Wealth Management

June 2, 2009

What Private Equity Does For Your Business

First up is McKinsey chatting about how they see private equity working for business owners and why this leap frogs bank money:

The Financial Post Executive: What Private Equity Does for Your Business - Sacha Ghai, McKinsey & Company

Then we have an entrepreneur who made his fortune and is now entrepreneur-in-residence with MaRS which incubates about 400 companies.

The Financial Post Executive: How Entrepreneurs Can Make the Leap - Ron Close, MaRS

June 1, 2009

Not all private equity firms are White Knights

Here is a case with a bad private equity firm in the NYT by J. Crosswell. To all business owners out there, be very careful how you pick your private equity partners. Loewen & Partners works with business owners to match them with ethical partners and we know these players who take advantage of bank leverage.

Here's what the company had to say:

“What soured me on this experience is that these private equity firms that come in and buy companies don’t look at a company to grow it. Whether it sinks or swims doesn’t really matter to them,” Mr. Pfeifer said. “They don’t think about the people whose livelihoods depend on that company. I hope I never have to go through that again.”

And here is a quote I got from Catterton's website to sum it all up:

Establishing a close working relationship with the management team of a portfolio company is a critical element in our operating philosophy and a key driver of our success. As a rule, we do not involve ourselves in the day-to-day operations of a portfolio company. Rather, we seek to create equity value in a company by assisting management in identifying the key strategic, operating, and financial priorities, and the resources needed to successfully execute against those priorities. We generally hold at least one seat on the Board of Directors and on key sub-committees of the Board.

May 29, 2009

Issues Facing Women Raising Capital

The good news: perceptions are slowly changing and there is money available for solid, high-growth firms that can adequately communicate their promise to investors. If you are female, grow some thick skin and deal with the stereotypes early on in your conversations. Here are a few:

• Woman entrepreneurs do not want to grow their business as quickly as men do.

• Female entrepreneurs just don’t ‘get’ how to source funding.

• Lack of networks is one reason for women’s challenges. When women were asked about their networks, they listed various men’s names. When those men were asked about their networks, they did not mention the women.

Before you write to your local newspaper to complain about the above list, take a breath. Let's go to the facts to verify these issues. What is true are the statistics on male- versus female-run businesses which illustrate that female companies may grow at a slower clip, but they tend to have a higher survival rate.

Understand that, when it comes to accessing private equity, Fund Managers favour the growth versus survival factor. It’s only logical that when you go about raising capital, your pitch must be at growing the business, otherwise leave private equity to the more aggressive CEOs. Keep on doing your slow growth but do not expect private equity investors to invest.

Barbara Orser, professor at Carlton, reiterates that critical point, “Here’s the bottom line for women: only entrepreneurs who start robust, high-potential businesses - and communicate that promise - will get the money they need.” Smart women understand that thinking, and reassure investors by spending more time on illustrating their ambition when reaching out to the VCs.

Are Women Capable of It?

I am invited to talk about women in business frequently which is always a pleasure as each and every time I learn something new from the audience. I will be speaking at Ivey about women and finance next week which got me thinking...

I am invited to talk about women in business frequently which is always a pleasure as each and every time I learn something new from the audience. I will be speaking at Ivey about women and finance next week which got me thinking...Cash is King for General Motors

"General Motors is a monster company employing a quarter million people worldwide. It sells $150 billion in cars – or at least it used to. It is not just a producer of vehicles. It is also a supplier. It has been through several joint ventures and has owned a number of foreign manufacturers, Isuzu and Opel being but two. In short, the company is a very big player, financially, economically and politically. Yet, somehow you get the impression that many in the financial media think we could just turn the lights out and go home. This is just not the best option." Watch Edward explain this further:

May 28, 2009

May 27, 2009

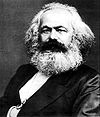

What would Marx Do?

When it comes to banking, many governments are now owners or part owners of their nation's banks. For retail banking (which has become a commodity) this may be a good development. Leave the higher risk financing to private equity and keep the meat and potato transactions for retail banking. It means that the people are not left drowning from this popped, speculative bubble while the bankers who created this situation are sitting on piles of bonus money.

When it comes to banking, many governments are now owners or part owners of their nation's banks. For retail banking (which has become a commodity) this may be a good development. Leave the higher risk financing to private equity and keep the meat and potato transactions for retail banking. It means that the people are not left drowning from this popped, speculative bubble while the bankers who created this situation are sitting on piles of bonus money.Jacoline Loewen is a partner at Loewen & Partners, private equity for companies over $10M in revenue.

Three Ways Private Equity Helps Grow Your Business

In these economic times, your private equity partners will advise you to forget the fads and get back to basics. With all of the latest and greatest concepts webcasts, podcasts and blogs vying for your attention, you would think that growing your business was as complicated as building the space shuttle. The fact is, there are only three ways to expand business...

Option #1 – Increase the number of customers

You increase the number of customers you have by reaching new customers with your existing offering or developing a new offering. Ideally you will leverage the offering you have to enter a new market or expand the reach in your exisiting market. Three key questions to answer to increase the number of customers are:

Who has a real need for the product/service I’m selling? Does my product meet that need in a manner that either saves money or provides additional value?

How much, if anything, are they spending to address that need today?

How many of those potential customers are there? How do I reach them?

Answering these questions meaningfully necessitates market research. Market research is like eating your broccoli – the idea is not appealing but it does the right job in keeping you healthy. Research teaches you a great deal about what you will need to know to effectively reach these new customers such as what to say, how to say it and to whom.

For example, in my industry which is finance and involves investing in companies, many of the big players have had a brick smashed to their heads. Private equity and venture capital funds are in bad shape. The market research done by the top funds and consulting firms like McKinsey and Company show that funds invested in smaller companies are faring better and enjoying higher returns. With this information, many or the funds are now looking for smaller companies. Reducing their size of company as a potential client opens up the customer pool.

Could you reduce one of your criteria to include a whole new category of client?

Option #2 – Increase the frequency of purchase

The shampoo companies used the wash, rinse, repeat mantra. This ordered their customers to use double the shampoo that is actually required. How many times have you washed your hair twice?

The quickest path to increasing the frequency of purchases is by making it as easy as possible for your existing customers to do business with you repeatedly. Another way to look at this is providing additional customer value – and ultimately building customer loyalty. If you make it easier for customers to buy from you, relative to your competition, then you will continue to win their business. This, of course, assumes your products or services are comparable or superior to your competitors.

Outside of customer loyalty programs, here are a few areas to consider improving:

- Responsiveness to requests, phone calls, emails

- Accessibility to the customer’s primary contact

- Consistency in offering

- Simple contract and pricing

- Bite-sized projects

- Follow-up and follow-through on meetings

- Accurate and timely billing.

While these may seem like common sense, consider how many vendors you no longer use because they were too difficult to do business with. Don’t become one of them to your customers. Option #3 – Increase the number of units sold

By default you will increase the number of units sold when you increase the number of clients and frequency of purchase. But you can also increase the number of units sold by understanding how to add value. If you want to sell more products or bill more hours, providing a value-add benefit or solution will begin to strengthen your customer relationship. If you are to consistently add-value to the customer relationship, you need to fully understand how your customers interpret, define, and quantify the value they receive from your products and services.

Here is a consumer example: A restaurateur offered existing customers 20 percent off for parties of 4 during lunch and early dinner. The idea was to add value to her existing clients by providing them with a benefit they could share. Result: Her lunch business went up by 88% in one month and by 53% over the campaign. On the frequency side, she experienced 71% retention of her customers when she dropped the campaign after 3 months.

Finally, don’t forget, to see real results, private equity will remind you to start with what you already know about your customers. It is the market research, customer knowledge you already have, that is literally a hidden goldmine of profit that can grow your business and increase your company's top line. It is this customer-focused information that will provide the foundation for generating more sales, retaining and cross-selling customers, and acquiring new customer business. Armed with customer-focused information, you will know which is the best way to grow your business.

Jacoline Loewen assists companies in raising capital and can be reached at www.loewenpartners.com. She is the author of Money Magnet:How to attract investors to your business (http://www.moneymagentbook.ca).

May 22, 2009

The stimulus package Washington is not talking about

Already, companies are beginning to link with private equity which is a new type of money which came on board within the last decade for small and mid sized companies. The banks have had a massive slap down and will be risk adverse for the next economic cycle at least. This leaves private equity to fill the role of higher risk lender or partner. By the way, if you are a business owner,do understand that Private equity is a misnomer as it also includes debt.

Listen to this podcast from Business Week on the money private equity is beginning to spend. You will understand why optimism about the economy is beginning to grow and private equity will play a large role.

View Private Equity Stimulus Package.