There are millions of private equity dollars out there looking for good businesses and smart owners. Even if you think your operation is not up to snuff—perhaps it’s not large enough, making too little profit, or employing too few people—you may be surprised how highly others value it.

I can say this because in my experience, I have often been astonished at which businesses are liked and coveted by investors—yes, even those that are not currently profitable.

McGregor Socks, a long serving Canadian company is such a case. After struggling to adapt to the fast changing global market, McGregor knew it needed to add China as a destination for knitting up Canadian-designed creations. It was a private equity fund that put up the money since they already had experience in China. Bringing in partners is a difficult transition but with supportive investors, an excellent Canadian brand continues to fill store shelves (look for a pair of McGregor’s the next time you need socks).

Jacoline Loewen is a contributing author to Peter Merrick's book, The Trusted Advisor's Survival Handbook.

Wealth Management

Voted #6 on Top 100 Family Business influencer on Wealth, Legacy, Finance and Investments: Jacoline Loewen My Amazon Authors' page Twitter:@ jacolineloewen Linkedin: Jacoline Loewen Profile

May 13, 2009

May 12, 2009

6 Reasons to Read Money Magnet: Attracting Investors to Your Business

I just finished reading Money Magnet. Thank you for writing/recommending it! The information you shared will save me a lot of time instead of reinventing the wheel. I like reading materials from people like you who can share specific industry insight (eg. when you described what VC Rick wants to see in slides). Some of my key takeaways include but are not limited to the following:

- Targeting qualified investors based on their mathematical fit and specifically asking them to clarify their full criteria

- How to be investor ready/the legacy investor concept.

- An investors’ protection/clauses (ensuring that I negotiate unnecessary ones).

- Knowing common pitfalls/key criteria investors like

- Ensuring that I answer the 4 investor-ready questions and

- Investor-friendly methods of structuring a presentation

May 11, 2009

May 5, 2009

5 Questions Board Directors Can Learn From Private Equity

If Private Equity gets involved with a company, as either a minority partner or over 50% ownership, there are usually five major thrusts of reform.

These translate into five key questions that directors should pose to senior management and expect a thoughtful analysis in response. If you are a Board Member, take note and try asking them at your next Board meeting:

1. Have we left too much cash on our balance sheet instead of raising our cash dividends or buying back our own shares?

2. Do we have the optimal capital structure with the lowest weighted after-tax cost of total capital, including debt and equity?

3. Do we have an operating plan that will significantly increase shareholder value, with specific metrics to monitor performance?

4. Are the compensation rewards for our top executives tied closely enough to increases in shareholder value, with real penalties for nonperformance?

5. Have our board members dedicated enough time and do they have sufficient industry expertise and financial incentive to maximize shareholder value?

Jacoline Loewen is a partner with Loewen & Partners and has been a Board Member for Bilingo China, Innovation Exchange, The Women's Post, Strategic Leadership Forum and more.

These translate into five key questions that directors should pose to senior management and expect a thoughtful analysis in response. If you are a Board Member, take note and try asking them at your next Board meeting:

1. Have we left too much cash on our balance sheet instead of raising our cash dividends or buying back our own shares?

2. Do we have the optimal capital structure with the lowest weighted after-tax cost of total capital, including debt and equity?

3. Do we have an operating plan that will significantly increase shareholder value, with specific metrics to monitor performance?

4. Are the compensation rewards for our top executives tied closely enough to increases in shareholder value, with real penalties for nonperformance?

5. Have our board members dedicated enough time and do they have sufficient industry expertise and financial incentive to maximize shareholder value?

Jacoline Loewen is a partner with Loewen & Partners and has been a Board Member for Bilingo China, Innovation Exchange, The Women's Post, Strategic Leadership Forum and more.

May 4, 2009

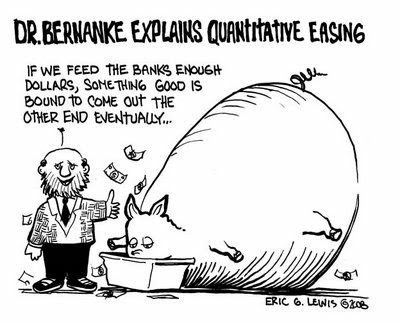

US Debt May Crowd Out Private Investment

Deficits are a way for governments to use tax payer money and public spending to stimulate the economy when private demand is weak. This works as long as a country closes its deficit and pays back its borrowings after its economy starts to recover.

The trouble is that government borrowing risks crowding out private investment, driving up interest rates and potentially slowing a recovery still trying to take hold. That is why the American Federal Reserve announced an extraordinary policy this year to buy back existing long-term debt — $300 billion over six months — to drive down yields. The strategy worked for a while, but now the impact of that decision appears to be wearing off as long-term interest rates tick up again.

Then there is the concern that the interest the government must pay on its debt obligations may hurt future generations. The Congressional Budget Office expects interest payments to more than quadruple in the next decade as Washington borrows and spends, to $806 billion by 2019 from $172 billion next year.

GRAHAM BOWLEY and JACK HEALY report in the Wall Street Journal, May 3, 2009: “You’re just paying more and more interest and having to borrow more and more money to pay the interest,” said Charles S. Konigsberg, chief budget counsel for the Concord Coalition, which advocates lower deficits. “It diverts a tremendous amount of resources, of taxpayer dollars.”

Of course, no one is suggesting the United States will have problems paying the interest on its debt. On Wednesday, even as it announced its huge financing needs for the latest quarter, the Treasury said financial markets could accommodate the flood of new bonds. “We feel confident that we can address these large borrowing needs,” said Karthik Ramanathan, the Treasury’s acting assistant secretary for financial markets.

One worry, however, is that there are fewer eager lenders to buy all that American debt. Most of the world is in recession, and other nations have rising borrowing needs as well. As other nations’ surpluses turn to deficits, America will face competition in global financial markets for its borrowing needs. For the moment, the United States is actually benefiting from a flight to quality into Treasuries brought on by the global financial crisis, which helped reduce rates to record lows this winter. But the influx will not continue forever.

China has lent immense sums to the United States — about two-thirds of its central bank’s $1.95 trillion in foreign reserves is believed to be in United States securities — but it has begun to voice concerns about America’s financial health.

To calm nerves and fill the deficit hole, the government is getting creative. The Treasury is ramping up its auction calendar, holding more frequent sales of government debt and selling the debt in expanded amounts. It is now holding sales of its 30-year bond each month, up from four times annually.It is also resuscitating previously discontinued bonds, such as the seven-year note and the three-year note, to try to mop up any available money all along the yield curve. There is even talk of issuing billions of dollars of a new 50-year bond, though the idea has not won official approval

The trouble is that government borrowing risks crowding out private investment, driving up interest rates and potentially slowing a recovery still trying to take hold. That is why the American Federal Reserve announced an extraordinary policy this year to buy back existing long-term debt — $300 billion over six months — to drive down yields. The strategy worked for a while, but now the impact of that decision appears to be wearing off as long-term interest rates tick up again.

Then there is the concern that the interest the government must pay on its debt obligations may hurt future generations. The Congressional Budget Office expects interest payments to more than quadruple in the next decade as Washington borrows and spends, to $806 billion by 2019 from $172 billion next year.

GRAHAM BOWLEY and JACK HEALY report in the Wall Street Journal, May 3, 2009: “You’re just paying more and more interest and having to borrow more and more money to pay the interest,” said Charles S. Konigsberg, chief budget counsel for the Concord Coalition, which advocates lower deficits. “It diverts a tremendous amount of resources, of taxpayer dollars.”

Of course, no one is suggesting the United States will have problems paying the interest on its debt. On Wednesday, even as it announced its huge financing needs for the latest quarter, the Treasury said financial markets could accommodate the flood of new bonds. “We feel confident that we can address these large borrowing needs,” said Karthik Ramanathan, the Treasury’s acting assistant secretary for financial markets.

One worry, however, is that there are fewer eager lenders to buy all that American debt. Most of the world is in recession, and other nations have rising borrowing needs as well. As other nations’ surpluses turn to deficits, America will face competition in global financial markets for its borrowing needs. For the moment, the United States is actually benefiting from a flight to quality into Treasuries brought on by the global financial crisis, which helped reduce rates to record lows this winter. But the influx will not continue forever.

China has lent immense sums to the United States — about two-thirds of its central bank’s $1.95 trillion in foreign reserves is believed to be in United States securities — but it has begun to voice concerns about America’s financial health.

To calm nerves and fill the deficit hole, the government is getting creative. The Treasury is ramping up its auction calendar, holding more frequent sales of government debt and selling the debt in expanded amounts. It is now holding sales of its 30-year bond each month, up from four times annually.It is also resuscitating previously discontinued bonds, such as the seven-year note and the three-year note, to try to mop up any available money all along the yield curve. There is even talk of issuing billions of dollars of a new 50-year bond, though the idea has not won official approval

Subscribe to:

Posts (Atom)