“This is a really, really bad idea.”“You’re crazy.”“You will end up going to the forest and slitting your wrists.”

“This is a really, really bad idea.”“You’re crazy.”“You will end up going to the forest and slitting your wrists.”These were vintage lines from the fieriest Dragon gazillionaire, Kevin O’Leary, who is to Dragons’ Den what Simon Cowell is to American Idol. Kevin says the things we are all thinking at home but would never dare to say to someone’s face and it’s what sets him apart as an investor. Like Simon Cowell, Kevin’s words may sting but not as much as spending $700,000 of your own money and ten years of your time without making a dime of profit – like the Dolls House kitty litter guys. That’s sad. Imagine if they had met up with the CBC Dragons back then, got a blast but listened. Maybe they would have changed their idea or found a job with Purina. Today they would have a healthy RRSP and bank balance instead of looking as if they’d sucked back a mouthful of Buckley’s cough medicine.

Ditto to the cute lady with her Bubbles the Dog book, the pizza box guy and the white-suited bee exterminator. As the marketing Dragon – Arlene Dickinson - quipped, “Bee gone!”

Dragons’ Den is back with a vengeance this season offering intrigue, drama, cruelty and redemption – better than any soap opera because if you listen to the Dragons’ questions and, yes, to Kevin’s digs, you cannot help but learn.

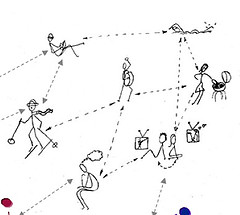

Dragons’ Den is back with a vengeance this season offering intrigue, drama, cruelty and redemption – better than any soap opera because if you listen to the Dragons’ questions and, yes, to Kevin’s digs, you cannot help but learn.First up (excuse the pun) was Fit to Touch, - a rather suggestive exercise program to do with your loved one, and if you have a friend but you are not a couple, do this program a few times and you will be. Although most of the Dragons chuckled and cringed, big Jim Treliving was interested because he had connections who could commercialize the concept.

In any developing business, no matter the industry, you need to translate your ideas into sales. In other words, how are you going to get customers to take money from their wallet and give it to you? Until you get healthy revenue you will need to depend on infusions of money: investment capital. In other words, cash from investors like the Dragons.

Kickspike, a golf shoe with retractable spikes, attracted the most money ever invested by the Dragons – one million dollars! What was so special? First of all, it is a sports product which speaks to all the Dragons. The shoe was easy to use and could be rolled out to a far wider market such as construction boots, seniors’ walking shoes and any sports shoes with cleats. Also, the designers, Colleen and Darrell Bachmann, were smart enough to take out a world-wide patent. With all these stars aligned, the Dragons recognized a good deal. Even the new Dragon, Brett Wilson, a brooding Clint Eastward from Alberta, broke character and actually got excited.

During the final deal, a computer interface that a senior could use to read emails, the full range of investor emotions ran across Robert Herjavec’s face. First, the realization that here’s a darn good product that could make a buck but quickly moving to the horror of how much it could cost to take it to the consumer market. As Robert said, almost to remind himself, “I could run through all of my money and still not have made a dent in the consumer market.”

Exactly. As Kevin pointed out, you have to calculate the cost of client acquisition. Then savvy Arlene shifted gears by reaffirming that the size of the seniors’ market was worth the effort and there were ways to reduce the cost of education by piggy backing the software with companies already serving the over seventies segment. With that, Robert and Arlene were in.

Getting back the invested cash – never mind a profit – from your investment is very hard. This is where watching Dragons’ Den is worth your time if you want to understand the mind of the entrepreneur. Kevin said he spent fifteen years battling in the trenches of the consumer marketplace. That is a long time being knocked down but getting right up again to push forward. It is where Kevin made his fortune but he told the other Dragons how he suffered nights waking up in a cold sweat and he ain’t goin’ back. With that, O’Leary said, “I’m not buying, I’m out.”