Wealth Management

March 8, 2009

Triple Whammy - stock market, banking, real estate

I think we would all agree.

A reasonable question to ask is why banks and dealers, as well as investors, never learn from previous financial crisis. If you look back over the past 150 years, booms and busts and financial crises occur with depressing regularity – almost like clockwork.

Ton Fell often said, if your country hasn’t had a banking or financial crisis in the past decade, just wait – one will be coming shortly.

There was a major banking crisis in the U.S. in the late 1870s following an incredible railroad boom. The U.S. Federal Reserve was created in 1913 following a series of bank crises and runs on deposits.

And then, of course, we had the stock market crash in 1929 and the Depression. This was followed in 1934 by the establishment of the Federal Deposit Insurance Corporation in the U.S. to protect depositors and the Securities and Exchange Commission to protect investors.

Crises over the last seventy-years have been less severe, although I can tell you they seemed, and were, very serious at the time.

The LDC banking crisis in 1982 – the Canadian Bank Stock Index fell by 42%.

The U.S. Savings & Loan crisis in the late 1980s when 2,000 S & Ls went out of business – U.S. bank shares fell by 45%.

Until now, the all time high water mark for massive market and business excesses in living memory was the breaking of the Japanese bubble in 1989. While this crisis was confined to Japan, it is the second largest economy in the world so it was big.

This was a triple whammy. A stock market bubble, a banking bubble and real estate bubble all wrapped up in one. When the bubble burst many banks and insurance companies were forced to merge, restructure or were bailed out by the government. The Japanese bank stock index topped out just after Christmas 1989 and dropped by 45% in just the first year but eventually declined by 91%.

(I call that a bear market)

It is of interest that, even now, the overall Japanese stock market, as measured by the Nikkei Dow, is 80% below where it was twenty years ago. The Japanese crisis lasted more than a decade and total losses were estimated at about $750 billion.

Finally, in the late 1990s we had the incredible telecom and internet bubble which broke in 2000. We can all remember this - you know, when Nortel had a market cap of over $350 billion.

The late 1990s was a period of wild investor hysteria.

It was a true feeding frenzy with the Nasdaq tripling in less than two years and IPOs doubling and tripling on the first day of trading.

As always, the bubble broke, the Nasdaq Stock Index declined by 77% over the next three years with the bankruptcy of Enron, Worldcom being two of the biggest in American history.

That crisis brought us Sarbanes-Oxley.

When you look back on all these cycles, a central question is “why do we have to go through constantly recurring market and business bubbles.

Kindleberger, the late MIT historian, is well known for his 1978 book “Manias, Panics and Crashes” which traces four centuries of booms and busts.

Cycle after cycle the similarities are striking. It all gets back to;

- over-optimism and herd mentality

- greed in the financial business

- excessive leverage

- borrowing short and lending long

- flawed financial innovation and

- regulatory failure

(usually all wrapped up with a good dollop of fraud and corruption)

Those who don’t learn from the mistakes of history are doomed to repeat them and that’s why we are here again – one more time.

March 7, 2009

5 Reasons Canada is Better Off than the USA

Second, the national retail banking franchises of the Canadian banks provides them with a strong and stable funding base, less dependent on volatile wholesale funding. This is a huge asset in difficult times.

Third, we have benefited in Canada from a strong regulatory framework. Our banks are the most conservatively capitalized in the world.

Fourth, in Canada we have kept tighter control of our residential mortgage market.

Fifth and final, I believe Canada’s financial institutions have been inherently more risk averse than those in the U.S. and Europe.

Less cowboy capitalism and less bet the bank mentality. This more conservative approach over the years has served us well.

March 6, 2009

CVCA Portfolio Management

- Cash flow "Quick Hits": Dial back growth; Focus on streamlining direct costs as opposed to SG&A; Aggressively manage working capital

- Very rarely are cuts too deep - need to react to current environment quickly and prepare for the worst - revisit downside case

Clearly, we are operating in very difficult and uncertain times. That being said, there was a general consensus that good deals will get done in 2009.

CVCA Valuation & Structuring

- For the most part, there is not widespread acceptance of the "new world" amongst sellers - deals getting done are when sellers are distressed

- Lack of transaction comps post Fall 2007, significantly deteriorating current trading and lack of visibility through 2009 make valuation incredibly difficult - greater emphasis on diligence

- To mitigate valuation concerns, recent transactions have seen a greater emphasis on earn outs and vendor take backs - trend will likely continue

- Most interesting opportunities have a restructuring angle - need to structure for the downside case.

CVCA Market Update

Market Update

PE deal activity has been crippled by significant expectation gaps between buyers and sellers and a lack of financing

- Current baseline LBO structure for a "middle of the fairway" business - EV: 5.0-6.0x EBITDA; Total debt: 2.0-2.5x EBITDA

- Shift towards smaller deals - Larger US sponsors are looking at equity tickets in the region of US$200m

- 2009 has seen positive inflows into leveraged loan and high yield funds marking a potential return to mainstream lending

- Increasing number of GP's are returning LP commitments and/or reworking terms - fundraising market is limited, although there is demand for distressed/turnaround funds

- Increasing number of mid market US sponsors looking North to Canadian carve outs and/or distressed situations

- 2007/2008 funds will make for some of the best vintages given unprecedented buying opportunities

The ongoing global, banking, financial and credit crisis

At their latest fiscal year-end, our five major banks had total assets of $2.5 trillion of which almost one trillion was outside of Canada.

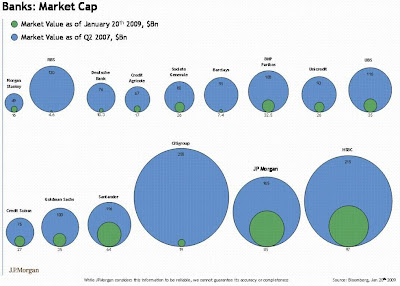

In terms of market capitalization the five Canadian banks headquartered in Toronto all rank within the top 35 in the world.

So Toronto is an important banking centre and, if we play our cards right, it’s going to become more so. While Canadian banks have received some shocks from this crisis, on a relative basis they have done well.

Last year total write-offs by financial institutions around the world were in excess of $1 trillion and Canadian banks accounted for less than 1.4% of this total. Canadian banks are in a stronger position than what we see south of the border or in Europe.

March 5, 2009

Blackstone cashed out at the right time

the listing of the private equity group could be the turning point inAn interesting dilemma for both China and the U.S.: read here.

financial history; one that will shape the world that emerges

from the current crisis: the moment when China really began to question its deep

financial entanglement with the US.

Jacoline Loewen, author of Money Magnet, says, "Blackstone cashed out at just the right time."

This article gives a glimpse of the dilemma facing both US and China with regard to their currencies and the management of growing debt on the US side versus the growing surplus on the Chinese side. The essence of this growing dilemma is highlighted in the following quote:

"US Treasuries are the safe haven; it is the only option," said Mr Luo. "Once you start issuing $1-$2 trillion . . . we know the dollar is going to depreciate, so we hate you guys, but there is nothing much we can do."

Chinese investors are now the biggest foreign holders of US Treasuries with nearly $700bn. In total, foreign investors own about $3,000bn or more than half of all US Treasuries publicly available. The fact that the US is still somewhat considered the only true safe haven would explain why the US Dollar still remains relatively strong against all other major currencies. However, it also shows the precarious situation the US may face in the very near future. In order to continue to be able to find buyers for the growing US debt mountain, something has got to give. If the US$ were to depreciate, foreign investors would need to be incentivized with significantly higher yields on US treasuries.

Inflation will be a debtor's best friend and a creditor's worst nightmare.

Causes of the Crisis

With so much government involvement and government ownership of big banks in both the U.S. and the U.K., we won’t know the full impact of all of this for a decade.

The stock market impact has been significant.

- the Standard & Poor’s diversified bank stock index is down 72%

- the financial index is down 76% and

- the insurance composite index is down 72%

The TSX Bank Stock Index is only down 50% - isn’t that wonderful – (we have outperformed).

I am not going to dwell on the causes of this crisis because they have been extensively and well covered in the press.

They include;

- Major public policy failure in the U.S. in the housing area.

- Far too low interest rates and easy credit under Alan Greenspan.

- Failed financial innovation on a massive scale.

- Almost complete regulatory failure in the U.S., U.K. and Europe – it was the age of deregulation.

- Total rating agency failure - - for the tenth time and

- Finally, too much leverage everywhere you look.

You could write a book on each of the above but I think Money Magnet - my latest book - will be one to help business owners understand how to access new money now that the banks are being restructured.

March 4, 2009

Succession Planning Family Business is a Nightmare on Elm Street

If so many jobs, so much wealth wasn't collateral damage when a family business is gifted, watching them pass to the next generation would continue for some to be the best theatre ticket in town.

But lenders and their shareholders aren't laughing as the single largest generational transfer of wealth begins in less than ideal economic circumstances.

If the questions that a family can ask themselves to protect their wealth weren't so simple, the impending destruction of so much wealth wouldn't be so sad.

On this point there is no debate -- at least not for me. Having watched three generations of my family start and sell their businesses instead of gifting them, the next generation has always been free to pursue their own great big idea.

Tom Deans, Author, Every Family's Business: 12 Common Sense Questions to Protect Your Wealth. www.ProtectingFamilyBusinessWealth.com

March 2, 2009

Does a Family Business Mess up the Next Generation?

Founders who gaze upward and utter the phrase "(insert company name) will always be family owned" are either delusional, narcissistic, or neither and just really get a charge out of messing with the heads of their children who lust for stuff -- free stuff.

I think most founders know that the businesses they gift are anything but easy to receive --are anything but easy to operate and sell.

The founders who gift businesses may indeed dish out what junior really deserves.

The profile of the spendthrift child with no discernible work ethic is well documented in popular culture and usually on display in Toronto at the Four Seasons in Yorkville most afternoons.

Tom Deans, Author, Every Family's Business: 12 Common Sense Questions to Protect Your Wealth. www.ProtectingFamilyBusinessWealth.com

March 1, 2009

Sell Your Family Business, Don't Gift It

So if gifting is out selling is in.

But with more sellers than buyers the inclination of throngs of aging business owners will be to wait out this down cyle and sell the business later when they are really ready to retire --you know when they are in their 80's and junior is hitting his prime in his 60's.

Truth be known little in the way of succession planning has ever been done to transfer businesses intelligently.

The script usually unfolds with the business owner dying and the stock rolling to the surviving spouse. It's like a bad movie-- it's Friday the 13th but with more family drama and bloodletting --especially when you roll in some sibling rivalry, add a dash of liquidity crisis family business style when the taxman comes knocking to collect capital gains or estate taxes.To all the founders reading this --here's my message. Offer to sell your business to your kids. If they don't want to buy it, put in place a compensation package for them to help you sell it to someone else. I know that selling the family business can feel like selling family but nothing could be further than the truth when a founder aligns the economic interest of all family members. I have a sneaky feeling that when parents put in place these compensation plans for their children, the love of pursuing the longevity of their family firm will fizzle and fizzle fast (the bigger the comp package the faster the fizzle).

Tom Deans, Author, Every Family's Business: 12 Common Sense Questions to Protect Your Wealth. www.ProtectingFamilyBusinessWealth.com

February 28, 2009

The Next Crisis - Family Businesses

It occurred to me that the sub-prime and resulting liquidity crisis is nothing compared to the much bigger bomb ticking away in family businesses big and small.

My prediction is that if the banks don't begin to press harder for evidence of real succession plans, the $10 trillion sitting in the retained earning of North American family businesses will dissappear faster than you can say Lehmann Brothers sell Lollipops by the Sea Shore.

When I say "real succession plans" I mean evidence that gifting the family business to junior isn't the plan. Gifting an operating business to dis-interested, ill-prepared, incapable hands of family is not going to cut it with lenders, shareholders, customers or employees.

by Tom Deans, Author, Every Family's Business: 12 Common Sense Questions to Protect Your Wealth. www.ProtectingFamilyBusinessWealth.com

February 25, 2009

Creative capitalism means private equity

Bill Gates is frustrated. He spoke about world poverty publicly with Warren Buffet at the last Davos conference and the conversation is now to be found in a book, but with the addition of economists weighing in with their views on the subject which makes for interesting reading.

Bill Gates is frustrated. He spoke about world poverty publicly with Warren Buffet at the last Davos conference and the conversation is now to be found in a book, but with the addition of economists weighing in with their views on the subject which makes for interesting reading.Gates and Buffet both spoke about creative capitalism which means companies that are not just working for their own dime but think far wider than that. For example, I did a project in South Africa for the largest mining company creating a data base of one person “businesses” near to the mines. The mine then hired these people on contract basis for cleaning, typing or temping services in order to support the community through work, not a hand out. People had purpose and money for work. The mine did not need to work in this more fragmented and unpredictable way, but they wanted to help the community.

One if the contributors, Larry Summers, is now an advisor to Obama who cautions this concept of creative capitalism and prefers to let companies pursue their own purpose. Summers cites Fannie Mae and Fannie Mac as a “really good creative capitalism idea” that did not work.

Perhaps Gates and Buffet are onto something says Economist Paul Ormerod who sees creative capitalism as buttressing the legitimacy of democratic capitalism against authoritarianism in China. Private equity is trying to improve its image and are early up-takers of this concept.

Creative is the second name for most Americans. Already, there have been thousands of get-togethers held across America to discuss the health care situation. Obama’s website gave a few starter discussion sheets and suggestions on how to organize each party. The answers to questions were sent back to the White House. There are naysayers, likening this movement to Tupperware parties, but people could add their own material and speakers.

Discussion educates and encourages people to see more than one side. Creative capitalism certainly creates integrity and Bill Gates and Warren Buffet have started this interesting conversation.

February 24, 2009

Does gifting a family business destroy it?

With a large number of family businesses operating in North America, the idea that gifting a business to the next generation is mainstream thinking.

At a debate held by the Family Firm Institute in Toronto, Tom Deans was brave enough to contradict the wisdom of the masses. As the son in a second generation business, Tom went through the experience of joining a family firm and working hard to achieve a dream. Tom details the difficulties of conversations not had and questions not asked by family members destroys the family in the long run. In his best selling book, Every Family’s Business, Tom advices that every business should have a plan to sell.

During the debate, Tom explained that if both generations know there is a sale time and what the economic benefit will be for them, the trust will be high.

Trusted advisors need to understand that families shy away from these difficult conversations but that they could help. Using Tom’s 12 questions listed at the back of his book, every trusted advisor could be helping family businesses create the wealth that both generations deserve.

February 23, 2009

Can companies pursuing their own purpose achieve more?

I was at the Liberty Grand (with a thousand other people) as guest speaker. I was to talk about Meaghan’s Walk, which has raised nearly $1 million dollars for brain research at Sick Kids’ Hospital, Toronto, including $50,000 by TD Waterhouse. CTV was there to film the event and I was worried I would be caught on TV, struggling to finish my speech, caught up in the emotion of how the fund raiser began.

Meaghan’s Walk was created by Dennis Bebenek, who lost her five year old daughter to brain cancer but wanted to make this tragedy into something positive, and so she created a walk and fundraiser for Sick Kids' Hospital.

As Dr. Eric Bouffet spoke about how, as he phrased it, seed money from Bebenek’s efforts had been used for research that would not have happened otherwise, it became clear that medicine also needs its private equity, higher risk money. Dr. Bouffet emphasized that the money raised meant ideas that were not as main stream were researched and with good results. Bebenek’s drive to pursue her purpose for her daughter’s memory has achieved far more than government funding alone.

February 17, 2009

Cash for Happiness

Ari Gold, of HBO's Entourage, once said, "Nobody is happy [...] except for the losers. Look at me, I'm miserable, that's why I'm rich". Though I tend to agree with Ari, a new study by the University of Pennsylvania's Wharton School of Business and published by Economist.com disputes Ari's quip on success.

February 16, 2009

Private investment in Sports continues to thrive

Although Mr. Petty, CEO of Toronto's Maple Leaf Sports & Entertainment private company, did not know how the Fall 2009 ticket sales would go, seems as if sports is one place that still has profits.

Although Mr. Petty, CEO of Toronto's Maple Leaf Sports & Entertainment private company, did not know how the Fall 2009 ticket sales would go, seems as if sports is one place that still has profits. Does privacy pay off for private equity?

One of the criticisms of private equity is its secrecy or as the fund managers may prefer to say, "Their below the radar approach." Privacy is why some owners choose to raise capital from private investors rather than expose themselves to the scrutiny and criticism of the public market. This approach certainly works for Maple Leaf Sports & Entertainment Ltd. (MLSE).

One of the criticisms of private equity is its secrecy or as the fund managers may prefer to say, "Their below the radar approach." Privacy is why some owners choose to raise capital from private investors rather than expose themselves to the scrutiny and criticism of the public market. This approach certainly works for Maple Leaf Sports & Entertainment Ltd. (MLSE).- 20.5% – Kilmer Sports Inc. owned by Larry Tanenbaum. (Their boardroom boasts the biggest collection of basketball sneakers in the biggest sizes I have ever seen.)

February 12, 2009

Multiple Mayhem

February 10, 2009

Oh, Canada

February 9, 2009

Business owners like the long view

"One of the reasons business owners are preferring private equity," says Jacoline Loewen, author of Money Magnet, "Is they appreciate that the investors go in for five years. It sure feels better than the short term view of shareholders in the public market who bale as soon as they see anything slightly off."

"One of the reasons business owners are preferring private equity," says Jacoline Loewen, author of Money Magnet, "Is they appreciate that the investors go in for five years. It sure feels better than the short term view of shareholders in the public market who bale as soon as they see anything slightly off."Long term trends are difficult to remember for investors in public markets.

This is an interesting chart as you can see we are still 5% above the trend line. Yet the public market ignored job loss information that came out last week, and ended up higher by Friday probably due to wishful thinking.

Private equity is in stark contrast to this short term thinking demonstrated in the public markets. Five years with a company before taking back the money is the shared goal. Think how this long term approach by shareholders helps business owners during these times.

One of the top fund managers at my secret handshake club said that these are historic times and our children will read about them. Now that is long term thinking.

February 6, 2009

Mining likes investing in Africa

Africa ain't for the faint hearted. Despite the harsh environment, and clash of cultures, Canadian mining companies are making huge advances.

Africa ain't for the faint hearted. Despite the harsh environment, and clash of cultures, Canadian mining companies are making huge advances.The time when Canada's presence on the African continent was primarily characterised by numerous missionaries and food donations is well and truly over! In countries such as Congo, Mali and Tanzania, when it is learned that you are from Canada, Denis Tougas says you are immediately asked if you work for the ‘mining’, a perception entirely consistent with reality.

Canada is now dominant - in fact, some say superpower - in the African mining sector, a position the country intends to maintain and develop using all means at its disposal.The salient presence of Canadian mining is relatively new in Africa and is rooted principally in the programmes of liberalisation of the sector from the early 1990s. These programmes have been driven by the World Bank, which from 1992

(1) had begun defining the extractive sector as the main engine of development for many countries.

(2) The privatisation of state enterprise – promoted as a means of encouraging the entry of foreign investment – has opened the door to foreign companies. At the head of this development, especially with regard to the smaller exploration companies known as ‘juniors’, are Canadian companies. These companies have an immense commercial presence in Canada: of the 1,223 mining companies listed on the Toronto Stock Exchange, the largest in the country, more than 1,000 are juniors!

(3)A HUGE EXPANSION

Currently, according to the Ministry of Natural Resources Canada (NRC), only the Republic of South Africa, with over 35% of assets and investments, is just ahead of Canada in the African mining industry. But with South Africa’s assets concentrated on its own territory, Canada dominates the rest of the continent.The data compiled by the NRC demonstrates the speed with which the value of Canadian mining assets in Africa has grown over the last twenty years: at US$ 233 million in 1989, this figure grew to $635 million in 1995, and $2.8 billion in 2001, growing further to $6.08 billion in 2005, and $14.7 billion in 2007.(4) This total value is estimated to reach $21 billion by 2010.

Read more...

Thank you to Michael Power for the referral to this article.

February 5, 2009

Does mean marketing grab market share?

February 4, 2009

Does an experienced partner win private equity more?

The quality of your partner counts big time. In the case of entrepreneurs seeking capital from Venture Capitalists, nothing helps more than having a partner with past success.

The quality of your partner counts big time. In the case of entrepreneurs seeking capital from Venture Capitalists, nothing helps more than having a partner with past success.Q: Was there anything in your findings that surprised you?

A: The size of the effect of past success was surprising. We know that there was likely to be some degree of performance persistence, but the magnitude was quite striking.

Q: Given the current economic conditions, do you have any advice for entrepreneurs who are considering launching a new venture at this time?

A: Certainly one lesson that emerges from our analysis is to find an experienced (and successful) partner! Given the very difficult investment conditions, venture investors are paring back their portfolios and are hesitant to make new commitments. To get serious consideration, the more that you can do to seem like a "sure thing," the better off you are.

More generally, being as careful as you can be with resources, and flexible.

The Big Mac Index

Definition from Wikipedia:

A popular derivative of the PPP concept is the Big Mac Index, developed by The Economist Magazine. The Index is based on the notion that a dollar should buy the same amount in all countries and that in the long run; the exchange rate between two countries should move towards PPP rate and hence moves the prices of the same goods for each country towards equilibrium.

The Economist just published the latest Big Mac Index on January 22nd:

February 3, 2009

That would explain why US markets faired relatively better than India, China and other countries of the developing world who seemingly ended up lower down the chain in this massive pyramid scheme.

Here's a link to George Soros discussing his trading philosophy and how he did so well in 2008 relative to the rest of the world - drink your strong coffee before you read it.

February 2, 2009

David Rubenstein at Davos

Will inflation hit private equity?

This is a copy of an old 10 Billion Mark coupon.

This is a copy of an old 10 Billion Mark coupon.Ponder this extraordinary piece of paper (which is obviously no longer is in circulation). Use it as a reminder of the hyper-inflation of the 1920s in Germany. In those days, these sums were the cost of daily groceries.

Certain early childhood experiences stay with you forever and some of these can impact the way you look at money and finances. In my case, I've always been weary about the hidden loss of value from inflation due to my upbringing in Zambia and Zimbabwe. So, yes, the 1920s were very different times which hopefully never come back. But with the current economic climate, particularly in the epicenter of leverage and deficit spending i.e. US government and households, we should never loose sight of the danger of inflation.

Look no further than Zimbabwe where in 2008, a loaf of bread cost 1.6 trillion Zimbabwe Dollars. In short, various prices have come down and quite rightly so are now at much more realistic levels, but we should fear inflation much more than deflation.

Private equity has cash but is not coming into the market at valuations business owners want. This dance will continue for 2009.

Where Do I Get Money?

"CYBF is a terrific place for young entrepreneurs to begin their journey," says Jacoline Loewen, author of Money Magnet. "CYBF will take entrepreneurs through the steps to managing their money and also help out with a mentor."

Listen to more on the radio show Small Business, Big Ideas.

January 28, 2009

Now You're Talking, Stephen

Stephen Harper's Conservative government recognizes the value of CYBF.

“Canada has no shortage of young people ready and willing to defy the current doom and gloom. This grant from the Government of Canada will let us increase dramatically the number of business start-ups that we can finance and support through our partners in more than 150 communities across the country,” said Vivian Prokop, CEO of the national charity.

“I would like to thank in particular Industry Canada, Industry Minister Tony Clement, and Minister of State for Small Business and Tourism Diane Ablonczy for their enthusiasm in nurturing a culture of entrepreneurship at a time when Canada needs it most.”

While access to business credit is tight and unemployment is rising, the demand for the CYBF’s financing and mentoring services continues to grow. The number of CYBF-funded start-ups from October 2008 through January 2009 was 68 percent higher than during the same period in 2007, and the Government of Canada’s investment will enable CYBF to meet this growing demand and accelerate its pace of lending.

An estimated 20,000 young people want to start businesses every year but find it difficult to obtain financing through traditional sources. CYBF offers an experienced volunteer mentor and a loan of up to $15,000 with no collateral. Qualified applicants can access a further $15,000 through a partnership with the Business Development Bank of Canada.

The one-year grant will provide much-needed stimulus in communities from coast to coast, enabling the launch of an estimated 800 new businesses within 5 years. Based on the performance of CYBF clients to date, these businesses will generate an estimated 5,000 new jobs, $135 million in sales revenue and $32 million in tax revenue within 5 years

Snapshot of Canada's 2009 Budget

Thanks to Scott Tomenson, Wealth Management Consultant, for providing us with this link. Read.

Visit Scott at http://familywealthmanager.blogspot.com/

January 26, 2009

Business owners need private equity

Entrepreneurs and business owners would like Frank McKenna - the fellow who was put forward to head the Liberal Party, but who sadly declined.

Entrepreneurs and business owners would like Frank McKenna - the fellow who was put forward to head the Liberal Party, but who sadly declined.I was at my Secret Handshake Bay Street Club - The Ticker Club - where Frank McKenna was the guest speaker and he blew the roof off with his dynamism. Coming from New Brunswick, Frank is prgamatic and gets the role of the manufacturing and other technology businesses in building a strong Canada.

He said, "We need to expand our thinking around innovation from just pumping oil to other countries. We need to be the best at the supporting manufacturing, equipment, technology and service busineses around oil. The same goes for forestry."

"Sounds great but the reality is tough. Many of those types of companies suggested by McKenna are potential clients for Loewen & Partners' services - raising capital for owner managed companies," says Jacoline Loewen, author of Money Magnet. "The problem is that these companies do need to get to be over $100M to survive in the global market. It is very difficult for these companies to do this on their own. Yet, many of these owners do not understand or trust private equity, their ideal partner to grow their companies."

http://www.moneymagnetbook.ca

$1 Trillion and Counting...

Astoundingly, and possibly incomprehensible to most, London based Private Equity Intelligence reported this month that Private Equity Funds raised the second highest level of annual funding in 2008. Approximately $1 Trillion of capital is currently ready to be deployed. Only a quarter of this was raised by large buy-out funds, though this amounts to $284.2 billion last year, about the size of Ireland's GDP. The rest was raised by funds with other focuses, such as real estate funds ($153.5 billion) and funds focused on SMEs, 217 funds raised money in this category, the most of any other.

Astoundingly, and possibly incomprehensible to most, London based Private Equity Intelligence reported this month that Private Equity Funds raised the second highest level of annual funding in 2008. Approximately $1 Trillion of capital is currently ready to be deployed. Only a quarter of this was raised by large buy-out funds, though this amounts to $284.2 billion last year, about the size of Ireland's GDP. The rest was raised by funds with other focuses, such as real estate funds ($153.5 billion) and funds focused on SMEs, 217 funds raised money in this category, the most of any other. However, this news may seem counterintuitive to the news released today, that 50,000 jobs were lost in the U.S. in one day. Coping with the shock is likely on the mind of all of 50,000 newly minted unemployed. However, to fund managers with bulging war chests, the wait is on to discover the bottom. With asset prices falling, demand slumping, and credit inaccessible for most, fund managers are in a very comfortable position to deploy the tremendous amount of cash at their disposal at the plethora of deals not finding an investor right now. The difficult part is finding the bottom.

A report in the Globe and Mail today suggests that the worst of the economic turmoil may now have passed. The argument made by Allan Robinson is that Treasury yields have stabilized and have actually shown preliminary signs of rising (judge for yourself the significance of the the rise, but the decline seems to have stabilized...for now). This means that investors are looking to move their money from out of the wing of the Treasuries and into, likely, investment grade corporate bonds. This is significant because it means investors are beginning to trust the relative stability we are seeing right now.

Jack Welch blames the i-bankers

Private equity will be coming into its own for exactly the reason Jack says - these are mostly privately held funds. The best funds will be those that risk the fund partners' money, not just yours. Otherwise, you can put your money back into the public market, but maybe you should head for Las Vegas instead.

Lending to Friends

Banks are not lending and owners of companies suffer.

Banks are not lending and owners of companies suffer.January 20, 2009

Bum Rap for Gen Y

Many Baby Boomers will say, “Those kids need to learn it’s tough and you don’t get a trophy just for turning up for work. No one’s there to applaud and video their every step.”

What about my generation – the Baby Boomers – will our work needs change? Millennial might say, “They destroyed the environment, let greed override ethics and are maxing out the credit, leaving Millennials to pay the tab.”

With four generations working together, we need to get beyond this tired cycle of thinking your own generation is the best and you have to fix the others because they don’t have clue. How can we understand each generation in order to blend the best of our talents?

I put this question to a Millennial engineer, Michael Keenan, whose employer, Arcelormittal Dofasco Steel, is actively addressing the generational gap. “We look at the pivotal events during the formative years of each generation,” says Michael. “Once you understand each generation’s shared geography, cultural and economic environment and the impact on their needs, it is much easier to work together because you understand why they are different.”

Dofasco is using Maslow’s hierarchy of needs to frame each generation’s work behaviour. Each level of needs must be fully satisfied before you can move up to the next level. First level of needs are the physical - which means having a full stomach, for example, or being comfortable. The next stage is the need for safety – to have a job, a home, a family and shared morality with your neighbours. For Canadian-raised Millenials, the luxury of growing up in the most peaceful and affluent time in Canada means that they can move past the safety level right up to esteem needs for recognition for their work and self motivation. They can even reach self actualization which is the need for self governance and the bigger issues of society like justice or peace. Since up until the economic melt down, Millennial have not been afraid for their jobs, they have enjoyed the space to explore these higher level needs.

Hollywood movies help us to put ourselves in those first twenty years of other generations and the early life experiences which shaped the rest of their lives. When supporting actors from the World War II movie Defiance talked about how miserable it got while filming in the forests of Lithuania, you know this is Generation X and The Millennial speaking about their work. It would be tough to imagine John Wayne complaining about the hardships of his movie location. Yet, on the other hand, these young actors are far more nuanced about the deep meaning of their movie and able to probe and question.

Now imagine if you were in that forest and hungry too, with real soldiers with real guns hunting for you. Even snuggled up next to Daniel Craig, smoothing back your hair and letting you check out his bikini briefs – you may find your needs are not so much about having a house with a white marble kitchen or a job that follows your dreams or even the rules of the Geneva Convention. You are at the bottom of Maslow’s hierarchy and after such a trauma, you would be grateful for any darn house, a solid job and you would faithfully work for the boss without question.

Baby Boomer journalist, Tom Brockaw, called people raised during the war “The Greatest Generation” which may sound like overblown hyperbole to Generation Xers and Millennials as they look at Grandfather slumped in his armchair. But WW II is within the memory of humans living today and I meet many of them still working, running poultry, transportation, construction companies, as well as law and finance firms.

In extraordinary contrast, Canadian born Millennial had no war, no fear for their lives, for their family, for their neighbours turning on them or their country being taken by force. Since parents may be funding their lives, they have the luxury of moving way up Maslow’s hierarchy of needs past the Baby Boomers’ level of social needs, to the esteem set of needs and for some, even to self actualization. It is not a surprise then that Millennial in the workplace have smaller social distance between others and have little fear of authority or of others. It is a great place to be.

Companies can benefit if they understand this level of needs. Boomers, once they get this, tap into Millennia’s energy which is team-based and seeking to be the best.

The Millennials I meet are in the finance industry and are exciting because they do question, can hold a range of views not just black and white, pick up work to do on their own initiative and for their own career development. This Canadian generation thinks globally, questions social issues, are challenging, want a balanced life but are there when the work needs to get done by midnight. I may have a slanted view but I think calling Millenials Most Entitled Generation gives them a bum rap.

In sum, it certainly helps me to understand work behaviour by using Maslow’s hierarchy of needs and to see how each generation’s context was completely different. It helps explain a great deal. I know I will be able to work together with more purpose. What do you think?

[1] http://www.abraham-maslow.com/m_motivation/Hierarchy_of_Needs.asp

[2] http://www.amazon.com/Greatest-Generation-Tom-Brokaw/dp/0375502025

Private Equity Increasingly the Place to Go for Money

At 12:32 PM, George and Laura Bush will take their last helicopter ride away from Capital Hill by helicopter. Already, approximately 2 million people have converged on Washington to witness this historic moment when power gets handed over to Obama. The Americans know how to do their pomp and pageantry well, but when tomorrow comes, Barack Obama will have some heavy lifting to do with two wars and a crisis not seen since the Great Depression.

At 12:32 PM, George and Laura Bush will take their last helicopter ride away from Capital Hill by helicopter. Already, approximately 2 million people have converged on Washington to witness this historic moment when power gets handed over to Obama. The Americans know how to do their pomp and pageantry well, but when tomorrow comes, Barack Obama will have some heavy lifting to do with two wars and a crisis not seen since the Great Depression.The banking black hole is far from over. NYU Professor Nouriel Roubini who bet his career describing the reason for a poor outcome for the U.S. housing market and outlined that U.S. financial losses from the credit crisis could reach U$3.6 trillion, half by banks and brokers dealers. Roubini says, "If that's true, it means the U.S. banking system is effectively insolvent because it starts with capital of U$1.4 trillion. This is a systemic banking crisis…In Europe it's the same thing."

Former Securities and Exchange Commission head, Arthur Levitt echoed that view saying we are witnessing a "slow but inevitable nationalization…we will see it and see it soon."

Yesterday the government announced it was converting its Royal Bank of Scotland preferred shares into ordinary shares, potentially increasing its stake to 70%. They U.K. government also has a 43% stake in the combined Lloyds TSB and HBOS. Shares of Royal Bank of Scotland (RBS) fell almost 70% yesterday on the news. RBS also said it does not expect to pay a dividend on its ordinary shares this year.

January 16, 2009

Ben Bernanke's Beard

Ben Bernanke and his beard have been working like dogs lately to pump out over a trillion dollars and save ourselves from a recession. These extreme measures should be no surprise to many, he was hailed as a radical by The New Yorker long before he assumed his current responsibilities, but you can't be blamed for thinking he was just another boring bureaucrat keen on never rocking the boat. Many have been fooled by that beard, the looks of which give the impression of a highly meticulous, erudite man that very likely wears inappropriate swimwear to the pool (I don't know Ben, I'm just guessing). His current monetary policy is certainly radical but time will tell if his decision to print and pump trillions of dollars into the economy will have him hailed as an equal to the world's bearded legends (Lincoln, Karl Marx, 'Macho Man' Randy Savage, etc) or a pariah with whiskers.

Ben Bernanke and his beard have been working like dogs lately to pump out over a trillion dollars and save ourselves from a recession. These extreme measures should be no surprise to many, he was hailed as a radical by The New Yorker long before he assumed his current responsibilities, but you can't be blamed for thinking he was just another boring bureaucrat keen on never rocking the boat. Many have been fooled by that beard, the looks of which give the impression of a highly meticulous, erudite man that very likely wears inappropriate swimwear to the pool (I don't know Ben, I'm just guessing). His current monetary policy is certainly radical but time will tell if his decision to print and pump trillions of dollars into the economy will have him hailed as an equal to the world's bearded legends (Lincoln, Karl Marx, 'Macho Man' Randy Savage, etc) or a pariah with whiskers.

January 8, 2009

Light at the End of the Tunnel

The first morsel of light poked through the darkness today. It was reported on CFO.com that the bond market is showing signs of thaw. According to the article, a "number of energy companies this week tapped the slowly thawing fixed-income market." One such company, Nabors Industries Inc., an offshore and onshore drilling company, raised $1.125 billion in senior unsecured notes due in 2019. What is encouraging is that the coupon rate is 9.25% while the bond is expected to yield 6.76%, impying the bond is priced at a premium.

The first morsel of light poked through the darkness today. It was reported on CFO.com that the bond market is showing signs of thaw. According to the article, a "number of energy companies this week tapped the slowly thawing fixed-income market." One such company, Nabors Industries Inc., an offshore and onshore drilling company, raised $1.125 billion in senior unsecured notes due in 2019. What is encouraging is that the coupon rate is 9.25% while the bond is expected to yield 6.76%, impying the bond is priced at a premium. January 6, 2009

Has Manufacturing and Engineering Lost Value?

Tom Peters posted an inspiring post on the value of the well-engineered hammer. He could not resist buying the one in this photograph. Reading Tom's comment section, I noted that a person called "ZED" wrote that that being a scientist or engineer has lost its value in North America.

Tom Peters posted an inspiring post on the value of the well-engineered hammer. He could not resist buying the one in this photograph. Reading Tom's comment section, I noted that a person called "ZED" wrote that that being a scientist or engineer has lost its value in North America. Posted by Jacoline Loewen at January 5, 2009 9:54 AM

I don't want to get in the middle of this, but beware apples and oranges. The Chinese are turning out engineers by the bushel. Or are they? A McKinsey Institute study last year claimed that some-many-most Chinese graduate engineers would not be accepted for engineering jobs in the U.S., EU, Japan, Korea, etc. At this point at least, many of the so-called engineering grads are holding what we might call a technician's certificate. Part of this is attributed to state control of curricula. Again, not my area of expertise.

Tax Cuts for Business Owners

"If there is something positive this early in January 2009," says Jacoline Loewen, author of Money Magnet and partner at Loewen & Partners, "It would be that the market continues to welcome actions taken by President elect Barack Obama who will be sworn in on Tuesday January 20."

Obama's stimulus package appears to be a mix between spending (to appeal to Democrats) and tax cuts (to appeal to Republicans). The funny thing about putting together such a large package is that it's really hard to find $800 billion worth of stuff to spend on that will be immediately stimulative to the economy; hence another reason perhaps that Mr. Obama is leaning more towards tax cuts.

January 5, 2009

PIPEs

According to Ron Burgundy, the "only way to bag a classy lady is to give her two tickets to the gun show, and see if she likes the goods". Any red-blooded male would agree with Ron, but I'm not about to talk about those sorts of "pipes".

According to Ron Burgundy, the "only way to bag a classy lady is to give her two tickets to the gun show, and see if she likes the goods". Any red-blooded male would agree with Ron, but I'm not about to talk about those sorts of "pipes".6 Surprises of Transition Management

Surprise One: You Can't Run the Company

Warning signs:

You are in too many meetings and involved in too many tactical discussions.

There are too many days when you feel as though you have lost control over your time.

Surprise Two: Giving Orders is Very Costly

Warning signs:

You have become the bottleneck.

Employees are overly inclined to consult you before they act.

People start using your name to endorse things, as in "Frank says…"

Surprise Three: It Is Hard To Know What Is Really Going On

Warning signs:

You keep hearing things that surprise you.

You learn about events after the fact.

You hear concerns and dissenting views through the grapevine rather than directly.

To read more

Transition within companies is the most important time to reap wealth for your hard work. Loewen & Partners advises owners on how to get the most value out of their businesses.

January 4, 2009

the 7 habits of inefficient markets

As we leave the decade of the "Naughts" and wrap up lessons learnt about markets in the past ten years, I realize that even this club of such smart men and women followed the markets off the cliff in 2008. What were they thinking?

Back in 2007, Paul Krugman summarized the seven habits that help produce the anything-but-efficient markets that rule the world. I thought a great way to begin the next decade would be a quick review of these:

Seven habits that help produce the anything-but-efficient markets:

1. Think short term.

2. Be greedy.

3. Believe in the greater fool

4. Run with the herd.

5. Overgeneralize

6. Be trendy

7. Play with other people's money

I got these 7 habits courtesy of Paul Krugman, quoted in Fortune back in 2007. Worth contemplating.

Jacoline Loewen, author, writer, and expert in private equity.

January 2, 2009

Private Equity interested in good companies

Banks may not be lending but private equity has cash for owners of businesses looking for growth capital. Watch Toronto's BNN's Squeezeplay as they chat with Jacoline Loewen, author of Money Magnet

http://watch.bnn.ca/squeezeplay/december-2008/squeezeplay-december-30-2008/#clip125488

For more information:

http://www.moneymagnetbook.ca

It's that time of year again, forecast 2009

One bright light is the 2009 forecast by Niall Ferguson in National Times. It may bring you some joy in the New Year. Here's a sample:

"Many commentators had warned in 2008 that the financial crisis would be the final nail in the coffin of American credibility around the world. First, neo-conservatism had been discredited in Iraq. Now the “Washington consensus” on free markets had collapsed. Yet this was to overlook two things. The first was that most other economic systems fared even worse than America’s when the crisis struck: the country’s fiercest critics – Russia, Venezuela – fell flattest. The

second was the enormous boost to America’s international reputation that followed Obama’s inauguration. "