One way to describe private equity is, simply put, privately-held money invested into privately-owned companies that are not listed on the stock market.

Investments could be your Uncle Jim’s $1M he put into your brother’s video gaming company. This is private, it is not listed on the public market where the shares can be bought and sold by anyone. This definition, however, omits the key difference that sets private equity far apart from alternate capital.

One of the leading private equity players, David Rubenstein of The Carlyle Group, gets to the nub. “Private equity is the effort made by individuals with a stake in a business.”[i] These individuals will put capital in, try to improve the business, make it grow, and, ultimately, sell their stake.

Jacoline Loewen is a partner with Loewen & Partners which has raised over $100M for owners of companies.

[i] Rubenstein’s definition sourced from the website www.bigthink.com/business-economics/6380>.

Wealth Management

Voted #6 on Top 100 Family Business influencer on Wealth, Legacy, Finance and Investments: Jacoline Loewen My Amazon Authors' page Twitter:@ jacolineloewen Linkedin: Jacoline Loewen Profile

May 18, 2009

May 15, 2009

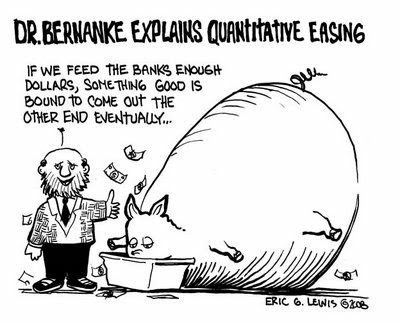

Private Equity can be alarming

Private Equity is such a tough type of financing to help owners of companies understand. The big deals done get the media attention. Some of the stories told are alarming for owners.

Private Equity is such a tough type of financing to help owners of companies understand. The big deals done get the media attention. Some of the stories told are alarming for owners.It is only in the last decade that this type of money has now become available in all sorts of formats for business owners of mid-sized companies. These stories do tend to fly under the media radar.

This is why Loewen & Partners runs CEO Round tables with Ivey Business School to showcase private equity. Yesterday, we had McKinsey and Company and Bill Wignall giving detailed presentations to a room of business owners. Here is the take away from Paul Hogendoorn, owner of OES.

"It’s both a professional benefit and a pleasure to attend your CEO events. Yesterday was no different. (BTW, my most recent column again referenced a key take-away from a previous event).

My big take-aways from this last one were:

- It’s OK not to need PE money

- Know specifically what you want to use any investor PE money for

- The structure of a deal can make even an otherwise unattractive deal workable

Ken enjoyed it to. Much of the first presentation was greek to him (and therefore intimidating – which was consistent with my first experienced a couple years ago), but he recognized the value in gaining some exposure to it, and he really enjoyed the second speaker."

The second speaker was a professional manager, Bill Wignall, who gave his experience in accessing Angel, Venture Capital and Private Equity Fund money. It was a great day and it is always gratifying to see that you are helping business owners.

May 13, 2009

Companies with Debt Are Attractive to Private Equity

There are millions of private equity dollars out there looking for good businesses and smart owners. Even if you think your operation is not up to snuff—perhaps it’s not large enough, making too little profit, or employing too few people—you may be surprised how highly others value it.

I can say this because in my experience, I have often been astonished at which businesses are liked and coveted by investors—yes, even those that are not currently profitable.

McGregor Socks, a long serving Canadian company is such a case. After struggling to adapt to the fast changing global market, McGregor knew it needed to add China as a destination for knitting up Canadian-designed creations. It was a private equity fund that put up the money since they already had experience in China. Bringing in partners is a difficult transition but with supportive investors, an excellent Canadian brand continues to fill store shelves (look for a pair of McGregor’s the next time you need socks).

Jacoline Loewen is a contributing author to Peter Merrick's book, The Trusted Advisor's Survival Handbook.

I can say this because in my experience, I have often been astonished at which businesses are liked and coveted by investors—yes, even those that are not currently profitable.

McGregor Socks, a long serving Canadian company is such a case. After struggling to adapt to the fast changing global market, McGregor knew it needed to add China as a destination for knitting up Canadian-designed creations. It was a private equity fund that put up the money since they already had experience in China. Bringing in partners is a difficult transition but with supportive investors, an excellent Canadian brand continues to fill store shelves (look for a pair of McGregor’s the next time you need socks).

Jacoline Loewen is a contributing author to Peter Merrick's book, The Trusted Advisor's Survival Handbook.

May 12, 2009

6 Reasons to Read Money Magnet: Attracting Investors to Your Business

I just finished reading Money Magnet. Thank you for writing/recommending it! The information you shared will save me a lot of time instead of reinventing the wheel. I like reading materials from people like you who can share specific industry insight (eg. when you described what VC Rick wants to see in slides). Some of my key takeaways include but are not limited to the following:

- Targeting qualified investors based on their mathematical fit and specifically asking them to clarify their full criteria

- How to be investor ready/the legacy investor concept.

- An investors’ protection/clauses (ensuring that I negotiate unnecessary ones).

- Knowing common pitfalls/key criteria investors like

- Ensuring that I answer the 4 investor-ready questions and

- Investor-friendly methods of structuring a presentation

Subscribe to:

Posts (Atom)