Andy Willis has a great blog in The Globe & Mail. Here he is talking about how the wagons are beginning to circle:

BMO Capital Markets is getting ready for the return of private equity funds by hiring an experienced leveraged finance expert in its New York office.

Eric Luftig, a veteran of GE Capital Markers and CIBC World Markets, joined the U.S. investment banking arm of Bank of Montreal as a managing director. The Manhattan-based executive is now responsible for debt and equity private placements in BMO's leveraged finance group.

Bank of Montreal is one of several former mid-tier players in U.S. private equity to upgrade its talent at a time when most Wall Street firms are cutting head count. The credit crunch has trimmed the ranks of lenders to private equity funds, while improving the terms on which loans get made. That makes this sector far more attractive to Bank of Montreal and domestic rivals such as Royal Bank of Canada, which has also added expertise in this area.

“Eric's experience in private placements, including 20 years of solid deals, complements our team's overall mandate as we look to broaden our lead role participation in the leveraged financing arena,” said Jim Moglia, New York-based executive managing director and co-head of the BMO Capital Markets' leveraged finance group. This team deals in both leveraged loans and high yield bond financings.

Wealth Management

Voted #6 on Top 100 Family Business influencer on Wealth, Legacy, Finance and Investments: Jacoline Loewen My Amazon Authors' page Twitter:@ jacolineloewen Linkedin: Jacoline Loewen Profile

April 14, 2009

The Big Dreams Private Equity Favours

For all of you who need some inspiration, here is a great story sent to me by Elliott Bay, founder of the kids' camp - Real Programming 4 Kids:

For all of you who need some inspiration, here is a great story sent to me by Elliott Bay, founder of the kids' camp - Real Programming 4 Kids:In 1883, a creative engineer named John Roebling was inspired by an idea to build a spectacular bridge connecting New York with the Long Island. However bridge building experts throughout the world thought that this was an impossible feat and told Roebling to forget the idea.

It just could not be done.

It was not practical.

It had never been done before.

Roebling could not ignore the vision he had in his mind of this bridge. He thought about it all the time and he knew deep in his heart that it could be done. He just had to share the dream with someone else. After much discussion and persuasion he managed to convince his son Washington, an up and coming engineer, that the bridge in fact could be built.Working together for the first time, the father and son developed concepts of how it could be accomplished and how the obstacles could be overcome. With great excitement and inspiration, and the headiness of a wild challenge before them, they hired their crew and began to build their dream bridge.

The project started well, but when it was only a few months underway a tragic accident on the site took the life of John Roebling. Washington was injured and left with a certain amount of brain damage, which resulted in him not being able to walk or talk or even move.

"We told them so."

"Crazy men and their crazy dreams."

"It`s foolish to chase wild visions."

Everyone had a negative comment to make and felt that the project should be scrapped since the Roeblings were the only ones who knew how the bridge could be built. In spite of his handicap Washington was never discouraged and still had a burning desire to complete the bridge and his mind was still as sharp as ever.He tried to inspire and pass on his enthusiasm to some of his friends, but they were too daunted by the task. As he lay on his bed in his hospital room, with the sunlight streaming through the windows, a gentle breeze blew the flimsy white curtains apart and he was able to see the sky and the tops of the trees outside for just a moment.

It seemed that there was a message for him not to give up. Suddenly an idea hit him. All he could do was move one finger and he decided to make the best use of it. By moving this, he slowly developed a code of communication with his wife.

He touched his wife's arm with that finger, indicating to her that he wanted her to call the engineers again. Then he used the same method of tapping her arm to tell the engineers what to do. It seemed foolish but the project was under way again.For 13 years Washington tapped out his instructions with his finger on his wife's arm, until the bridge was finally completed. Today the spectacular Brooklyn Bridge stands in all its glory as a tribute to the triumph of one man's indomitable spirit and his determination not to be defeated by circumstances. It is also a tribute to the engineers and their team work, and to their faith in a man who was considered mad by half the world. It stands too as a tangible monument to the love and devotion of his wife who for 13 long years patiently decoded the messages of her husband and told the engineers what to do.Perhaps this is one of the best examples of a never-say-die attitude that overcomes a terrible physical handicap and achieves an impossible goal.

This is the type of person that private equity seeks - a strong sense of wonder at what is possible and someone who perseveres to finish the project. Quite a story.

Sent to Jacoline Loewen, author of Money Magnet by Elliott Bay M.Sc. (Mathematics)President, Real Programming 4 Kids

Toll Free: 1-877-307-3456

Toronto: 416-469-9676

Email: rp4kelliott@gmail.com

April 12, 2009

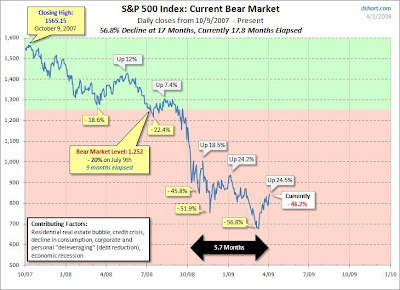

How Bear Markets Turn

This current market is great for technical analysts who are too often ignored. Looking at the market currently, any clues are welcome.

Take a look at this interesting slide show of the past century of market data. You will quickly see how it illustrates that technical analysts do have a very useful role.

Henry Blodgett has posted the slide show on trends of bear markets.

April 6, 2009

Bear Market Bounce?

The concern is that this bear rally is just around optimism and wishful thinking rather than reality. Also, the blogs are full of worries that no one will invest in the public market ever again.

In the long overview of public markets, there is a small window where they make a strong profit before they do self correct.

There are cycles.

Private equity investors are also impacted as the market affects their company revenues too. We are all connected in this complex financial system.

Technically, it is yet too early to call out a bottom formation since the intermediate trendline is still downward sloping and must be broken to move higher. Until we see a clear reversal of this trend, the charts suggest a bear market rally that needs additional momentum to break the bearish trendline and form a true reversal. A break above 850 on the S&P500 and a subsequent re-attempt of the previous double top around 877 should give impetus to such a trend reversal.

In the meantime, call a client and keep moving forward.

April 3, 2009

Managing private equity portfolios in the downturn

I am posting notes taken by Shailen Chande at the last CVCA conference. This is the up date on managing private equity portfolios.

Portfolio company management:

- Critical to proactively manage portfolio company performance through a downturn - increased focus on dashboard reporting and managing expectations

- Cash flow "Quick Hits": Dial back growth; Focus on streamlining direct costs as opposed to SG&A; Aggressively manage working capital

- Very rarely are cuts too deep - need to react to current environment quickly and prepare for the worst - revisit downside case

There you have it and Shailen Chande can be reached at Shailen Chande at hotmail.com

Portfolio company management:

- Critical to proactively manage portfolio company performance through a downturn - increased focus on dashboard reporting and managing expectations

- Cash flow "Quick Hits": Dial back growth; Focus on streamlining direct costs as opposed to SG&A; Aggressively manage working capital

- Very rarely are cuts too deep - need to react to current environment quickly and prepare for the worst - revisit downside case

There you have it and Shailen Chande can be reached at Shailen Chande at hotmail.com

What is new with valuations and structuring of transactions?

I have more from Shailen Chande who attended the CVCA conference. Here is what Shailen has to say about Valuation & Structuring transactions:

- Valuation of Canadian PE deals never reached the heights of their US counterparts - many Canadian sponsors sat on the bench and leverage levels were relatively prudent.

- For the most part, there is not widespread acceptance of the "new world" amongst sellers - deals getting done are when sellers are distressed.

- Lack of transaction comps post Fall 2007, significantly deteriorating current trading and lack of visibility through 2009 make valuation incredibly difficult - greater emphasis on diligence.

- To mitigate valuation concerns, recent transactions have seen a greater emphasis on earn outs and vendor take backs - trend will likely continue.

- Most interesting opportunities have a restructuring angle - need to structure for the downside case.

By the way, you can reach Shailen at Shailen Chande at hotmail.com.

- Valuation of Canadian PE deals never reached the heights of their US counterparts - many Canadian sponsors sat on the bench and leverage levels were relatively prudent.

- For the most part, there is not widespread acceptance of the "new world" amongst sellers - deals getting done are when sellers are distressed.

- Lack of transaction comps post Fall 2007, significantly deteriorating current trading and lack of visibility through 2009 make valuation incredibly difficult - greater emphasis on diligence.

- To mitigate valuation concerns, recent transactions have seen a greater emphasis on earn outs and vendor take backs - trend will likely continue.

- Most interesting opportunities have a restructuring angle - need to structure for the downside case.

By the way, you can reach Shailen at Shailen Chande at hotmail.com.

April 2, 2009

Two ways of looking at things

There are always two ways to see a situation.

There are always two ways to see a situation.Take this economy, for example.

My friend Andy Fireman, an Angel investor involved in interesting companies, picked up my day with this comment:

"We need to think of this economy as perhaps the best opportunity we will ever see in our lives. The question is: how do we capitalize on this. Interesting story I heard ... Joe Kennedy Sr was worth only $4 mil in 1929 ... But by 1933 he was worth $180 mil. For him, the Great Depression was a golden opportunity.

So, how do we turn this economy into an opportunity?"

So, how do we turn this economy into an opportunity?"

Thanks, Andy. I love positive people.

How do you know who can help you to raise capital?

If an investment banker can't provide the following, DON'T HIRE THEM:

1. Experience and knowledge of innovative financing structures to maximize client value (by proof of past clients)

2. Direct relationships and established contacts with a breadth of private equity funds - ability to present a deal and know the funds will listen.

3. Produce an extremely high quality financial model and written report in a manner that will attract fund managers.

4. Prepare some 75% of the due diligence material material required by a fund - save the client the time and effort

And most importantly:

5. Be capable and experienced enough to negotiate the best terms for the client with the fund. Fund managers negotiate financing deals for a living, whereas most entrepreneurs negotiate a major financing once or twice in a lifetime. A good I-banker evens the scales.

Hope that helps!

1. Experience and knowledge of innovative financing structures to maximize client value (by proof of past clients)

2. Direct relationships and established contacts with a breadth of private equity funds - ability to present a deal and know the funds will listen.

3. Produce an extremely high quality financial model and written report in a manner that will attract fund managers.

4. Prepare some 75% of the due diligence material material required by a fund - save the client the time and effort

And most importantly:

5. Be capable and experienced enough to negotiate the best terms for the client with the fund. Fund managers negotiate financing deals for a living, whereas most entrepreneurs negotiate a major financing once or twice in a lifetime. A good I-banker evens the scales.

Hope that helps!

April 1, 2009

CVCA's PD session on Deal and Valuation trends

I received a summary of the latest CVCA event from Shailen Chande. It's worth a peak:

Market overview:

- PE deal activity has been crippled by significant expectation gaps between buyers and sellers and a lack of financing

- Current baseline LBO structure for a "middle of the fairway" business - EV: 5.0-6.0x EBITDA; Total debt: 2.0-2.5x EBITDA

- Shift towards smaller deals - Larger US sponsors are looking at equity tickets in the region of US$200m

- 2009 has seen positive inflows into leveraged loan and high yield funds marking a potential return to mainstream lending

- Increasing number of GP's are returning LP commitments and/or reworking terms - fundraising market is limited, although there is demand for distressed/turnaround funds

- Increasing number of mid market US sponsors looking North to Canadian carve outs and/or distressed situations

- 2007/2008 funds will make for some of the best vintages given unprecedented buying opportunities

Market overview:

- PE deal activity has been crippled by significant expectation gaps between buyers and sellers and a lack of financing

- Current baseline LBO structure for a "middle of the fairway" business - EV: 5.0-6.0x EBITDA; Total debt: 2.0-2.5x EBITDA

- Shift towards smaller deals - Larger US sponsors are looking at equity tickets in the region of US$200m

- 2009 has seen positive inflows into leveraged loan and high yield funds marking a potential return to mainstream lending

- Increasing number of GP's are returning LP commitments and/or reworking terms - fundraising market is limited, although there is demand for distressed/turnaround funds

- Increasing number of mid market US sponsors looking North to Canadian carve outs and/or distressed situations

- 2007/2008 funds will make for some of the best vintages given unprecedented buying opportunities

Is anyone getting any money?

I see Jeff Frost is asking on the Venture Capital forum on Linkedin if there is any money being loaned or invested. Here in Canada, our banks have moved onto the list of top largest banks in the world which really is quite remarkable. When you fly across the country, most of it seems unoccupied! Also, we only have six cities with a population over a million while China has 100 cities with 1 million plus people.

So to get back to the question -is anyone putting money into companies?

Yes.

First up the government is handing out sugar plums to early stage companies. But since our banks are very conservative - as they should be we have come to appreciate - it has made room for a very healthy private equity fund industry.

If you have a business generating over $10M in revenues, you are of interest to a private equity fund in your field of expertise. Old style manufacturers, do not despair, as you are of interest too.

Last night, Loewen & Partners had a board meeting with one of our clients who is doing very well with global clients. Two years ago, when we first met, it was not a pretty picture. What happened? We matched the owner with a private equity fund who bought a 35% stake in the business. They also pushed him to do the strategic changes he had always meant to do. We raised capital - over $15M for the company and they had revenues of $35M and a downward trend. So you can see that there are possibilities where your Canadian banker may not wish to go.

The smiles around the table make private equity a great business.

So to get back to the question -is anyone putting money into companies?

Yes.

First up the government is handing out sugar plums to early stage companies. But since our banks are very conservative - as they should be we have come to appreciate - it has made room for a very healthy private equity fund industry.

If you have a business generating over $10M in revenues, you are of interest to a private equity fund in your field of expertise. Old style manufacturers, do not despair, as you are of interest too.

Last night, Loewen & Partners had a board meeting with one of our clients who is doing very well with global clients. Two years ago, when we first met, it was not a pretty picture. What happened? We matched the owner with a private equity fund who bought a 35% stake in the business. They also pushed him to do the strategic changes he had always meant to do. We raised capital - over $15M for the company and they had revenues of $35M and a downward trend. So you can see that there are possibilities where your Canadian banker may not wish to go.

The smiles around the table make private equity a great business.

Subscribe to:

Posts (Atom)