To get a realistic understanding of the value of the business, here is an overview of how to get a rough estimate that you can do yourself:

While firstly, revenue and secondly, profit are obviously two key factors in determining your company’s worth, assessing them in a vacuum simply won’t result in an accurate valuation. Even the additional details you provide regarding the number of customers you served during the previous two years simply don’t amount to sufficient data to perform a reliable valuation.

What you have to remember is that any investor, regardless of the reason for the interest in your company, will not be satisfied with a “ballpark” estimate of your value. They will delve deep into every aspect of your business when performing their due diligence in this regard and so should you.

To give you an idea of the complexity involved in performing a valuation, allow me to describe the process:.

1) EBITDA

Firstly, we will establish the company’s Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA) or Seller Discretionary Earnings (SDE).

EBITDA is used mostly for companies valued at over $5M and is calculated by adding interest, taxes, depreciation and amortization back to your net income.

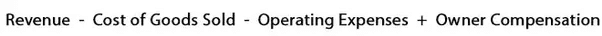

For companies valued at under $5M, Seller Discretionary Earnings (SDE) is typically used. SDE is the profit left to the business owner after the costs of all goods sold as well as critical operating expenses have been subtracted from gross income. Importantly, the owner’s salary can also be added back to the profit to reflect the true earnings power of the business.

SDE can be calculated using the following formula:

2) The Multiple Applied

The second step of the valuation process is to calculate the multiple that is applied to the EBITDA or SDE figure.

There can be between 80 and 100 data points into consideration when conducting this comprehensive investigation. Here is a small extract from the checklist of factors that we delve into:

Niche

- What level of threat does established competitors pose?

- Are there any expansion options available within the company’s niche?

- Is the niche evergreen?

Operations

- What level of technical know-how is required to manage the business?

- How are current staff members and contractors managed?

- What standard operating procedures (SOPs) in place?

Financials

- How has the gross and net income been trending for the past 1 - 3 years?

- How stable is the company’s earning power?

- Are there any anomalies in the business’ financial history and can they be explained?

Customer base

- What is the customer churn rate and lifetime value?

- How much does it cost to acquire a new customer?

- Why is the business losing customers?

Traffic

- Are current referral programs effective and sustainable?

- How effective and secure are current search engine rankings?

- Has the site been affected by any Google algorithm changes or manual penalties?

Other

- Are there any specific locational responsibilities or physical assets with the business?

- Are there any licensing requirements in order to run the business?

- Is the company’s intellectual property (IP) protected?

This investigation and research process leads us to an eventual multiple figure that we apply to the EBITDA or SDE value to establish your company’s value.

Typically, this falls between the 2.5x to 4.0x range, although there are exceptions to both sides of this spectrum.

Investigating these factors is dependent not only on a significant amount of experience in the M&A industry, but also on having the time and capacity to perform all the necessary research.

You can get more information on the valuation process by reading the full article at the website of FI International - this article.

Jacoline Loewen on Twitter @jacolineloewen