J.B. Loewen's

J.B. Loewen's blog about

Dragons' Den:

It’s time for another game of

Crack the Whip with

Kevin O’Leary at the head and the entrepreneur at the end.

And we were not disappointed as the Dragons’ Den show opened with Elke presenting her

Lump O’ Coal, a Christmas stocking stuffer.

Robert Herjavec thought it was cute but as Elke brought out her red Lump O’ Coal for Valentine’s, and so on, Arlene saw the flaw - Elke really had a single product for the investment opportunity.

There is only one thing that bothers Kevin—SKUs!

We’ve covered the topic of SKUs (Stock Keeping Unit) before with past

Dragons’ Den presentations; Kevin means that the cost of managing and delivering single unit orders will eat up the profits. Think shirts: If you only had one design of shirt, you can see why delivering orders of one shirt to many stores would not be cost effective. To scale up, a company needs a wider range of products to pack for each client, otherwise you will be SKUed. And with that, Kevin skewered the deal, saying, “Deep in your heart, Elke, you know

Lump O’ Coal will be a lump of you-know-what.”

Arlene tried to reason with Elke and said with a calming smile, “Cut through the harsh criticism (I’m really sorry you have to listen to Kevin) and hear the very good advice (Kevin is not such a ‘

nothing burger’, he does teach at an important Business School).”

What Arlene was trying to explain is that an equity investor needs to make returns of above 20%, but by no means is Elke in a bad business. A single, seasonal product will simply not attract investors like the Dragons, and she would be better off getting debt financing or a government loan from the EDC. Quite rightly,

Jim Treliving also respectfully advised that the company was a nice cottage industry and to keep it that way.

Single SKU companies can work and we saw this with a previous presenter – Sue and her Omega Tree Stand – who did well after fizzling at Dragons’ Den. Getting exposure on the show resulted in orders coming to Sue—landing her Canadian Tire and big-box stores high volume orders.

That doesn’t change the fact that for venture capital, the Dragons made the right decision, but thanks to Dragons’ Den, Sue got the free marketing exposure to get her phone ringing.

W. Brett Wilson, who is more used to coal as a source of energy, squinted in his tough guy way and rasped, “But why would anyone

buy a lump of coal?”

Being of Scottish descent, I know that the Lump O’ Coal comes from the tradition of having a tall, dark stranger with a piece of coal for your fireplace be the first to cross the threshold in the New Year (Fabio look-a-likes being particularly popular with the ladies of the house.)

But I digress.

Let’s get back to

Robert Herjavec, he of the matching tie and handkerchief sets, with his agreeable—almost rakish—way of chatting with entrepreneurs. It’s evident that Kevin doesn’t want to be any entrepreneur’s Facebook friend, but Robert’s warmth will soothe entrepreneurs, getting them to relax. But it was not enough to calm the nerves of the laid-off auto worker team, Jason and Leigh, as they presented their

wall calendar. Arlene, being a single mum of four children herself, knows what it is like to co-ordinate family and commiserated that a shared wall calendar sounded good but, like some Nanny 911 ideas, hard to follow through.

Indeed, Kevin wished he could fire his family for their slacker ways over schedules.

When unpacking what went wrong afterwards with

Dianne Buchner, the Den’s insightful host who adds helpful hints, Jason said the presentation was not good enough.

Ouchey! I wondered if Jason’s wife, who did the lion’s share of the presentation, was thinking, “Buddy—you’re not getting

any for the next month!

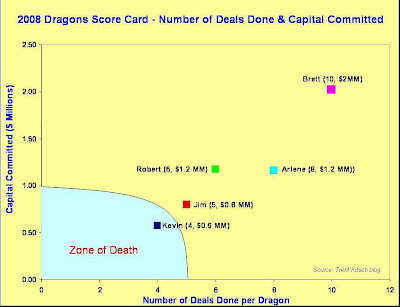

There is a great deal of ambiguity in investing and each Dragon has their style. One Dragon might love your product but another one not be remotely interested. Throughout this season, the rookie Dragon, W. Brett Wilson, has been the shining light for entrepreneurs, coming through to invest in people he sees are trying their best or with a unique product. Likewise, we see

Kevin O’Leary invest with his strict set of rules which, luckily, he teaches us.

We saw Brett do a handshake deal for a million dollars with a green energy technology entrepreneur, the big prerogative being IF

Magnacoaster passes through the due diligence process and does what the entrepreneur says it does. Then Brett returns to Moxy Trades with a reduced offer, and clinches that deal. Finally, Brett and Arlene both shake hands with the First Memories Photobook team. After all, new mums can never have enough pictures of their baby snuggle-muffins.

What happened? Two words.

Deals done.

Clearly, Brett is a Dragon ready to invest and I love the “Kaching, Kaching” noises inserted every time there’s a handshake.

Finally, up comes a magic show,

Illusions Dinner Theatre - would Brett sign up another entertainment act? Would we see more of Big Jim’s smooth dance moves which rival the Four Tops? To the bemusement of all, Robert volunteered for the magic act. Whoa! Robert, what were you thinking? By that stage, had the entrepreneur, Don, already sensed the deal was not happening? He could have been planning a horse’s head under Kevin O’Leary’s bed. Now you’re going to let him stick knives in your head?

Repeat: Knives and Dragons are a dangerous mixture—especially when the entrepreneur may be unhappy with the “no investment” decision.

Again, the Dragons enjoyed Don’s talent show but real estate financing is not the typical type of deal that equity investors do. As Big Jim advised, “It was a great show but cabaret acts last twenty months. Get to a bigger place, like Vegas, and don’t get saddled with real estate.”

And that’s all folks.

I’m sure you will agree that Dragons’ Den has succeeded in pulling back the curtain of mystery to reveal what are the features of a business every entrepreneur must be able to discuss with a potential investor. The Den is a gateway into how to be a great entrepreneur and, if you watch the whole season on the website, it’s an MBA course in Entrepreneurship 101—minus the school fees. Many of the presenters asking for investment dollars in the Den are Creative Achievers—people who do not fit the traditional management career track, who take risks and who change the world a little or a lot. Probably all of the Dragons fall into this category. None of this season’s presenters need bother with an MBA, and with Dragons’ Den giving many a jump start, they will be phenomenal.

Kudos to CBC for creating the Dragons’ Den website with the Forum where fans can blog. I think it has elevated the level of transparency and trust – a boost for the CBC brand. Also, the updates on companies from the show as they begin to blossom with a little help from their Dragon investors, is proving to be a terrific platform for Canadian enterprise. We can find out more about

EcoTraction, for instance, which reminds me to buy the eco-salt for my doggy’s paws, as well as anything sporting the Dragons’ Den logo. The CBC showcases how an investor might work for your company by cross-selling products. Quicksnap goes to Afghanistan with CDs of a Canadian country singer who also wears

Hillberg and Berk jewellery. Here you see three products, two from Dragons’ Den, being cross-marketed in a compelling way.

Watching the video of Quicksnap in Afghanistan though, with the enthusiastic Afghanistan gentleman enjoying the music, was the best Christmas present for me this year, bringing tears to my eyes. That is the true heart of business.

Before I get too schmaltzy, better close.

Dragons’ Den is my (and I suspect for a lot of you too) weekly passion. Now, as the season draws to a close, what are we going to do? Here’s an idea—the CBC has taken a leaf out of the play book of Gene Simmons’ success with KISS, by marketing the band of Dragons. I recommend wearing your favourite Dragon T-shirt to do your grocery shopping on a Saturday morning; it will probably improve your dating odds. Can you see it now—Arlene bumps into Big Jim in the tofu aisle.

I’ve said it before but even Kevin will agree Dragons’ Den is a great use of our tax payer

moneeeeeeeey.

See you on January 11th.

Private equity and debt deal of the century ends. See the full story here.

Private equity and debt deal of the century ends. See the full story here.