This past month has been interesting, in my role as business development for my team of financial advisers. I have heard the same three questions from prospective clients.

To see if you also share these, I thought I would give a quick answer to these important questions to ask in regards to managing your money:

To see if you also share these, I thought I would give a quick answer to these important questions to ask in regards to managing your money:

1. How will you react in a coming correction?

Most people will

tell you they are cool under pressure, yet during a correction in the market,

the truth is that many will panic and do the worst thing – sell at the wrong

time. Selling is exactly what you should not do and this fear over common

market occurrences is probably the number one reason you should partner with an

expert to manage your wealth. They protect you from your own psychology. The past years have been smooth sailing where most could have made money but what about when the correction arrives - and it will arrive. Talk to your adviser about an upcoming correction and how are you protected from the downside.

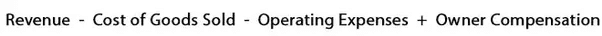

2.Are you overpaying for performance?

It is no longer about

the fees. In fact, it is about the economics. Do you understand the business

model of a broker versus the Financial Adviser being rewarded to advise you to

achieve your goals? What would you do if you had your doctor prescribing

treatments where he got a kick back from the drug company? That is the broker

model, which I believe is flawed, and people are realizing the economics are set

up to reward the house, not the client. Ask your adviser for the economics of your portfolio. Are they able to source investments outside of their institution? How are they paid? Ask if they earn an additional fee when you accept their recommendation.

Does your adviser have conflicts of interest?

Again, the

broker model is set up to reward the broker, not you, the investor. If your financial

adviser is pressuring you to trade often and to buy their own products, rather

than offer an open-house architecture, your long term financial outcome will be

compromised. Is your broker stuck selling you their in-house products or do they have a global diversification and product diversification capability at minimal cost?

Visit Amazon Author page for Jacoline Loewen. Click here.