruptcies.

- Unemployment is rising fast.

- Interest rates are volatile.

It all sounds familiar. But those headlines aren’t from today. They’re from 1974. Doomsayers foresaw disaster 35 years ago, predicting hundreds of corporate bankruptcies. New York City and State, and utilities like Con Edison, seemed on the brink of collapse. Business publications wrote that major money-center banks would fail and ran articles like, “I’ll Never Own a Stock Again!” Struggling companies got little help from financial institutions, which had problems of their own. Businesses with the highest returns on investment, the most innovation and the fastest growth were starved for capital. The debt of good companies sold for pennies on the dollar.

In 1974, as now, those who once thought they had the answers came to realize their assumptions were flawed. But opportunity emerged from that crisis as people with creative solutions and the skill to implement them stepped forward and developed new ways to access capital. Over the next two years, the markets recovered strongly. That skill in finding new opportunities when things look bleak is part of what economists call human capital.

In financing companies that could grow and create jobs, I always considered management skills as important an asset as numbers on the balance sheet. And it’s never more important than in times of crisis.

While people worldwide have recently suffered some $60 trillion in losses on financial instruments and real estate, that figure is actually dwarfed by the value of the world’s human capital, worth substantially more than $1,000 trillion. With a value like that on our collective potential, a cancer cure would be worth more than $50 trillion in the U.S. and well over $100 trillion globally.

This suggests that investments in medical research may have more value than building new bridges or highways. And it underscores what we already know about education: in the long run, it’s the single best investment in stimulating the world’s economy.

Also - the human capital that private equity brings to a company is the reason their results are superior to the public market investments.

Famous words

My favorite classic line:

"In today's regulatory environment, it's virtually impossible to violate rules...it's impossible for a violation to go undetected, and certainly not for a considerable period of time."

Bernard Madoff, Oct. 27, 2007.

Maybe this could be used in MBA classes?