"My riskeist investment was into my business," says John Rothschild, CARA Operations Ltd.

Read the full article here:

The following article is a summary of a conversation with Mr. Rothschild, CARA Operations, Ltd., speaking with David Simpson, Ivey Business School, at the UBS Speakers Series, 2018. We were honoured to have John share his journey from entrepreneur to managing wealth.

|

| Phaby Utomo, John Rothschild, David Simpson, Jacoline Loewen, |

First published in The Globe and Mail, written by Jacoline Loewen.

Business owners are challenged to make decisions every day, and it is essential for them to know their risk tolerance.

“My riskiest investment was the ownership in my business,” says John Rothschild, senior vice-president of CARA Operations and former Chairman and CEO of Prime Restaurants.

Mr. Rothschild knows about risk. When the opportunity emerged to buy Prime, a family owned business in which he served as an investment manager, he decided to take on the challenge despite the unhealthy balance sheet. His friends were aghast. He had a very comfortable life and he was in a strong financial position and they questioned his decision to risk buying a questionable business. Mr. Rothschild personally guaranteed all the loans required to make the acquisition.

He offered these four ideas on how business owners can minimize their personal financial risk:

1. Plan succession early.

You’ve seen the statistics: more than two-thirds of business owners over 60 years of age don’t have an exit plan. They want to sell their businesses, but fewer than 15 per cent are able to pass them along to a family member.

After Mr. Rothschild made the transition to business owner, he had to figure out how to take money out of the company.

“I knew that passing the family business to the next generation was not in the plans and that I had to monetize the business in a different way,” he says. “We did an income trust in 2002, where shares are held by outsiders. I had bought my business with borrowed money and personal guarantees. The income trust allowed me to pay off loans and personal guarantees, and there was some money left over. Also, I still got to keep my role.”

2. When opportunities come along, be ready to take them.

Mr. Rothschild says income trusts “were a great opportunity and only came by once.” Then he was faced with another opportunity when Fairfax Financial came shopping for restaurant companies. Fairfax is a blue-chip Canadian investment firm modelled after Berkshire Hathaway, founded by Warren Buffett, where the investment company buys businesses and holds them for a long time. Fairfax offered to buy the public part of Prime Restaurants and Mr. Rothschild was invited to stay on and grow the business.

“It was a defining moment when Fairfax then invested in Cara and merged Prime into it. Prime could have stayed an independent business, but the opportunity to scale up and turn something around was tremendous. You can’t pick your exit, or the moments when these opportunities come along, necessarily. You can just say yes or no. I saw this as the opportunity to make restaurant history. We are now the third largest in Canada.”

A business owner needs to plan for the company to be ready for monetizing at any stage, Mr. Rothschild explains. He pointed out that being ready is critical. For example, tax planning in advance is essential. When the opportunity arrives, that is a bad time to be starting your tax planning.

3. Know yourself and plug the gaps.

Mr. Rothschild recognized his strengths and he was honest about his gaps. “I don’t cook, but at Prime, I get to do what I love to do every day. I would tell people not to be afraid to go into an industry where you are not the core expert. It’s about running a business.”

Going from investor to business owner and operator meant that he needed to understand how to build customer loyalty.

When asked the key to success, Mr. Rothschild says: “It’s about the people surrounding me. My team is wonderful. I also had a five-person board for Prime Restaurants and the majority were outsiders who would challenge me, otherwise I would just be talking to myself. I can't make great deals by myself. I’m a numbers guy so I plug the gaps with people who have talents beyond my own.”

4. Take money off the table.

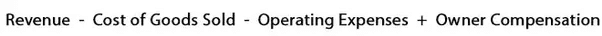

Keeping all your eggs in the one basket is risky. Business owners have the majority of their wealth invested in their own business.

The idea of having more wealth invested in what the business owners know best leads them to concentrate their wealth back into their company. This leads to concentration risk. This specific risk is the type of uncertainty that comes with the company or industry they are invested in. In the case of business owners, this is quite high.

The risk can be reduced through diversification, such as taking exposures across other industries. That is where a wealth manager becomes important.

It’s possible to diversify the long-term wealth preservation for your family by taking some money out of the business in a disciplined, mechanical way. By keeping money aside, Mr. Rothschild could handle the risks in the business, but have peace of mind by setting aside a nest egg for the family.

“I recognized that my highest risk was the business,” Mr. Rothschild says. “You do need to reinvest in the business. You do have to put money in the business or it will die. You have to manage that business on a daily basis.

"But it’s also essential to take money for your personal portfolio. I don’t have the time to manage my personal money. I choose people who I trust and they do it well. I made the effort to balance personal wealth and operating company investment. I stayed within my lifestyle, and shared the gains with those around me.”

During the conversation, Mr. Rothschild’s humble, quiet style of leadership stands out, as well as his deep concern and interest in his employees. But as an accountant, he also understands the financial factors driving the restaurant business.

“My friends thought I was crazy, as I did take on personal debt at a time when I was set up with my home and family and my career was stable."

"Buying a business was seen as financially risky but it has been an adventure worth living.”

Published in "The Globe and Mail," August 12, 2014.

Jacoline Loewen is the director of business development of UBS Bank (Canada). She has over 25 years of experience in finance for high-achieving entrepreneurs and family businesses. She specializes in the transition from business to sudden wealth from sale of a business and the impact on the Founder, their family, inter-generational wealth transfer and philanthropy. Prior to joining UBS Bank, Ms. Loewen specialized in finance, specifically sales and acquisitions, successions and private equity financing.

Ms. Loewen has authored numerous best-seller books such as, Money Magnet: How to Attract Investors to Your Business, Business e-Volution and The Power of Strategy. She is a guest columnist to the Globe & Mail and contributor to the National Post, Thomson Reuter, Profit and was a regular panellist on BNN: The Pitch. In 2018, Ms. Loewen was awarded #1 Forecast for Markets and Stocks by The Ticker Club Annual Forecast. She is ranked # 6 in the Top 100 Family Business Influencers on social media and awarded Top 50 Board Diversity. She is on a director on the Toronto Atmospheric Fund board and investment committee, Chair of the OCAD University business catalyst advisory board, as well as former director on the Private Capital Market Association board.