Wealth Management

February 10, 2009

Oh, Canada

February 9, 2009

Business owners like the long view

"One of the reasons business owners are preferring private equity," says Jacoline Loewen, author of Money Magnet, "Is they appreciate that the investors go in for five years. It sure feels better than the short term view of shareholders in the public market who bale as soon as they see anything slightly off."

"One of the reasons business owners are preferring private equity," says Jacoline Loewen, author of Money Magnet, "Is they appreciate that the investors go in for five years. It sure feels better than the short term view of shareholders in the public market who bale as soon as they see anything slightly off."Long term trends are difficult to remember for investors in public markets.

This is an interesting chart as you can see we are still 5% above the trend line. Yet the public market ignored job loss information that came out last week, and ended up higher by Friday probably due to wishful thinking.

Private equity is in stark contrast to this short term thinking demonstrated in the public markets. Five years with a company before taking back the money is the shared goal. Think how this long term approach by shareholders helps business owners during these times.

One of the top fund managers at my secret handshake club said that these are historic times and our children will read about them. Now that is long term thinking.

February 6, 2009

Mining likes investing in Africa

Africa ain't for the faint hearted. Despite the harsh environment, and clash of cultures, Canadian mining companies are making huge advances.

Africa ain't for the faint hearted. Despite the harsh environment, and clash of cultures, Canadian mining companies are making huge advances.The time when Canada's presence on the African continent was primarily characterised by numerous missionaries and food donations is well and truly over! In countries such as Congo, Mali and Tanzania, when it is learned that you are from Canada, Denis Tougas says you are immediately asked if you work for the ‘mining’, a perception entirely consistent with reality.

Canada is now dominant - in fact, some say superpower - in the African mining sector, a position the country intends to maintain and develop using all means at its disposal.The salient presence of Canadian mining is relatively new in Africa and is rooted principally in the programmes of liberalisation of the sector from the early 1990s. These programmes have been driven by the World Bank, which from 1992

(1) had begun defining the extractive sector as the main engine of development for many countries.

(2) The privatisation of state enterprise – promoted as a means of encouraging the entry of foreign investment – has opened the door to foreign companies. At the head of this development, especially with regard to the smaller exploration companies known as ‘juniors’, are Canadian companies. These companies have an immense commercial presence in Canada: of the 1,223 mining companies listed on the Toronto Stock Exchange, the largest in the country, more than 1,000 are juniors!

(3)A HUGE EXPANSION

Currently, according to the Ministry of Natural Resources Canada (NRC), only the Republic of South Africa, with over 35% of assets and investments, is just ahead of Canada in the African mining industry. But with South Africa’s assets concentrated on its own territory, Canada dominates the rest of the continent.The data compiled by the NRC demonstrates the speed with which the value of Canadian mining assets in Africa has grown over the last twenty years: at US$ 233 million in 1989, this figure grew to $635 million in 1995, and $2.8 billion in 2001, growing further to $6.08 billion in 2005, and $14.7 billion in 2007.(4) This total value is estimated to reach $21 billion by 2010.

Read more...

Thank you to Michael Power for the referral to this article.

February 5, 2009

Does mean marketing grab market share?

February 4, 2009

Does an experienced partner win private equity more?

The quality of your partner counts big time. In the case of entrepreneurs seeking capital from Venture Capitalists, nothing helps more than having a partner with past success.

The quality of your partner counts big time. In the case of entrepreneurs seeking capital from Venture Capitalists, nothing helps more than having a partner with past success.Q: Was there anything in your findings that surprised you?

A: The size of the effect of past success was surprising. We know that there was likely to be some degree of performance persistence, but the magnitude was quite striking.

Q: Given the current economic conditions, do you have any advice for entrepreneurs who are considering launching a new venture at this time?

A: Certainly one lesson that emerges from our analysis is to find an experienced (and successful) partner! Given the very difficult investment conditions, venture investors are paring back their portfolios and are hesitant to make new commitments. To get serious consideration, the more that you can do to seem like a "sure thing," the better off you are.

More generally, being as careful as you can be with resources, and flexible.

The Big Mac Index

Definition from Wikipedia:

A popular derivative of the PPP concept is the Big Mac Index, developed by The Economist Magazine. The Index is based on the notion that a dollar should buy the same amount in all countries and that in the long run; the exchange rate between two countries should move towards PPP rate and hence moves the prices of the same goods for each country towards equilibrium.

The Economist just published the latest Big Mac Index on January 22nd:

February 3, 2009

That would explain why US markets faired relatively better than India, China and other countries of the developing world who seemingly ended up lower down the chain in this massive pyramid scheme.

Here's a link to George Soros discussing his trading philosophy and how he did so well in 2008 relative to the rest of the world - drink your strong coffee before you read it.

February 2, 2009

David Rubenstein at Davos

Will inflation hit private equity?

This is a copy of an old 10 Billion Mark coupon.

This is a copy of an old 10 Billion Mark coupon.Ponder this extraordinary piece of paper (which is obviously no longer is in circulation). Use it as a reminder of the hyper-inflation of the 1920s in Germany. In those days, these sums were the cost of daily groceries.

Certain early childhood experiences stay with you forever and some of these can impact the way you look at money and finances. In my case, I've always been weary about the hidden loss of value from inflation due to my upbringing in Zambia and Zimbabwe. So, yes, the 1920s were very different times which hopefully never come back. But with the current economic climate, particularly in the epicenter of leverage and deficit spending i.e. US government and households, we should never loose sight of the danger of inflation.

Look no further than Zimbabwe where in 2008, a loaf of bread cost 1.6 trillion Zimbabwe Dollars. In short, various prices have come down and quite rightly so are now at much more realistic levels, but we should fear inflation much more than deflation.

Private equity has cash but is not coming into the market at valuations business owners want. This dance will continue for 2009.

Where Do I Get Money?

"CYBF is a terrific place for young entrepreneurs to begin their journey," says Jacoline Loewen, author of Money Magnet. "CYBF will take entrepreneurs through the steps to managing their money and also help out with a mentor."

Listen to more on the radio show Small Business, Big Ideas.

January 28, 2009

Now You're Talking, Stephen

Stephen Harper's Conservative government recognizes the value of CYBF.

“Canada has no shortage of young people ready and willing to defy the current doom and gloom. This grant from the Government of Canada will let us increase dramatically the number of business start-ups that we can finance and support through our partners in more than 150 communities across the country,” said Vivian Prokop, CEO of the national charity.

“I would like to thank in particular Industry Canada, Industry Minister Tony Clement, and Minister of State for Small Business and Tourism Diane Ablonczy for their enthusiasm in nurturing a culture of entrepreneurship at a time when Canada needs it most.”

While access to business credit is tight and unemployment is rising, the demand for the CYBF’s financing and mentoring services continues to grow. The number of CYBF-funded start-ups from October 2008 through January 2009 was 68 percent higher than during the same period in 2007, and the Government of Canada’s investment will enable CYBF to meet this growing demand and accelerate its pace of lending.

An estimated 20,000 young people want to start businesses every year but find it difficult to obtain financing through traditional sources. CYBF offers an experienced volunteer mentor and a loan of up to $15,000 with no collateral. Qualified applicants can access a further $15,000 through a partnership with the Business Development Bank of Canada.

The one-year grant will provide much-needed stimulus in communities from coast to coast, enabling the launch of an estimated 800 new businesses within 5 years. Based on the performance of CYBF clients to date, these businesses will generate an estimated 5,000 new jobs, $135 million in sales revenue and $32 million in tax revenue within 5 years

Snapshot of Canada's 2009 Budget

Thanks to Scott Tomenson, Wealth Management Consultant, for providing us with this link. Read.

Visit Scott at http://familywealthmanager.blogspot.com/

January 26, 2009

Business owners need private equity

Entrepreneurs and business owners would like Frank McKenna - the fellow who was put forward to head the Liberal Party, but who sadly declined.

Entrepreneurs and business owners would like Frank McKenna - the fellow who was put forward to head the Liberal Party, but who sadly declined.I was at my Secret Handshake Bay Street Club - The Ticker Club - where Frank McKenna was the guest speaker and he blew the roof off with his dynamism. Coming from New Brunswick, Frank is prgamatic and gets the role of the manufacturing and other technology businesses in building a strong Canada.

He said, "We need to expand our thinking around innovation from just pumping oil to other countries. We need to be the best at the supporting manufacturing, equipment, technology and service busineses around oil. The same goes for forestry."

"Sounds great but the reality is tough. Many of those types of companies suggested by McKenna are potential clients for Loewen & Partners' services - raising capital for owner managed companies," says Jacoline Loewen, author of Money Magnet. "The problem is that these companies do need to get to be over $100M to survive in the global market. It is very difficult for these companies to do this on their own. Yet, many of these owners do not understand or trust private equity, their ideal partner to grow their companies."

http://www.moneymagnetbook.ca

$1 Trillion and Counting...

Astoundingly, and possibly incomprehensible to most, London based Private Equity Intelligence reported this month that Private Equity Funds raised the second highest level of annual funding in 2008. Approximately $1 Trillion of capital is currently ready to be deployed. Only a quarter of this was raised by large buy-out funds, though this amounts to $284.2 billion last year, about the size of Ireland's GDP. The rest was raised by funds with other focuses, such as real estate funds ($153.5 billion) and funds focused on SMEs, 217 funds raised money in this category, the most of any other.

Astoundingly, and possibly incomprehensible to most, London based Private Equity Intelligence reported this month that Private Equity Funds raised the second highest level of annual funding in 2008. Approximately $1 Trillion of capital is currently ready to be deployed. Only a quarter of this was raised by large buy-out funds, though this amounts to $284.2 billion last year, about the size of Ireland's GDP. The rest was raised by funds with other focuses, such as real estate funds ($153.5 billion) and funds focused on SMEs, 217 funds raised money in this category, the most of any other. However, this news may seem counterintuitive to the news released today, that 50,000 jobs were lost in the U.S. in one day. Coping with the shock is likely on the mind of all of 50,000 newly minted unemployed. However, to fund managers with bulging war chests, the wait is on to discover the bottom. With asset prices falling, demand slumping, and credit inaccessible for most, fund managers are in a very comfortable position to deploy the tremendous amount of cash at their disposal at the plethora of deals not finding an investor right now. The difficult part is finding the bottom.

A report in the Globe and Mail today suggests that the worst of the economic turmoil may now have passed. The argument made by Allan Robinson is that Treasury yields have stabilized and have actually shown preliminary signs of rising (judge for yourself the significance of the the rise, but the decline seems to have stabilized...for now). This means that investors are looking to move their money from out of the wing of the Treasuries and into, likely, investment grade corporate bonds. This is significant because it means investors are beginning to trust the relative stability we are seeing right now.

Jack Welch blames the i-bankers

Private equity will be coming into its own for exactly the reason Jack says - these are mostly privately held funds. The best funds will be those that risk the fund partners' money, not just yours. Otherwise, you can put your money back into the public market, but maybe you should head for Las Vegas instead.

Lending to Friends

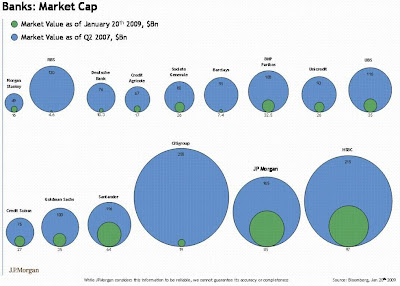

Banks are not lending and owners of companies suffer.

Banks are not lending and owners of companies suffer.January 20, 2009

Bum Rap for Gen Y

Many Baby Boomers will say, “Those kids need to learn it’s tough and you don’t get a trophy just for turning up for work. No one’s there to applaud and video their every step.”

What about my generation – the Baby Boomers – will our work needs change? Millennial might say, “They destroyed the environment, let greed override ethics and are maxing out the credit, leaving Millennials to pay the tab.”

With four generations working together, we need to get beyond this tired cycle of thinking your own generation is the best and you have to fix the others because they don’t have clue. How can we understand each generation in order to blend the best of our talents?

I put this question to a Millennial engineer, Michael Keenan, whose employer, Arcelormittal Dofasco Steel, is actively addressing the generational gap. “We look at the pivotal events during the formative years of each generation,” says Michael. “Once you understand each generation’s shared geography, cultural and economic environment and the impact on their needs, it is much easier to work together because you understand why they are different.”

Dofasco is using Maslow’s hierarchy of needs to frame each generation’s work behaviour. Each level of needs must be fully satisfied before you can move up to the next level. First level of needs are the physical - which means having a full stomach, for example, or being comfortable. The next stage is the need for safety – to have a job, a home, a family and shared morality with your neighbours. For Canadian-raised Millenials, the luxury of growing up in the most peaceful and affluent time in Canada means that they can move past the safety level right up to esteem needs for recognition for their work and self motivation. They can even reach self actualization which is the need for self governance and the bigger issues of society like justice or peace. Since up until the economic melt down, Millennial have not been afraid for their jobs, they have enjoyed the space to explore these higher level needs.

Hollywood movies help us to put ourselves in those first twenty years of other generations and the early life experiences which shaped the rest of their lives. When supporting actors from the World War II movie Defiance talked about how miserable it got while filming in the forests of Lithuania, you know this is Generation X and The Millennial speaking about their work. It would be tough to imagine John Wayne complaining about the hardships of his movie location. Yet, on the other hand, these young actors are far more nuanced about the deep meaning of their movie and able to probe and question.

Now imagine if you were in that forest and hungry too, with real soldiers with real guns hunting for you. Even snuggled up next to Daniel Craig, smoothing back your hair and letting you check out his bikini briefs – you may find your needs are not so much about having a house with a white marble kitchen or a job that follows your dreams or even the rules of the Geneva Convention. You are at the bottom of Maslow’s hierarchy and after such a trauma, you would be grateful for any darn house, a solid job and you would faithfully work for the boss without question.

Baby Boomer journalist, Tom Brockaw, called people raised during the war “The Greatest Generation” which may sound like overblown hyperbole to Generation Xers and Millennials as they look at Grandfather slumped in his armchair. But WW II is within the memory of humans living today and I meet many of them still working, running poultry, transportation, construction companies, as well as law and finance firms.

In extraordinary contrast, Canadian born Millennial had no war, no fear for their lives, for their family, for their neighbours turning on them or their country being taken by force. Since parents may be funding their lives, they have the luxury of moving way up Maslow’s hierarchy of needs past the Baby Boomers’ level of social needs, to the esteem set of needs and for some, even to self actualization. It is not a surprise then that Millennial in the workplace have smaller social distance between others and have little fear of authority or of others. It is a great place to be.

Companies can benefit if they understand this level of needs. Boomers, once they get this, tap into Millennia’s energy which is team-based and seeking to be the best.

The Millennials I meet are in the finance industry and are exciting because they do question, can hold a range of views not just black and white, pick up work to do on their own initiative and for their own career development. This Canadian generation thinks globally, questions social issues, are challenging, want a balanced life but are there when the work needs to get done by midnight. I may have a slanted view but I think calling Millenials Most Entitled Generation gives them a bum rap.

In sum, it certainly helps me to understand work behaviour by using Maslow’s hierarchy of needs and to see how each generation’s context was completely different. It helps explain a great deal. I know I will be able to work together with more purpose. What do you think?

[1] http://www.abraham-maslow.com/m_motivation/Hierarchy_of_Needs.asp

[2] http://www.amazon.com/Greatest-Generation-Tom-Brokaw/dp/0375502025

Private Equity Increasingly the Place to Go for Money

At 12:32 PM, George and Laura Bush will take their last helicopter ride away from Capital Hill by helicopter. Already, approximately 2 million people have converged on Washington to witness this historic moment when power gets handed over to Obama. The Americans know how to do their pomp and pageantry well, but when tomorrow comes, Barack Obama will have some heavy lifting to do with two wars and a crisis not seen since the Great Depression.

At 12:32 PM, George and Laura Bush will take their last helicopter ride away from Capital Hill by helicopter. Already, approximately 2 million people have converged on Washington to witness this historic moment when power gets handed over to Obama. The Americans know how to do their pomp and pageantry well, but when tomorrow comes, Barack Obama will have some heavy lifting to do with two wars and a crisis not seen since the Great Depression.The banking black hole is far from over. NYU Professor Nouriel Roubini who bet his career describing the reason for a poor outcome for the U.S. housing market and outlined that U.S. financial losses from the credit crisis could reach U$3.6 trillion, half by banks and brokers dealers. Roubini says, "If that's true, it means the U.S. banking system is effectively insolvent because it starts with capital of U$1.4 trillion. This is a systemic banking crisis…In Europe it's the same thing."

Former Securities and Exchange Commission head, Arthur Levitt echoed that view saying we are witnessing a "slow but inevitable nationalization…we will see it and see it soon."

Yesterday the government announced it was converting its Royal Bank of Scotland preferred shares into ordinary shares, potentially increasing its stake to 70%. They U.K. government also has a 43% stake in the combined Lloyds TSB and HBOS. Shares of Royal Bank of Scotland (RBS) fell almost 70% yesterday on the news. RBS also said it does not expect to pay a dividend on its ordinary shares this year.

January 16, 2009

Ben Bernanke's Beard

Ben Bernanke and his beard have been working like dogs lately to pump out over a trillion dollars and save ourselves from a recession. These extreme measures should be no surprise to many, he was hailed as a radical by The New Yorker long before he assumed his current responsibilities, but you can't be blamed for thinking he was just another boring bureaucrat keen on never rocking the boat. Many have been fooled by that beard, the looks of which give the impression of a highly meticulous, erudite man that very likely wears inappropriate swimwear to the pool (I don't know Ben, I'm just guessing). His current monetary policy is certainly radical but time will tell if his decision to print and pump trillions of dollars into the economy will have him hailed as an equal to the world's bearded legends (Lincoln, Karl Marx, 'Macho Man' Randy Savage, etc) or a pariah with whiskers.

Ben Bernanke and his beard have been working like dogs lately to pump out over a trillion dollars and save ourselves from a recession. These extreme measures should be no surprise to many, he was hailed as a radical by The New Yorker long before he assumed his current responsibilities, but you can't be blamed for thinking he was just another boring bureaucrat keen on never rocking the boat. Many have been fooled by that beard, the looks of which give the impression of a highly meticulous, erudite man that very likely wears inappropriate swimwear to the pool (I don't know Ben, I'm just guessing). His current monetary policy is certainly radical but time will tell if his decision to print and pump trillions of dollars into the economy will have him hailed as an equal to the world's bearded legends (Lincoln, Karl Marx, 'Macho Man' Randy Savage, etc) or a pariah with whiskers.

January 8, 2009

Light at the End of the Tunnel

The first morsel of light poked through the darkness today. It was reported on CFO.com that the bond market is showing signs of thaw. According to the article, a "number of energy companies this week tapped the slowly thawing fixed-income market." One such company, Nabors Industries Inc., an offshore and onshore drilling company, raised $1.125 billion in senior unsecured notes due in 2019. What is encouraging is that the coupon rate is 9.25% while the bond is expected to yield 6.76%, impying the bond is priced at a premium.

The first morsel of light poked through the darkness today. It was reported on CFO.com that the bond market is showing signs of thaw. According to the article, a "number of energy companies this week tapped the slowly thawing fixed-income market." One such company, Nabors Industries Inc., an offshore and onshore drilling company, raised $1.125 billion in senior unsecured notes due in 2019. What is encouraging is that the coupon rate is 9.25% while the bond is expected to yield 6.76%, impying the bond is priced at a premium. January 6, 2009

Has Manufacturing and Engineering Lost Value?

Tom Peters posted an inspiring post on the value of the well-engineered hammer. He could not resist buying the one in this photograph. Reading Tom's comment section, I noted that a person called "ZED" wrote that that being a scientist or engineer has lost its value in North America.

Tom Peters posted an inspiring post on the value of the well-engineered hammer. He could not resist buying the one in this photograph. Reading Tom's comment section, I noted that a person called "ZED" wrote that that being a scientist or engineer has lost its value in North America. Posted by Jacoline Loewen at January 5, 2009 9:54 AM

I don't want to get in the middle of this, but beware apples and oranges. The Chinese are turning out engineers by the bushel. Or are they? A McKinsey Institute study last year claimed that some-many-most Chinese graduate engineers would not be accepted for engineering jobs in the U.S., EU, Japan, Korea, etc. At this point at least, many of the so-called engineering grads are holding what we might call a technician's certificate. Part of this is attributed to state control of curricula. Again, not my area of expertise.

Tax Cuts for Business Owners

"If there is something positive this early in January 2009," says Jacoline Loewen, author of Money Magnet and partner at Loewen & Partners, "It would be that the market continues to welcome actions taken by President elect Barack Obama who will be sworn in on Tuesday January 20."

Obama's stimulus package appears to be a mix between spending (to appeal to Democrats) and tax cuts (to appeal to Republicans). The funny thing about putting together such a large package is that it's really hard to find $800 billion worth of stuff to spend on that will be immediately stimulative to the economy; hence another reason perhaps that Mr. Obama is leaning more towards tax cuts.

January 5, 2009

PIPEs

According to Ron Burgundy, the "only way to bag a classy lady is to give her two tickets to the gun show, and see if she likes the goods". Any red-blooded male would agree with Ron, but I'm not about to talk about those sorts of "pipes".

According to Ron Burgundy, the "only way to bag a classy lady is to give her two tickets to the gun show, and see if she likes the goods". Any red-blooded male would agree with Ron, but I'm not about to talk about those sorts of "pipes".6 Surprises of Transition Management

Surprise One: You Can't Run the Company

Warning signs:

You are in too many meetings and involved in too many tactical discussions.

There are too many days when you feel as though you have lost control over your time.

Surprise Two: Giving Orders is Very Costly

Warning signs:

You have become the bottleneck.

Employees are overly inclined to consult you before they act.

People start using your name to endorse things, as in "Frank says…"

Surprise Three: It Is Hard To Know What Is Really Going On

Warning signs:

You keep hearing things that surprise you.

You learn about events after the fact.

You hear concerns and dissenting views through the grapevine rather than directly.

To read more

Transition within companies is the most important time to reap wealth for your hard work. Loewen & Partners advises owners on how to get the most value out of their businesses.

January 4, 2009

the 7 habits of inefficient markets

As we leave the decade of the "Naughts" and wrap up lessons learnt about markets in the past ten years, I realize that even this club of such smart men and women followed the markets off the cliff in 2008. What were they thinking?

Back in 2007, Paul Krugman summarized the seven habits that help produce the anything-but-efficient markets that rule the world. I thought a great way to begin the next decade would be a quick review of these:

Seven habits that help produce the anything-but-efficient markets:

1. Think short term.

2. Be greedy.

3. Believe in the greater fool

4. Run with the herd.

5. Overgeneralize

6. Be trendy

7. Play with other people's money

I got these 7 habits courtesy of Paul Krugman, quoted in Fortune back in 2007. Worth contemplating.

Jacoline Loewen, author, writer, and expert in private equity.

January 2, 2009

Private Equity interested in good companies

Banks may not be lending but private equity has cash for owners of businesses looking for growth capital. Watch Toronto's BNN's Squeezeplay as they chat with Jacoline Loewen, author of Money Magnet

http://watch.bnn.ca/squeezeplay/december-2008/squeezeplay-december-30-2008/#clip125488

For more information:

http://www.moneymagnetbook.ca

It's that time of year again, forecast 2009

One bright light is the 2009 forecast by Niall Ferguson in National Times. It may bring you some joy in the New Year. Here's a sample:

"Many commentators had warned in 2008 that the financial crisis would be the final nail in the coffin of American credibility around the world. First, neo-conservatism had been discredited in Iraq. Now the “Washington consensus” on free markets had collapsed. Yet this was to overlook two things. The first was that most other economic systems fared even worse than America’s when the crisis struck: the country’s fiercest critics – Russia, Venezuela – fell flattest. The

second was the enormous boost to America’s international reputation that followed Obama’s inauguration. "

December 30, 2008

Squeezeplay with Kevin O'Leary

The Baltic Dry Index

December 26, 2008

Crisis on Wall Street - Blodgett's view

I was intrgued to see old Henry's take on the current state of the markets. Read...

Last year, I wrote about the fall of the public markets in Money Magnet. At the time, my publisher asked me to tone it down as she could not see Wall Street ever losing value!

December 22, 2008

Credit Crunch Games for Your Christmas Party

I was surprised to see that The Economist has a sense of humour during these dark days but this is a good game to play. I got it from Jeff Watson.

Check it out:

http://www.economist.com/displaystory.cfm?story_id=12798307

December 19, 2008

Manufacturing in Ontario

We have passed the agricultural, industrial, and information ages and we've entered the conceptual age. The three As—abundance, automation, and Asia—ushered in this new era.

In the same way that machines have replaced our bodies in certain kinds of jobs, software is replacing our left brains by doing sequential, logical work.

And that brings us to Asia, to where that work is being shipped.

In Asia you have tens of millions of people who can do routine tasks like write computer code. Routine is work you can reduce to a spreadsheet, to a script, to a formula, to a series of steps that has the right answer.

Daniel Pink has written A Whole New Mind about this change and how it applies to the companies we create. "This is great book to tell you where to invest your private equity fund money," says Jacoline Loewen , author of Money Magnet and a partner in the private equity company of Loewen & Partners. "Every manufacturer in Ontario should read it to know what to do."

He tells us that his generation's parents told their children, "Become an accountant, a lawyer, or an engineer; that will give you a solid foothold in the middle class."

But these jobs are now being sent overseas. So in order to make it today, you have to do work that's hard to outsource, hard to automate. To play an interview with Daniel Pink, press on link below:

http://event.oprah.com/videochannel/soulseries/oss_player_980x665.html?guest=dp&part=1

December 16, 2008

Getting the Public Equity Markets Right

http://www.charlierose.com/view/interview/9713

Taleb talks about Capitalism 2 where instead of relying on public markets to make money, people will now revert back to private money.

This is exactly what I said in Money Magnet, where I predicted the end of the public markets as the main model for creating value. Private equity is money which goes into companies directly from one human to another human who look eachother in the eye at least once every few months and who work together to build value in the business.

Beats the ATM machine style of investing in the public markets.

The Wisdom of the Markets

Rudyard Kipling wrote his poem 'God of the Copybook Headings' and still stands a metaphor for our current woes:

Rudyard Kipling wrote his poem 'God of the Copybook Headings' and still stands a metaphor for our current woes:About Kipling: He had lost his dearly loved son in World War One, and a precious daughter some years earlier. He was a drained man in 1919, and England, which he identified with so intensely, was a drained nation. With all this as background, the general opinion is that The Gods of the Copybook Headings is a clinging to old-fashioned common sense by a man deeply in need of something to cling to....

As many do again just on 90 years later.

December 15, 2008

What is The VC Screening Process?

Where Does Your Deal Fit?

Ask your venture capitalist where your company investment would be placed in their fund horizon. If your company is first in, then you have more time (five years) to make money before being required to pay back the full amount. If you are last in, the time for the VC to get out will be closer.

It also depends when you meet with the VCs and at which stage they are with their fund. If they have already filled up most of their fund, they will be very choosy about the last two companies. If they have just obtained the cash, then they will be feeling more generous. After the investment, find out who will handle your file. Will it be the same person who did the due diligence and who spent time getting to know your business? That person will have an emotional attachment. If a new guy is handling your file, there will be far less commitment.

The VC is a high-risk, high-return animal. Three out of ten companies in their fund will drive their fund’s return. If you are in that portfolio and your business is struggling, expect some pressure from the VCs. They want winners as these are their bread and butter. VCs make money for people who make them money. There are usually ten years in their life cycle: the first five years are used to seed your business and the remaining five are used to harvest the investment. The VCs must get out. They are not there to fund you into retirement.

How Much Should I Prepare to Meet an Investor?

Your business plan is much like a resume and it’s the ticket that will get you to the next stage: a face-to-face meeting. Attracting money to your business will be easier if you show your vision of the business and how you plan to execute it. You can make yourself far more attractive to investors if you have a merger possibility on the radar that you can name.

“It's the people, not the product, that investors are most interested in,” says Ilske Treurnicht, MArs. “And first impressions are important. Be active and interested without being arrogant. A banking or VC relationship typically lasts four to eight years, so investors tend to look for people they like and believe they'll get along with. Also, they do want people who are prepared.”

"How people present themselves to investors says very loudly how that business owner presents their product to their customers.

I Need Money - Where Do I get It?

One of the bloggers on CBC's hit TV reality show, Dragons' Den, posed the often posed question, "I'm under thirty years old, where do I get money to start my business?"

One of the bloggers on CBC's hit TV reality show, Dragons' Den, posed the often posed question, "I'm under thirty years old, where do I get money to start my business?"December 14, 2008

Driving Canada's Business Success

I live in an age which has seen the end of the British Empire, the collapse of the Soviet Union, and now, perhaps the decline of America, like a giant air balloon slowly deflating. In the meantime, the peaceful rise of a dynamic China and other Asian countries, matched with the rise in our own overambitious government entitlement programs, creates a new level of expectation for citizens.

I live in an age which has seen the end of the British Empire, the collapse of the Soviet Union, and now, perhaps the decline of America, like a giant air balloon slowly deflating. In the meantime, the peaceful rise of a dynamic China and other Asian countries, matched with the rise in our own overambitious government entitlement programs, creates a new level of expectation for citizens.When I went to McGill University, a slice of pizza at Gertrude’s on a Friday would be my one treat – otherwise I lived on peanut butter, tuna sandwiches, and beans on toast (yes, I like bread). I rarely bought a pre-made meal, which is why I was jolted by a blog written in response to Karen Selick, a lawyer with Reynolds O'Brien, LLP., who commented on Food Banks. This student was horrified at the thought of another student not being able to buy a cafeteria item. What’s wrong, I wondered, with the cheaper option of packing a cheese sandwich and an apple for lunch?

The end goal of helping the poor is desirable, but the debate rages around “how” we give.

The Food Bank style of charity – giving to ease symptoms – is not to be confused with venture giving – philanthropy – which targets the underpinnings of society, asks why poverty occurs, and seeks to level access to opportunities.

Andrew says, “It’s private companies like CYBF who taught me the skills to be an independent business owner by providing me with $1,000 a month for a year and giving me a mentor. CYBF insisted that I write business plans, make financial projections, and answer questions about the revenues and strategy of my business. By transferring their entrepreneurial skills, CYBF encouraged my passion for music into a business. I won the sound contract for a Sprite commercial and now I have my own studio – King Squire Audio. Of the 20 people in my CYBF program, more than half are now hiring other people. The cost – $240,000 – is peanuts compared to what the government is spending on big conglomerates.”

Andrew agrees with Selick, that “how” skills or resources are given increase the impact of levelling the playing field. “The CYBF model should be exploited as it is entrepreneurs who are running the program. Letting government ‘do the giving’ would be inefficient. It was private business people who taught me how to raise money and who gave me the right ideas about the tough world of business and this came through CYBF.”

The Food Bank is well meaning with its belief in the redistribution of wealth, but I believe in the redistribution of skills to people like Andrew Squire, who has shed his dreadlock image and projects a quiet confidence. The Food Bank tips the pendulum toward socialism. I nudge the pendulum toward free enterprise. The totality of resources is never sufficient to meet all goals at the same time. Life is dialectic – private enterprise versus public duty. But effective giving is something we can all have the courage and honesty to face.

Jacoline Loewen is a financial advisor for companies seeking capital, as well as a corporate strategy expert, lecturer, and writer with three published books. the latest is Money Magnet: How to attract investors to your business.

December 12, 2008

How to Get the VC to Call

VCs don’t invest in technology or markets, they invest in people.

If the people stuff goes wrong, it’s hell. They put you through due diligence while at the same time trying to find out what kind of person you are.

When you pitch in, it’s a sociological experiment to see what makes you tick and whether you will be co-operative or will crack.

Probably the most powerful action you can take is to find a referral to a partner in the business. It’s a bit like dating. If someone they trust refers you to a VC, they will take your call. "The question I get asked the most is how to find investors," says Jacoline Loewen, author of Money Magnet. "Owners are better of having a company like Loewen & Partners find them a suitable investor."

Warning: Bad phone manners are an immediate red flag. The VC knows they are entering into a seven-year relationship and they will not waste time with someone who rankles. If they can’t see themselves married to you, it’s a quick, “thank you but no thanks.”

December 11, 2008

How do you define value?

"Your conversation around the valuation of your business may begin with the investor asking for a quick snapshot of your financial picture, but a weak EBITDA (see glossary) will by no means end the chat" says Jacoline Loewen. "Valuation of a business comes from the fund itself and the type of companies they already have in their portfolio."

"Your conversation around the valuation of your business may begin with the investor asking for a quick snapshot of your financial picture, but a weak EBITDA (see glossary) will by no means end the chat" says Jacoline Loewen. "Valuation of a business comes from the fund itself and the type of companies they already have in their portfolio."“Often companies we like do not have EBIDTA or revenues, so we cannot use these tools as value markers.” Instead, Peter Carrescia of VenGrowth Capital Management Inc. says, his team values businesses with:

• High barriers to entry;

• The capability of rapid revenue growth;

• An analysis of what will happen in the market over the next three years;

• Identification of the Number One Issue to overcome;

• The perfect intersection of company, services/products and cycle in the market.

The whole business of investing is complex and wrought with chaos. A very big difference when investing in IT compared to other businesses is that the VCs know that eventually it all comes down to the team involved. Tech VCs can perform the complex science of due diligence, research the market and call past clients, but the only valid metadata worth drilling into is the people. The art of predicting winning people is much harder. Investing in a practiced team is a good indicator of success, but it is still an art.

Deal dead and buried

Private equity and debt deal of the century ends. See the full story here.

Private equity and debt deal of the century ends. See the full story here.The key reason why the biggest leveraged buyout ever was killed was that it

didn't live up to a "solvency opinion" -- a declaration by auditor KPMG that the

company would have been solvent after the takeover loaded it with billions in

fresh debt.Posted by Anastassia Kobeleva

December 10, 2008

Raising Capital for SMEs

Last night I was at the RBC Women Entrepreneur of the Year awards and Diane Francis of The National Post was there and also commented frequently on the tough days we are facing. There was a ripple of agreement through the room of 2,000 female entrepreneurs. The Publisher of Profit magazine brought some light to all this gloom and doom telling us about research that recessions and depressions first begin to lift in the SME sector. Our target market - Loewen & Partners, that is - is the SME with revenues of $10M+ and it’s true that there is private equity investment dollars available.

Quite heartening.

December 9, 2008

You've Got Talent But...

J.B. Loewen's blog about Dragons' Den:

J.B. Loewen's blog about Dragons' Den:It’s time for another game of Crack the Whip with Kevin O’Leary at the head and the entrepreneur at the end.

And we were not disappointed as the Dragons’ Den show opened with Elke presenting her Lump O’ Coal, a Christmas stocking stuffer. Robert Herjavec thought it was cute but as Elke brought out her red Lump O’ Coal for Valentine’s, and so on, Arlene saw the flaw - Elke really had a single product for the investment opportunity.

There is only one thing that bothers Kevin—SKUs!

We’ve covered the topic of SKUs (Stock Keeping Unit) before with past Dragons’ Den presentations; Kevin means that the cost of managing and delivering single unit orders will eat up the profits. Think shirts: If you only had one design of shirt, you can see why delivering orders of one shirt to many stores would not be cost effective. To scale up, a company needs a wider range of products to pack for each client, otherwise you will be SKUed. And with that, Kevin skewered the deal, saying, “Deep in your heart, Elke, you know Lump O’ Coal will be a lump of you-know-what.”

Arlene tried to reason with Elke and said with a calming smile, “Cut through the harsh criticism (I’m really sorry you have to listen to Kevin) and hear the very good advice (Kevin is not such a ‘nothing burger’, he does teach at an important Business School).”

What Arlene was trying to explain is that an equity investor needs to make returns of above 20%, but by no means is Elke in a bad business. A single, seasonal product will simply not attract investors like the Dragons, and she would be better off getting debt financing or a government loan from the EDC. Quite rightly, Jim Treliving also respectfully advised that the company was a nice cottage industry and to keep it that way.

Single SKU companies can work and we saw this with a previous presenter – Sue and her Omega Tree Stand – who did well after fizzling at Dragons’ Den. Getting exposure on the show resulted in orders coming to Sue—landing her Canadian Tire and big-box stores high volume orders.

That doesn’t change the fact that for venture capital, the Dragons made the right decision, but thanks to Dragons’ Den, Sue got the free marketing exposure to get her phone ringing.

W. Brett Wilson, who is more used to coal as a source of energy, squinted in his tough guy way and rasped, “But why would anyone buy a lump of coal?”

Being of Scottish descent, I know that the Lump O’ Coal comes from the tradition of having a tall, dark stranger with a piece of coal for your fireplace be the first to cross the threshold in the New Year (Fabio look-a-likes being particularly popular with the ladies of the house.)

But I digress.

Let’s get back to Robert Herjavec, he of the matching tie and handkerchief sets, with his agreeable—almost rakish—way of chatting with entrepreneurs. It’s evident that Kevin doesn’t want to be any entrepreneur’s Facebook friend, but Robert’s warmth will soothe entrepreneurs, getting them to relax. But it was not enough to calm the nerves of the laid-off auto worker team, Jason and Leigh, as they presented their wall calendar. Arlene, being a single mum of four children herself, knows what it is like to co-ordinate family and commiserated that a shared wall calendar sounded good but, like some Nanny 911 ideas, hard to follow through.

Indeed, Kevin wished he could fire his family for their slacker ways over schedules.

When unpacking what went wrong afterwards with Dianne Buchner, the Den’s insightful host who adds helpful hints, Jason said the presentation was not good enough.

Ouchey! I wondered if Jason’s wife, who did the lion’s share of the presentation, was thinking, “Buddy—you’re not getting any for the next month!

There is a great deal of ambiguity in investing and each Dragon has their style. One Dragon might love your product but another one not be remotely interested. Throughout this season, the rookie Dragon, W. Brett Wilson, has been the shining light for entrepreneurs, coming through to invest in people he sees are trying their best or with a unique product. Likewise, we see Kevin O’Leary invest with his strict set of rules which, luckily, he teaches us.

We saw Brett do a handshake deal for a million dollars with a green energy technology entrepreneur, the big prerogative being IF Magnacoaster passes through the due diligence process and does what the entrepreneur says it does. Then Brett returns to Moxy Trades with a reduced offer, and clinches that deal. Finally, Brett and Arlene both shake hands with the First Memories Photobook team. After all, new mums can never have enough pictures of their baby snuggle-muffins.

What happened? Two words.

Deals done.

Clearly, Brett is a Dragon ready to invest and I love the “Kaching, Kaching” noises inserted every time there’s a handshake.

Finally, up comes a magic show, Illusions Dinner Theatre - would Brett sign up another entertainment act? Would we see more of Big Jim’s smooth dance moves which rival the Four Tops? To the bemusement of all, Robert volunteered for the magic act. Whoa! Robert, what were you thinking? By that stage, had the entrepreneur, Don, already sensed the deal was not happening? He could have been planning a horse’s head under Kevin O’Leary’s bed. Now you’re going to let him stick knives in your head?

Repeat: Knives and Dragons are a dangerous mixture—especially when the entrepreneur may be unhappy with the “no investment” decision.

Again, the Dragons enjoyed Don’s talent show but real estate financing is not the typical type of deal that equity investors do. As Big Jim advised, “It was a great show but cabaret acts last twenty months. Get to a bigger place, like Vegas, and don’t get saddled with real estate.”

And that’s all folks.

I’m sure you will agree that Dragons’ Den has succeeded in pulling back the curtain of mystery to reveal what are the features of a business every entrepreneur must be able to discuss with a potential investor. The Den is a gateway into how to be a great entrepreneur and, if you watch the whole season on the website, it’s an MBA course in Entrepreneurship 101—minus the school fees. Many of the presenters asking for investment dollars in the Den are Creative Achievers—people who do not fit the traditional management career track, who take risks and who change the world a little or a lot. Probably all of the Dragons fall into this category. None of this season’s presenters need bother with an MBA, and with Dragons’ Den giving many a jump start, they will be phenomenal.

Kudos to CBC for creating the Dragons’ Den website with the Forum where fans can blog. I think it has elevated the level of transparency and trust – a boost for the CBC brand. Also, the updates on companies from the show as they begin to blossom with a little help from their Dragon investors, is proving to be a terrific platform for Canadian enterprise. We can find out more about EcoTraction, for instance, which reminds me to buy the eco-salt for my doggy’s paws, as well as anything sporting the Dragons’ Den logo. The CBC showcases how an investor might work for your company by cross-selling products. Quicksnap goes to Afghanistan with CDs of a Canadian country singer who also wears Hillberg and Berk jewellery. Here you see three products, two from Dragons’ Den, being cross-marketed in a compelling way.

Watching the video of Quicksnap in Afghanistan though, with the enthusiastic Afghanistan gentleman enjoying the music, was the best Christmas present for me this year, bringing tears to my eyes. That is the true heart of business.

Before I get too schmaltzy, better close.

Dragons’ Den is my (and I suspect for a lot of you too) weekly passion. Now, as the season draws to a close, what are we going to do? Here’s an idea—the CBC has taken a leaf out of the play book of Gene Simmons’ success with KISS, by marketing the band of Dragons. I recommend wearing your favourite Dragon T-shirt to do your grocery shopping on a Saturday morning; it will probably improve your dating odds. Can you see it now—Arlene bumps into Big Jim in the tofu aisle.

I’ve said it before but even Kevin will agree Dragons’ Den is a great use of our tax payer moneeeeeeeey.

See you on January 11th.

December 8, 2008

Private Equity: Up, Up and Away

Job losses in the United States are the early cough of the venerable cold Canada will catch soon enough. Unemployment statistics out of the U.S. released last weak showed jobs are being shed across the whole economy and at a faster rate than expected. Big, infectious coughs, blowing up over the Adirondacks and into our backdoor.