The concern is that this bear rally is just around optimism and wishful thinking rather than reality. Also, the blogs are full of worries that no one will invest in the public market ever again.

In the long overview of public markets, there is a small window where they make a strong profit before they do self correct.

There are cycles.

Private equity investors are also impacted as the market affects their company revenues too. We are all connected in this complex financial system.

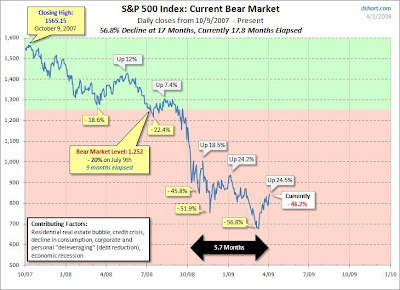

Technically, it is yet too early to call out a bottom formation since the intermediate trendline is still downward sloping and must be broken to move higher. Until we see a clear reversal of this trend, the charts suggest a bear market rally that needs additional momentum to break the bearish trendline and form a true reversal. A break above 850 on the S&P500 and a subsequent re-attempt of the previous double top around 877 should give impetus to such a trend reversal.

In the meantime, call a client and keep moving forward.