Usually family and business blends are developed in countries where there is low trust. As Western countries have law and order to ensure corporations work well, family businesses are less in demand. Those that do work and get passed to the next generation properly, tend to do exceptionally well.

The de Gaspe Beaubien family is a great example where the next Gen. were able to influence the sale of the original business that made the wealth. Now the next Gen. is re-inventing the family business to the next level.

Here are a few excerpts from a Globe article talking about some of the questions to ask to achieve a strong and positive family business:

BRENDA BOUWSPECIAL TO THE GLOBE AND MAILAPRIL 29, 2018

While there’s an old adage that says never go into business with family (or friends), experts say the corporate pairing of relatives can be powerful, if properly handled. A recent report of 1,000 family-owned firms worldwide, including some in Canada, showed the financial performance of family-owned companies is superior to that of non-family-owned businesses. Family-owned companies generated a cumulative return of 126 per cent since the start of 2006. Revenue and earning growth (measured by earnings before interest, taxes, depreciation and amortization, or EBITDA) was stronger, EBITDA margins were higher and cash flow returns are better, the report said, adding that family-owned businesses have a “longer-term and conservative focus.”

A well-known example many experts point to is consumer products conglomerate SC Johnson, now being run by the fifth-generation of the Johnson family. It even uses the slogan “A Family Company,” to help boost its brand.

“When an entrepreneurial family gets together to work on something, they care so much more than someone who doesn’t have their name on the building or doesn’t have a stake in the community. To me, that’s a recipe for building a great business,” says David Simpson, head of the Business Families Centre at Western University’s Ivey School of Business. “However, when it goes poorly, it goes poorly doubled down because you’re losing your brother or sister or cousin.”

“There’s an intrinsic conflict that comes with family businesses,” says Mark Barnicutt, co-founder and CEO of HighView Financial Group, which works with high-net-worth families, many of whom are entrepreneurs with their own companies.

“Emotional issues easily come to the surface,” he says. The most successful family businesses recognize that could happen and put in place the proper governance, including family roles and responsibilities, to cover what happens when conflicts arise. “A business isn’t a family and a family isn’t a business. You really need to separate the two,” Mr. Barnicutt says.

Family members in business together should also outline what happens if one person wants out, or there’s a disagreement in direction, Mr. Simpson says.

“It’s unromantic … but a business is an organism that lives, dies and changes,” he says. “Businesses aren’t worth blowing up a family for. A business is just an instrument of economic gain … If you go the nuclear option of suing each other, you’ve hurt both the family and the business.”

Mr. Simpson once ran a business with his younger brother, Craig Simpson, a former National Hockey League player who is now a broadcaster with Hockey Night in Canada. The business relationship ended after his brother retired from hockey and focused more on the company. “We found out that our formerly passive, equal partnership didn’t work as active partners,” Mr. Simpson says. “We didn’t share the same vision, risk tolerance and personal objectives and our general assumption that siblings are of course similar, was surprisingly inaccurate. We were better brothers than business partners.”

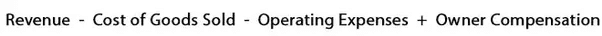

Most often, it’s money and corporate strategy – including how various family members are compensated and disagreement over the direction of the company – that lead to family business feuds, says Jane-Michèle Clark, an instructor who teaches the family enterprise course in the entrepreneurship program at York University’s Schulich School of Business.

Ms. Clark recommends business families hold strategy sessions that cover topics such as their family values, how they want the business to work for them and vision for the company.

“When you start by reaffirming the family values and relationship, then get clear about each person’s expectations about what they want the family business to do for them, and then move on to the vision, the conversation takes on a whole different tone,” she says. And while she recommends family businesses bring in a family council or an advisory board “to act as both a resource and a buffer,” few do, believing it’s not necessary or conflict won’t happen in their case.