It seems as though every second start-up business is about social networking.

Is it over-hyped?

Is it like a movie with famous faces but no plot?

Just remember, high tech has always been over-hyped, whether for cars, phones or electricity, the Internet, or the current new bubbles of alternative energy and climate change.

As discussed in the new book on private equity,

Money Magnet, companies put their business plan together, obtain funding from venture capitalists, open an office, and hire engineers and PR types. They talk up their technology and hope that the Bay Street analysts will declare the new product a world-changer.

"The technology for social networking is just beginning," says

John Loewen of

Loewen & Partners. "It will be a world changer. No longer just for swapping music files or photos, business people are using social networking to market and communicate."

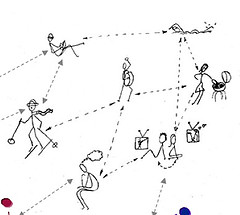

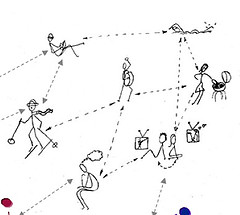

Just as Nicholas Negroponte predicted in his 1995 best seller, Being Digital, the three separate industries of computers, broadcasting and publishing have merged. Imagine a Venn diagram, which Negroponte describes as three teething rings – the interactive world, the entertainment world, and the information world. The convergence of these three giants – who had power comparable to Soviet-controlled industries – changed how decisions are made regarding who gets published and what gets broadcast. The impact on society has been extraordinary.

To access this ocean of information, we are all hooked into a giant grid by means of various devices – iPhone, Blackberry, laptop, car navigation system or TV. It gives us marketing, entertainment, business access, our child’s latest school marks and social connections to school pals from thirty years ago. Technology does determine the future of the human race but as we have learned over the course of history, the social bits around the technology are more critical.

“To control or not to control?” is the question asked by parents watching what appears to be the slothful, antisocial behaviour of their online children or by anxious employers eyeing their staff online during work hours. Yet this social networking allows staff to play, explore, take journeys far from the office and bring back useful nuggets for your next marketing piece or customer sales presentation. Merging your soft (people) with the hard (technology) is good business and if you are worried, remember, the more you use the reins, the less they’ll use their brains. China has developed MBA schools to teach these soft skills, encouraging employees to think for themselves. Xiang Bing, Dean of the Cheung Kong Graduate School of Business, talks about the hard-working ethics of the Chinese and their excellent technology but also points out the challenge of further developing their soft skills.

Less democratic governments are anxious about social networking. Many are trying to control this sharing of ideas and have convinced Google to co-operate in censoring online access to content. Thank heavens Canada seems to have more confidence in the ability of its people to maintain harmony despite the blogging of nutjobs or hate-mongers.

Are people sitting inside their four walls connected to this giant grid but not getting outside to meet real people? Yes, but they are also meeting others from far away neighborhoods that they will never visit and they can read blogs by people with radically different political views. All of this may raise their blood pressure but it surely develops mutual understanding. These online journeys and conversations are teaching people more about social interaction and how to argue a point. Up until now, fake personas and fake names have been used by many online people and anonymity - not owning your own words - is one of the biggest contributors to the rudeness on comment sections of blogs. It seems that people have forgotten their manners (I’m being kind here in assuming they had them in the first place); they quickly move off the debate topic and resort to name calling: “Gawd, Joey99, how do you put your pants on in the morning?”

I am still waiting for the business version of YouTube with real names only, so we can do without the juveniles and can we get some grown up brand names while we are at it? Saying Twitter, Dig this or Bebo makes me laugh!

Absolutely, social networking is a great journey, but do keep your real life. My sons have assigned me a “technology hour” when I’m at home so that I don’t bury myself in blogs. It seems they understand this technology thing better than I do

Last week, Private Equity Hub's Dan Primack interviewed Michael Bleyzer, CEO of Ukrainian-based private equity firm SigmaBleyzer, to discuss the impact of the conflict in Georgia. Though Mr. Bleyzer admits that the Georgian market has not drawn much of his interest, he does point out that an aggressive Russia cultivates politically-driven volatility in the large country that remains unattractive to him. Naturally, he advises to stay away from sectors vulnerable to political or oligarchical influence, (i.e. energy, defense, etc.). British Petroleum can attest to this, of course. However, he does mention that though the "Bear" may be winning the fight to expand its regional sphere of influence, this is raising moral considerations for investors when considering to put their money in the country.

Last week, Private Equity Hub's Dan Primack interviewed Michael Bleyzer, CEO of Ukrainian-based private equity firm SigmaBleyzer, to discuss the impact of the conflict in Georgia. Though Mr. Bleyzer admits that the Georgian market has not drawn much of his interest, he does point out that an aggressive Russia cultivates politically-driven volatility in the large country that remains unattractive to him. Naturally, he advises to stay away from sectors vulnerable to political or oligarchical influence, (i.e. energy, defense, etc.). British Petroleum can attest to this, of course. However, he does mention that though the "Bear" may be winning the fight to expand its regional sphere of influence, this is raising moral considerations for investors when considering to put their money in the country.