Need to be revved up and pushed back out into the market place? Here’s a great place to go and get inspired. It’s Rick Spence’s video series on how to get your business started but it applies also as a quick reminder for those who have been working at it for years.

At Loewen & Partners, we are using the marketing plan video as the base for doing our plan for next year.

Wealth Management

Voted #6 on Top 100 Family Business influencer on Wealth, Legacy, Finance and Investments: Jacoline Loewen My Amazon Authors' page Twitter:@ jacolineloewen Linkedin: Jacoline Loewen Profile

December 3, 2008

Dragons Bail on Yet Another Deal

The CBC show, Dragons' Den, is in serious danger of getting the same tarnished image that tinged the British show - the Dragons will not close the deals they agreed to do on national TV. There are all sorts of excuses.

Again, after the Uno letdown, Brett Wilson is left alone holding the bag to finance a great product, Ecotraction, and finally, this is getting noticed by the newspaper journalists. Mary Teresa Bitti, Financial Post writes, "all five (Dragons) agreed to put up a combined $500,000 for a 25% stake." They blame their change of heart on the market collapse.

That's a convenient excuse.

There are two types of investors: those that do it for a living and those who have made it, and invest their own money. The Dragons are supposed to be in the later category. Surely, they can afford $75,000 each on a product with guaranteed sales? Or maybe not?

I have a spread sheet tracking deals declared and deals done. Email me if you want a copy to see how much these Dragons are actually putting into our Canadian entrepreneurs. CBC should be asking Arelene Dickinson and Brett Wilson if they have any buddies who want to be Dragons and kick out the others who don't cough up the dough.

Again, after the Uno letdown, Brett Wilson is left alone holding the bag to finance a great product, Ecotraction, and finally, this is getting noticed by the newspaper journalists. Mary Teresa Bitti, Financial Post writes, "all five (Dragons) agreed to put up a combined $500,000 for a 25% stake." They blame their change of heart on the market collapse.

That's a convenient excuse.

There are two types of investors: those that do it for a living and those who have made it, and invest their own money. The Dragons are supposed to be in the later category. Surely, they can afford $75,000 each on a product with guaranteed sales? Or maybe not?

I have a spread sheet tracking deals declared and deals done. Email me if you want a copy to see how much these Dragons are actually putting into our Canadian entrepreneurs. CBC should be asking Arelene Dickinson and Brett Wilson if they have any buddies who want to be Dragons and kick out the others who don't cough up the dough.

December 2, 2008

Which Dragon Invests the Least?

Here’s a challenge for all of CBC's Dragons' Den armchair investors. You have been riveted by these intelligently selective Dragons sifting over the business ventures brought into the Den. Now it’s time to swivel your armchairs away from the entrepreneurs, towards the Dragons.

First up, let’s do a little of our own “Due Diligence.”

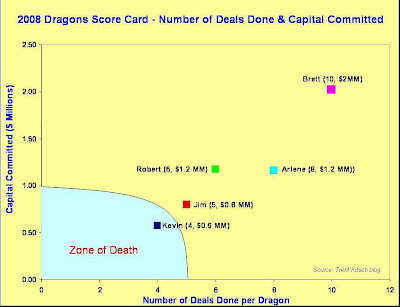

If you pull up the CBC Dragons’ Den website and find Trent Kitsch’s record of past episodes, he helpfully lists the dollar value of the deals made and the Dragons who committed capital, making it easy to jot down the investment record of each Dragon. Since Trent’s blog only goes up to Episode 8, I may be missing a deal here or there, but I think there’s enough to chew on the interesting statistics.

I invite you to examine the Dragons’ Score Card (at the top of this blog) where next to each Dragon’s name, you will find the number of deals done and, as Robert Herjavec likes to say, “money put at risk”.

So chaps, how’s the investing going?

From my calculations, our Dragons from Alberta are demonstrating why they are the “have” province and Ontario is the “have not”. W. Brett Wilson and Arlene Dickinson committed to 18 deals and $3.2 million in investments.

And surprise, surprise – what do we have here? The lowest investor is the one with the most bluster. It’s dear old Mr. Kevin O’Leary. Well, well, well.

Jack Welsh, the leader who took General Electric (GE) to the top of the stock market, had a firm but simple rule: the bottom 10% performers of the work force got fired – every year!

Sounds cruel?

Well, Kevin has been telling us all season that the market is cruel, so why shouldn’t the market bite down hard on a low investing Dragon? Why should it just be the presenters who have that unwanted feeling of hot adrenaline?

By the current rules, the Dragons are not under any obligation to spend a dime, but surely they should be under pressure? After all, in the real world, investors have their laws of the marketplace too. If they don’t invest, they obtain a low return on their capital, and if they are managing other people’s money and don’t have the ‘ovaries’ (or other body parts) to place it, that cash would be taken back rapidly.

If an investor does not commit dollars to companies, the only return they are making is on their original lump sum of capital and what’s the point of that? Kevin should know better than any as he runs a fund and, for sure, works within this rule. Right now, Kevin has the lowest record for investing capital and for that, to coin one of his favourite phrases, “he should be blowtorched out of existence.”

A common complaint by investors in the real world is that they don’t see good enough deals, and I suspect that the Dragons would say the same about the visitors to their Den, “They’re a little subprime, not likely to profit.”

Pardon me, but all sorts of idiotic things do well. The game Trivial Pursuit got turned down by hundreds of Angel investors who thought it was too dull. I still love mood rings, tiny troll dolls with pink hair, Billy Bee Honey but who would’ve invested in those things at their start? Even Barbie had its troubles getting launched.

That’s an excuse.

With the celebrity of the Dragons, many of the company products could gain some momentum. Surely, with several Dragons pitching in with their skills and rolodexes of global contacts, they could achieve something?

Ya’think?

Ah…but Kevin would say he adds valuable entertainment which should be factored in to his score card.

Fair enough.

Although, the Dragons’ Den is a display of Canadian entrepreneurship, it has to be watchable and it’s an added benefit that Kevin does an exceptional job of teaching. Our Canadian show is far superior to the British version because we are fortunate to have entrepreneurs with deep experience: Jim Treliving adds gravitas, Arlene Dickinson mixes in marketing sense, Brett Wilson brings formidable gunpowder, Robert Herjavec has spark and it is exciting to see Kevin grasp onto entrepreneurs and drag them flailing around the Den. People going on the show do realize there must be good ratings, but the fair swap is that there is a real cash opportunity too.

If it’s ratings the CBC needs, maybe one of the entrepreneurs could come back on the final show and say, “Kevin, you’re out!” push him shouting across a moat and as the draw bridge pulls up, a sofa-sized dragon could lunge at him.

Is it possible that he could even scream?

You have to admit, that would make great entertainment and since ratings are a factor in this materialistic, greedy, money-grubbing world of ours, a scene of a Dragon’s demise would be of enormous interest to more than a few viewers.

Which Dragon would you roast?

Right – so we are agreed then. Here are the new rules for the Dragons: lowest cash investor, you are the weakest Dragon. In Kevin’s words, “You’re a nothing burger”. You’re off the show!

Now, that’s entertainment.

Cluster$%#@ to Power

This is the worst possible scenario. Amidst the most severe economic turmoil since the Great Depression, Canadian politics got interesting. Not good. Of course, I hope no one is under the impression that the concerns of the guerrilla faction, namely the leaders of the opposition parties, is entirely concerned with the absence of a stimulus package. The plans for this coup were put in place weeks ago by Jack Layton and the Separatists; and there could not be a worst time to be getting politically creative, it will be the economy that suffers.

This is the worst possible scenario. Amidst the most severe economic turmoil since the Great Depression, Canadian politics got interesting. Not good. Of course, I hope no one is under the impression that the concerns of the guerrilla faction, namely the leaders of the opposition parties, is entirely concerned with the absence of a stimulus package. The plans for this coup were put in place weeks ago by Jack Layton and the Separatists; and there could not be a worst time to be getting politically creative, it will be the economy that suffers.Canada's economy, still regarded by many as a bastion of stability amidst the world's other large economies, actually exceeded analysts' expectations last month while others continue to falter. The country's gross domestic product expanded by an annualized rate of 1.3%, the fastest in a year, last month, a month which saw some of the most volatile stock market movements in 20 years. While Britain and the U.S. wane under the pressure of the crushing lack of credit, Canada's approach has squeezed stability and modest growth from our industry. Obviously, it is unlikely that this will continue with exports declining as they are (1.4% last quarter, the fifth straight decline), but a rash, emotional approach to this situation will destabilize confidence and certainly create uncertainty. The wherewithal of a coalition government, one led by Dion and backed by socialists and separatists, is, though historic, an unlikely, unproven, and confusing alternative to what is in place now.

The Canadian dollar will certainly depreciate as a result of this politically driven turmoil, and considering the fall in commodity prices and weakened American demand, will not prove advantageous to the Canadian manufacturing and resource industry. Interest rates will rise in pursuit of fleeing capital, which will make credit even less accessible, making investment in infrastructure and development less productive and less profitable.

A stimulus package from a coalition will undoubtedly be influenced considerably by the NDP, preying upon the acquiescence of the Liberals, desperately clinging to power. A socialist stimulus package would likely be focused on consumers rather than industry. Rather than corporate tax breaks and subsidies to provide incentive and support for investment in infrastructure to support sustainable growth, for example, the coalition would benefit most from a package that pacifies voters with consumer focused incentives, such as Bush's tax rebate that delved out about $1,200 to each citizen in the U.S. last February. As Bush's example showed this type of incentive program would prove ineffectual, even disastrous, since consumers are free to spend as they wish. The $1,200 that Bush dished out went, in large part, to foreign exports, which is no help to the domestic market, some even stashed the money in the bank for darker days, like today. The Liberals do have some economic heavyweights that seem poised to act as advisers, if a coalition is to take over governing, who would likely see the impracticality of this approach. The issues are that the Liberals may have no choice in the matter and as a result, no one knows what is in store or who would be involved or in which capacity.

The point is that the very economy that the coalition says it's protecting will suffer on account of their actions, certainly in the near-term, likely in the long. The cornucopia of potential quagmires we are headed towards if we are led by a coalition government of liberals, socialists, and separatists is a distasteful, abhorrent, godless thing to behold. Of course, the Conservatives are not without blame in this mess, and there are points in their fiscal update that definitely deserves vilification, but to usurp the government as its walks a tight rope through these volatile times is hypocritical to the very cause the coalition seems committed to resolve. In the long-term, this may prove as politically disastrous for the liberals, NDP, and Separatists, as it will prove to the economy in the short-term.

December 1, 2008

Why Hank Paulson Let Lehman Brothers Go

The reason Hank Paulson let Lehman Brothers fail, according to a Wall Street insider, is because he hated the CEO, Richard Fuld – the man who got punched in the face while exercising at his company gym. Seems Paulson was not alone in those feelings. Paulson, who rose up the ranks to run Goldman Sachs, is leading the government program to get the American stock market back to its punching weight.

“Thank heavens Paulson’s doing it,” says this leading investment banker, as we chatted at the St Andrew’s Ball, waiting for the next Scottish dance, Strip the Willow, to get going.

“He knows what he’s doing and this is a situation we have never seen before. He's not going to let Goldman Sachs go because it's the centre of capitalism. If that goes, the very essence of capitalism goes too.”

The banker went on to explain that in the USA, if a business person joins government, they get a once-in-a-life-time chance to sell off all of their business interests tax free. For Paulson, this was reportedly about $600M in tax free savings as he made the switch from Wall Street to the government. Apparently this is a great incentive to get top quality brains working for the government.

Agreed.

It does show you that even in melt downs, who you know and who likes you still counts.

“Thank heavens Paulson’s doing it,” says this leading investment banker, as we chatted at the St Andrew’s Ball, waiting for the next Scottish dance, Strip the Willow, to get going.

“He knows what he’s doing and this is a situation we have never seen before. He's not going to let Goldman Sachs go because it's the centre of capitalism. If that goes, the very essence of capitalism goes too.”

The banker went on to explain that in the USA, if a business person joins government, they get a once-in-a-life-time chance to sell off all of their business interests tax free. For Paulson, this was reportedly about $600M in tax free savings as he made the switch from Wall Street to the government. Apparently this is a great incentive to get top quality brains working for the government.

Agreed.

It does show you that even in melt downs, who you know and who likes you still counts.

Subscribe to:

Posts (Atom)